- Japanese equities have climbed to 34-year highs

- Some profit taking is to be expected, and the BoJ’s proposed end to negative interest rates has also curbed sentiment

- However, the 2024 outlook remains positive, bolstered by strong corporate earnings, governance reforms and retail incentives

Japan’s blistering stock market rally took a breather after the Bank of Japan (BoJ) signalled last Tuesday that an end to negative interest rates was nearing.

Although the BoJ left its ultra-loose monetary policy unchanged, Governor Kazuo Ueda said that the likelihood of Japan sustaining its 2 percent inflation target was “gradually heightening”. Noting improvements to Japan’s service sector prices and wage growth, he suggested that should these conditions hold firm, Japan could soon eventually revise its -0.1 percent benchmark interest rate. Japan has battled deflation and negative rates since 2016.

Investors take profit

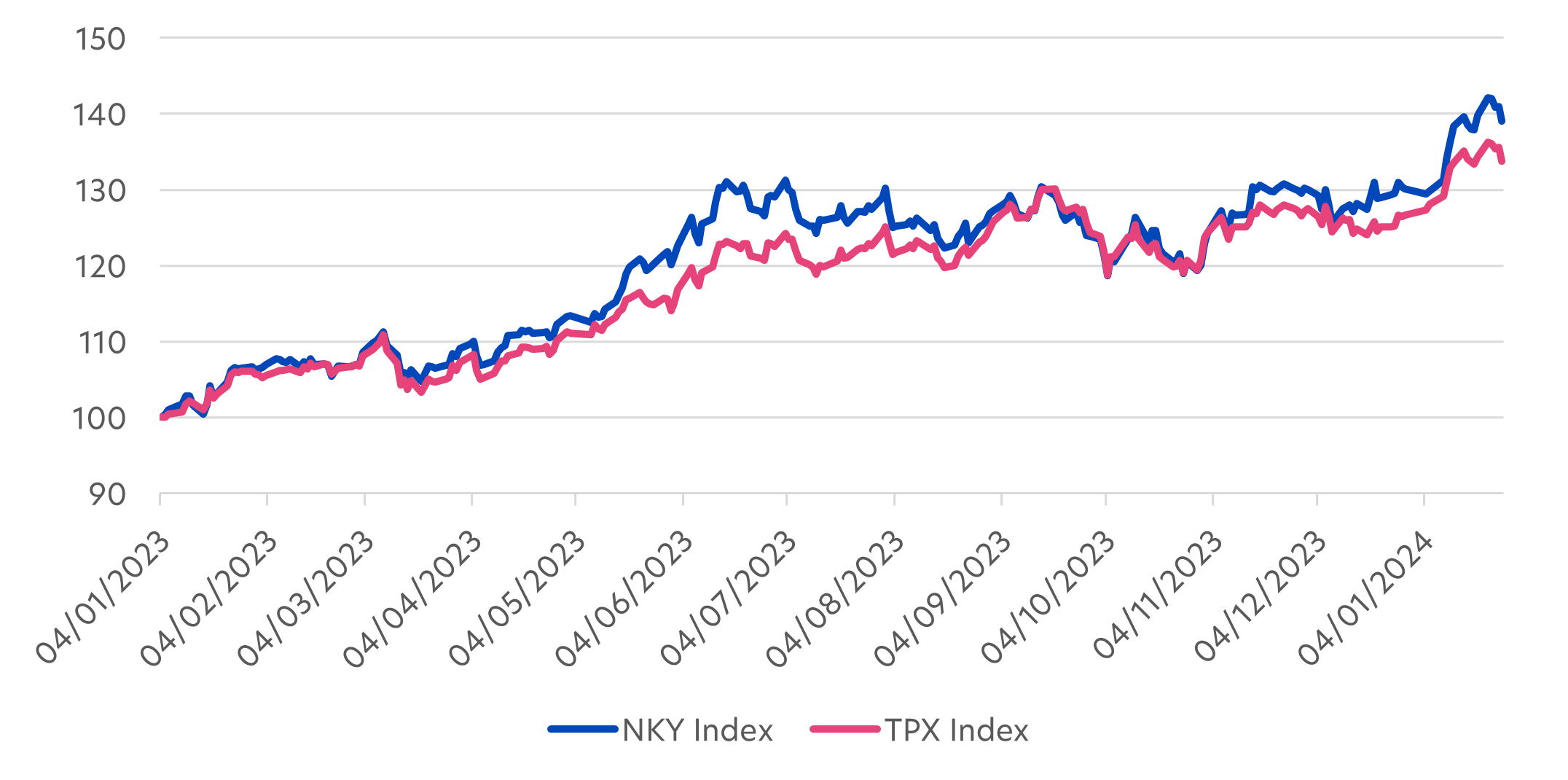

Although the governor stressed that monetary policies will remain “very accommodative”, his hawkish tone sparked a minor sell-down. In the following three days, the Nikkei 225 and broader TOPIX index both slid about 2.0 percent.

However, we would argue that much of the sell-down was due to profit taking. Last year, the Nikkei rose by 30.1 percent and the TOPIX by 26.7 percent1. By mid-January this year, both indices had risen to 34-year highs. It is not unusual for investors to lock in some gains after such a robust rally, and does not change our positive longer-term outlook for Japan stocks.

Fig 1: Nikkei 225 and TOPIX performance, 2023 – 2024 YTD

Source: Bloomberg

Structural market drivers

We think the following structural factors are in place and will continue to pick up pace this year:

