The US economy is finely balanced across growth, recession and stagflation. Faced with these multiple scenarios, we think neutrality is the most appropriate strategy

Chong Jiun Yeh, Chief Investment Officer

Despite ongoing economic risks, such as those stemming from the trade war, we are continuing to see a broad recovery in global equities and good investor confidence.

This may seem counterintuitive but market participants price uncertainty in different ways depending on prevailing conditions. It appears that during this period of ample liquidity, markets are effectively pricing in hope rather than risk, and therefore assigning near-full valuations, even to uncertain assets.

Navigating fundamentals and technicals

But here at UOB Asset Management (UOBAM), we think this environment requires an astute balancing of market fundamentals with technical signals.

From a fundamental perspective, we emphasise a disciplined valuation framework that appropriately discounts for uncertainty. At the same time, technical and quantitative indicators suggest that the current widespread underweight in investor positioning could fuel further market rallies.

As such, our approach for 3Q25 is to strike a careful balance: acknowledging downside risks that may not yet be fully priced in, while remaining open to the potential for continued market strength. Our base case is that the trade war will deescalate as more “deals” are done, but the risk of re-escalation remains significant.

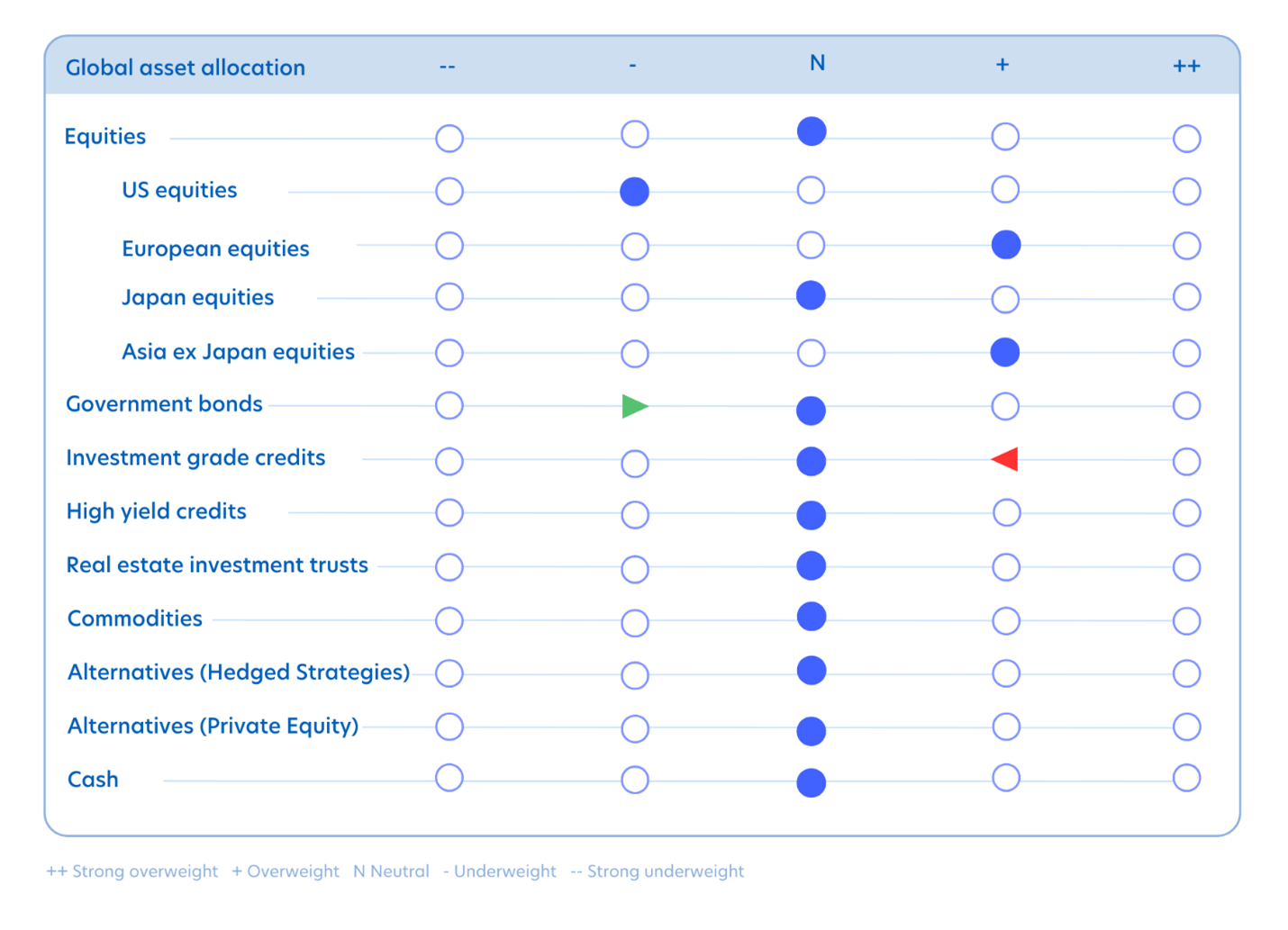

Accordingly, we recommend a neutral stance between growth and defensive assets. Equities may continue to perform well if downside growth scenarios are avoided and investor confidence persists. Meanwhile, safe-haven assets such as fixed income and gold remain attractive - supported by high yields, lower volatility, and ongoing demand for stability.

Here’s a summary of our views.

- Macroeconomy

In broad terms, we see the global outlook underpinned by three macroeconomic scenarios in the US - a rebound back to start of the year levels, slower but sustained growth and higher inflation, or a recession. At the moment, we think all three scenarios are equally weighted. - US inflation

We expect inflation to rise to 3 – 4 percent by the end of 2025. The question is whether this can be contained as a one-off, tariff-induced increase. More worryingly, on-going trade uncertainties could lead to a wage price spiral. - US interest rates

The US Fed is likely to wait most of the year to see how these inflation risks play out. Given this, we expect no more than 1 - 2 cuts by the end of the year, bringing the US terminal rate to 4.0 - 4.25 percent this year. - Global equities

Despite increased uncertainties in the global macro-outlook, there is a positive case to be made for equities. We lean more into Europe and Asia equities and underweight the US. This is because we see the global growth differentials narrowing and expect non-US equity markets to catch up. - US bond yields

We expect UST 10-year bond yields to range between 4.25 - 4.75 percent in 2H 2025. - USD

We see the USD as structurally weak for the coming years, but may have devalued enough for this year. As such, we expect a rangebound to slightly weaker trend in 2H 2025.

Read the full 3Q25 Quarterly Investment Strategy report here.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z