Key Highlights

- Markets have shown surprising composure in the wake of Russia’s invasion

- There remain hopes that the crisis will be over quickly

- It may be too early to lift defensive plays, but investors should remain watchful

- Energy and commodities sectors offer short term upside potential

No market meltdown

As we enter the second week of Russia’s invasion of Ukraine, many investors have noted the market volatility but also the lack of full scale panic. Following a 9 - 10 percent correction in the S&P500 and EURO STOXX 600 since the start of the year, both markets have managed to lift off their lowest point reached at the end of last week. This is not to say all sectors were spared. Having previously outperformed, European banks were badly hit by the prospect of sanctions, and also the possibility that interest rate tightening might be more limited than investors were expecting.

However, specific sectors aside, clearly a large number of investors are continuing to buy risk assets like equities in the hope that, as with previous geo-political crisis, this one will not have wide-ranging consequences. Similarly, assets traditionally thought of as safe-havens have not been overrun. The USD has increased but only by one percent over the past five days. Meanwhile, 10-year Treasury yields have been relatively flat. Gold prices have trended up but are still below the highs seen at the start of the Covid outbreak.

Scenario One: Containment

Investors in this camp point out that the fighting could end soon. Current sanctions may also not have the broad impact on global economies that some are imagining. While major Russian banks are to be removed from the international Swift messaging system, thereby disrupting payments for Russian exports, other systems - for example, China's Cross-Border Interbank Payment System - could kick in.

Eurozone finance ministers have also admitted that while higher energy prices and lower business confidence can be expected to downgrade growth expectations, they say they are ready to provide support via fiscal and other policies. The European Central Bank’s chief economist forecasts a drop of between 0.3 – 0.4 percent, and at worst 1.0 percent.

Meanwhile, prior to the invasion consensus forecasts for earnings growth for companies in the MSCI Europe and S&P500 indices stood at a very healthy 30 and 31 percent respectively, providing an incentive to stay invested in risk assets.

Scenario Two: Chaos

Those in this camp point out that President Putin has not completely had his way and many uncertainties remain.

Talks between Russia and Ukraine to end the fighting has ended with no immediate agreements except to keep talking. Meanwhile Russia’s assault on Ukraine’s largest cities continue, with an estimated 75 percent of troops previously amassed on the borders now inside Ukraine. Despite this, it appears that Ukrainian resistance continue to be strong and all cities remain under Ukrainian control.

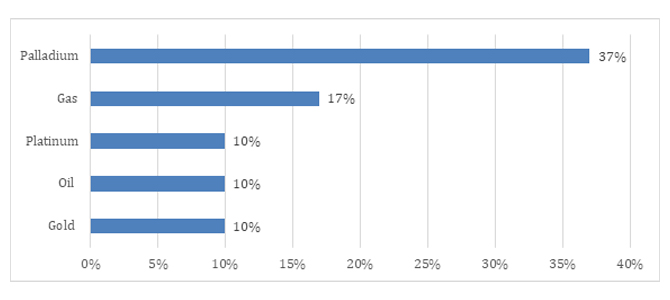

Given these uncertainties as to whether the war will be prolonged, and the likelihood that sanctions will continue to bite not just Russian but global interests, this camp argues that now is not the time to reverse previous flight-to-quality positions. This is especially the case given the importance of Ukraine and Russia as hard commodities exporters, such as those listed below, as well as soft commodities such as wheat, maize and soya bean. The combination of higher food and energy prices in an extended conflict will likely impact global growth as they seek to emerge from Covid restrictions.

Figure 1: Russia accounts for a large proportion of commodities global supply

Russia’s commodity output (share of global production)

Source: WBMS, IEA, Wood Mackenzie. Morgan Stanley Research

We remain watchful

At UOBAM, we will continue to maintain our defensive positions until we are able to see a resolution ahead. We are also on the lookout for signs that higher oil and commodity prices will only have a limited impact on the Asian and US economies. We recognize that central banks around the world, faced with high inflation, have less leeway to cut interest rates, As such, a slowdown in global growth is a concern but not a given.

For those keen not to stay on the sidelines, we would highlight the oil and gas space. Russia’s invasion, low inventories and supply disruptions suggest that oil prices could continue to climb from its current US$ 100 per barrel to possibly reach US$120 per barrel as we move into the first half of the year.

However, there is good reason to believe that this rise may be temporary and may soften back to below US$100 levels in the second half of the year. There is expected to be a lift in supply as OPEC countries seek to pump more oil to leverage current high prices. The lifting of Iranian sanctions, thought possible in 2H22, will bring onstream 1.3 percent of global oil consumption levels. This price moderation of course pre-supposes that Russian oil and gas exports do not become severely curtailed, although we note that the West has so far refrained from cutting off Russian supplies.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.