1. Earnings momentum and wage growth

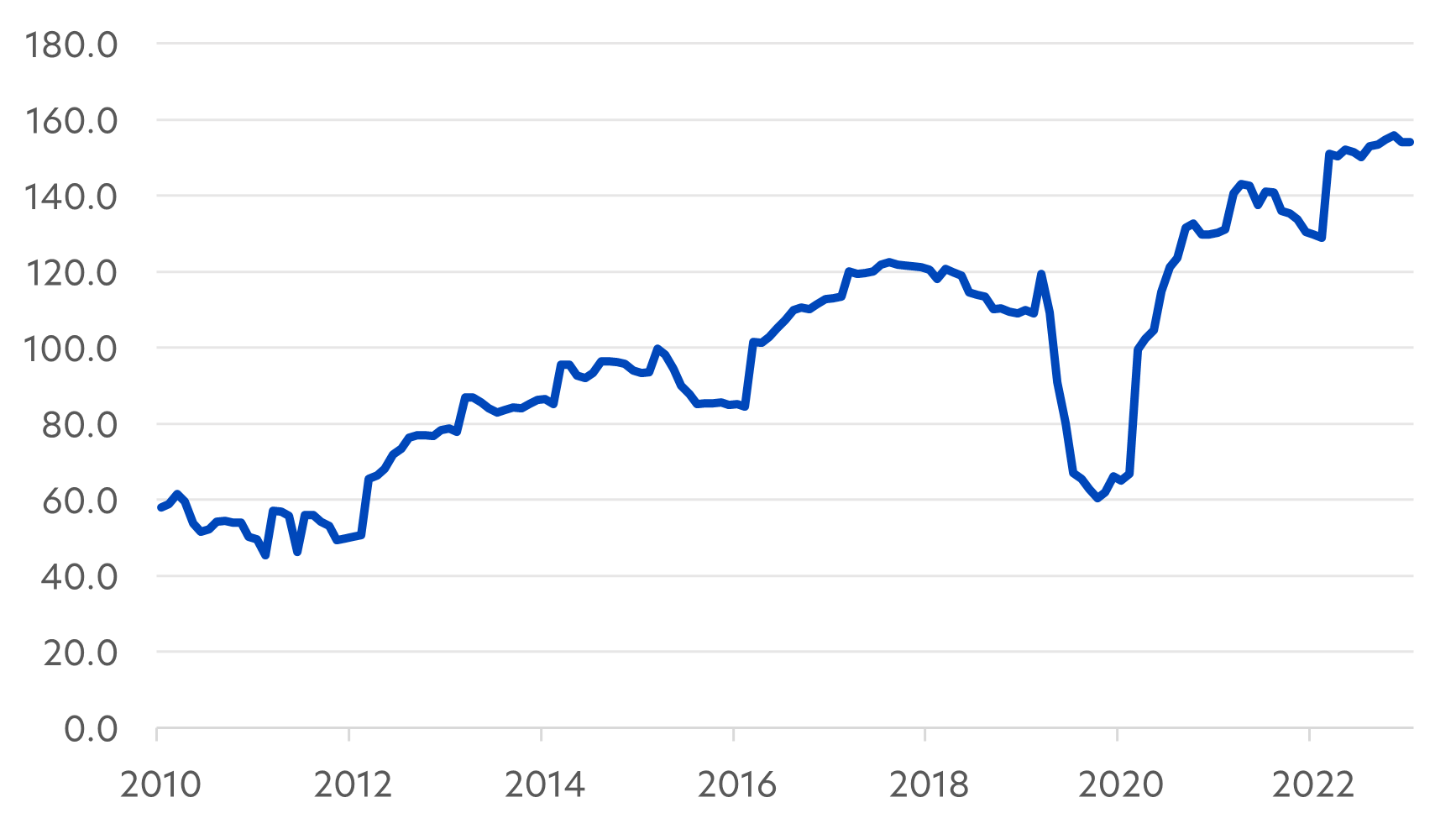

Rising wages are key to sustainable inflation in Japan. Deflation had led to static wages, lacklustre company earnings and a poorly-functioning economy. However, inflation started to rise in 2023, allowing Japanese companies to raise prices and corporate earnings to improve. This in turn has spurred wage demands, as workers sought to counter the effect of inflation on their spending power. As a result, average wages in Japan grew by 3.6 percent last year, a 30-year high.

Fig 2: TOPIX 12M forward EPS

Source: UOBAM, Nomura’s Corporate Earnings Forecast for FY 2023-2024

Given that TOPIX companies are continuing to forecast higher earnings per share (EPS), there is hope for even higher wage growth in 2024. Unions in Japan are advocating for a minimum 5 percent increase and several large Japanese companies such as Suntory Holdings and Aeon have already pledged to raise wages beyond that. In a further gesture of support, the government has introduced new tax incentives for companies that administer large wage increases.

As part of a virtuous cycle, this will boost consumption and spark further price hikes, which in turn will boost wages, drive up company earnings and further boost the Japanese market.

