Key Highlights

- Over the week, global markets reversed its declining trend, raising hopes for a normalisation of sentiment

- However, worries about higher inflation and slower economic growth have not gone away

- We see an easing of extreme risk-off conditions, but do not expect an end to the current volatility

A confusing week

The Russia-Ukraine hostilities have not abated. The Fed has signalled more aggressive rate hikes. Inflation is at multi-year highs. Yet equity markets are continuing to rise. Many investors are asking: why?

It has been a confusing week for many. Equity indices bottomed about 10 days ago and started to climb. Thought initially to be a short blip, the S&P500 has risen about 2.5 percent this week and is now almost 4.0 percent above where it was a month ago (although still down by 7.1 percent year-to-date).

With no real end in sight for the Ukraine war, and the number of casualties on both sides getting significantly worse, this recent equity strength is somewhat baffling, even for the experts.

Multiple factors in play

The problem is the number of variables now pulling at stock and bond markets, all at the same time. Even before the war started, the world was trying to come to grips with post-Covid supply chain issues that was causing inflation to rise. However, these were deemed to be “positive” inflationary pressures – in so far as they were thought “transitory” and a natural side-effect of strong global economic expansion.

With the Ukraine war, oil and commodity supplies have been further disrupted, and the impact of sanctions is starting to be felt. As a result, the US announced this month that its consumer price index (CPI) in February rose 7.9 percent, the highest 12-month increase in four decades. It is the same story over in Europe, with UK numbers released yesterday putting inflation at 6.2 percent, a 30-year high.

These inflationary pressures are viewed less favourably because they have the potential to be more entrenched, and could be accompanied by slower or negative global growth. If so, they pave the way for the possibility of stagflation. In an attempt to avoid this worst-case scenario, central banks around the world must carefully navigate their way between the twin evils of high inflation and a recession. This is not easy when there is a war raging and new uncertainties emerge every day.

It would appear that the US Fed’s strategy is to adopt a hawkish tone. Having raised rates by 25 basis points (bps) for the first time in three years, US Fed chairman Jerome Powell, indicated that a 50 bps rate hike was possible in the near future to control inflation that is “much too high”. He also noted that tighter monetary policies do not necessarily give rise to recessions.

Equity markets are seeking to counteract inflation

Equity markets appear to be reassured, for now at least. Despite GDP growth forecasts being revised down in most countries (US forecast for 2022 is 3.6 percent versus 2021 actual of 5.7 percent), there appears to be good support for the idea that central banks will be able to tighten and yet keep a recession at bay.

This suggests that investors may be choosing to focus instead on the evils of high inflation. A major concern is oil price volatility. In the last one month alone, Brent crude prices have fallen below US$100 and risen above US$125. With many European countries expected to transition over time to non-Russian sources of oil, this price volatility and upward trend may continue for an extended period.

An increasing number of experts cite this as a driver of the current market rally. Equity returns, even if modest, can help investors counter the effects of higher living expenses. This produces a virtuous cycle. Investors who do not expect a recession are opting for equities, thereby pushing up markets and in turn attracting more investors. This positive momentum, they say, helps to explain the markets’ rise, in spite of the uncertainties of war.

Bond markets may be telling a different story

Bond investors appear to be less sanguine about the possibility of a recession. Given the Fed’s previous warnings of impending rate rises, plus recent strong language on the need to do this more quickly, it is no surprise that short term bonds have seen prices fall and yields rise. The 2-year US Treasury bond yield is at 2.14 percent, the highest since May 2019, having risen fairly steadily since September last year.

However, the yield trend for longer term bonds is more worrying. 10-year US Treasuries are yielding just 2.34 percent. This small gap (spread) between short and long duration bond yields, relative to the long term average of around 90bps, is typically taken as a sign that investors do not have good confidence in the economy’s growth outlook.

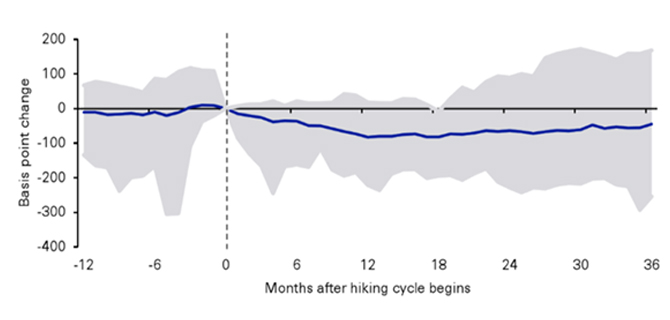

It should be pointed out that spreads do tend to reduce after rate hikes kick in. This flattening of the yield curve can be seen based on spreads averaged since 1950 (see chart) and should not over-alarm investors.

Figure 1: Yield curves tend to flatten after the start of rate rises

US Treasury yield spread movements after first rate hike

Grey areas: Yield spread movements for every hiking cycle since 1950.

Blue line: Average yield spread movements

Source: UOBAM, Deutsche Bank

However, a flattening yield curve can sometimes lead to a sustained inversion (ie when long term yields are lower than short term yields). Such inversions are often regarded as a recession predictor, although the time frame for this to materialise can range from six months to several years.

Growth shock

As written about previously, UOBAM’s risk indicators were triggered in the run-up to the Ukraine war. This signalled an unacceptably high level of market volatility and as a result, we prioritised risk management by transitioning out of some our higher risk assets and holding more cash.

Our indicators have since normalised and having tracked the markets closely, we believe that there are now opportunities for us to deploy our cash. That said, our asset allocation stance is to remain underweight in equities, slightly underweight in bonds, and overweight in alternative assets.

This is based on our assessment that global economies retain their potential for moderate growth as part of a mid-term expansion, and we do not currently see a case for a global recession. However, we believe the world is experiencing a growth shock that is yet to fully discounted. In order to be convinced that markets are bottoming, we continue to look for signs that current hostilities in Ukraine will not deepen, and that rate rises are managing to control inflation without hurting growth. We note that inflation will likely remain a factor for some time even after the war is over, unless the world tips into negative growth.

Within equities, Asia is expected to be less affected by the turmoil in Europe, has better valuations, and is less prone to an aggressive rate hike cycle that could stunt its growth. Within fixed income, government bond prices may see a short term reprieve if central banks appear more dovish, but this looks unlikely to last. Under these circumstances, high grade corporate bonds offer more promise.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.