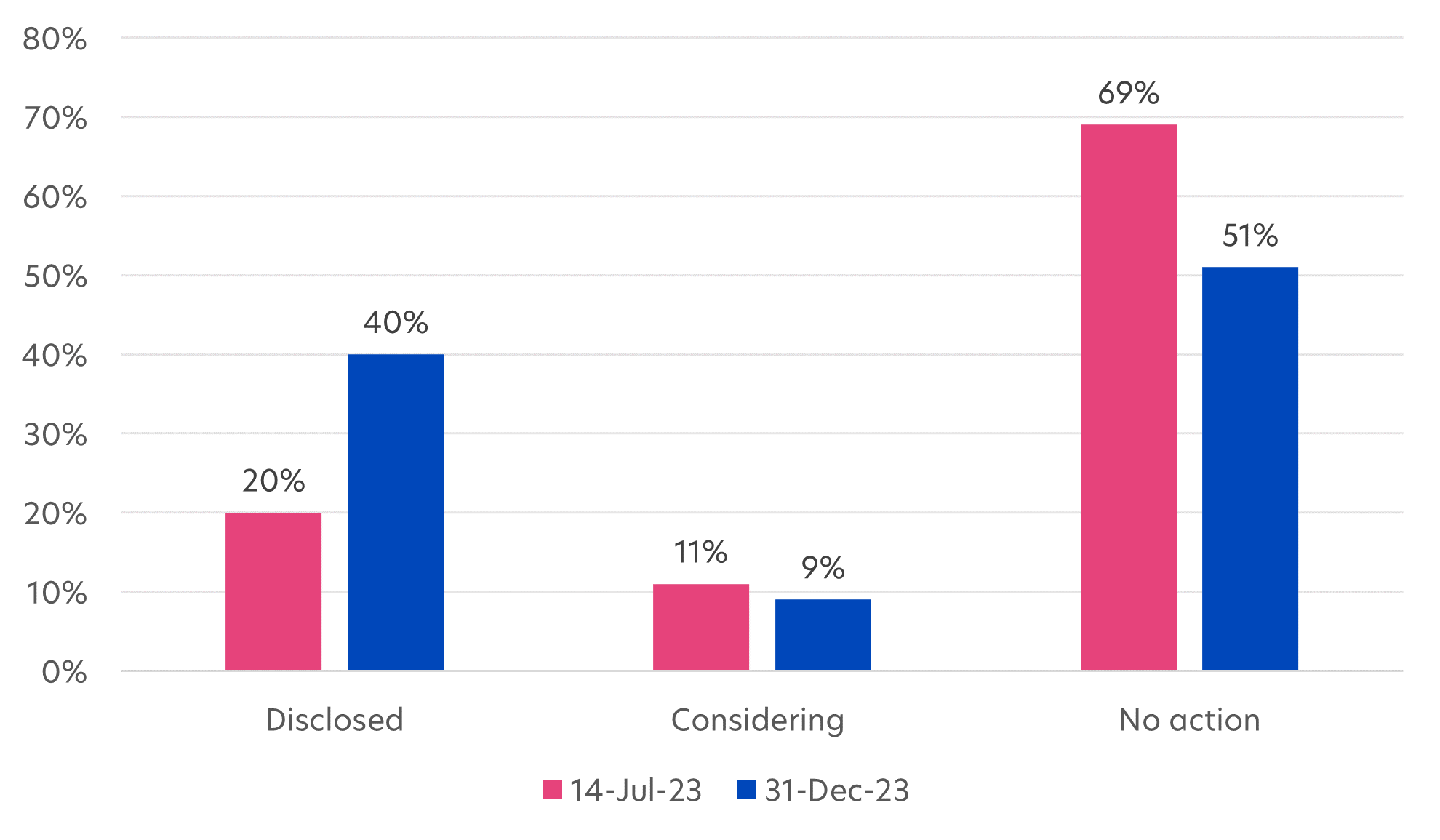

2. Corporate reforms

Capital efficiency and shareholder returns have not featured highly within company priorities. This changed after the Tokyo Stock Exchange (TSE) called on companies to do so. The number of Japanese corporations planning to improve their capital efficiency increased over the following 6 months. There were also a slew of share buybacks and dividend hikes. This increased focus on company profits and stock prices resulted in a boost to investor confidence, not just in Japan but around the world.

Fig 3: Percentage of Japanese companies that plan to enhance capital efficiency

Source: JPX

The TSE’s push for reforms is ongoing. For example, it will begin releasing a monthly list of companies that have disclosed plans to increase their capital efficiency. This move is designed to pressure laggard companies to change their behaviour.

3. Retail participation

Deflationary conditions and economic stagnation also discouraged individuals from investing. As a result, half of Japanese households’ 2.1 quadrillion yen of financial assets is kept in cash and only about 18 percent of household financial is invested in stocks and investment trusts.

To counter this, a new Nippon Individual Savings Account (NISA) programme has been launched to facilitate a shift from savings to investments. Under this new framework, annual investment limits have been increased, allowing individuals to hold up to 18 million yen across their NISA accounts on a permanently tax-exempt basis.

Although we expect that around 80 percent of NISA investments would go into US or global equities, the remaining will still go to domestic equity funds and individual Japanese stocks, representing a significant boost for Japanese shares.

Risks to note

Despite the buoyant outlook, a key risk for Japan’s stock market in the near term is the divergence between Japan monetary policy and that adopted by other major economies. While the BoJ is expected to raise interest rates, other developed economies look set to cut theirs in the coming months. This could cause some short-term volatility.

Japan’s current low labour productivity is a longer term area of concern. Data shows that Japan’s labour productivity per person has remained nearly flat for 25 years through 2021. As a result, the country was in the bottom 10 of the OECD’s 2022 ranking of labour productivity.

As Japan’s society rapidly ages, and its labour pool shrinks further, its economic growth depends on this issue being addressed urgently. Policymakers will need to do more to promote digital transformation, labour mobility and investment in human capital.

1In JPY terms

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z