As the second half of the year kicks off, our analysts are more convinced than ever that a deep recession can be avoided. In our 3Q23 Quarterly Investment Strategy, we detail the four key trends that we expect to unfold. Here is a brief summary.

1. Room for more optimism

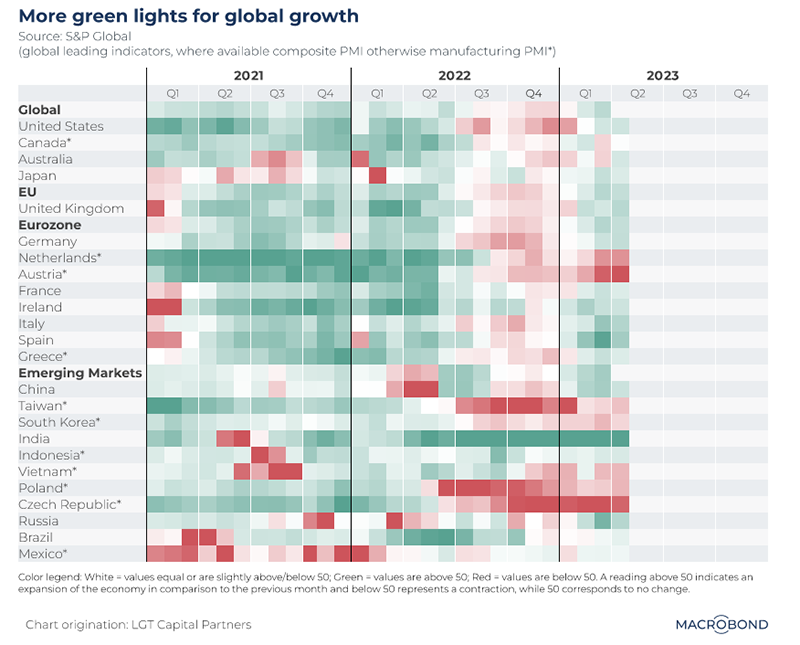

At the start of the year we asserted that markets in 2023 would ultimately be driven by inflation, global economic conditions and central bank responses. We were relatively optimistic that these macro-fundamentals would not lead to a market crisis. At the halfway point of the year, we note that within global economic indicators, green zones are now replacing red zones.

Figure 1: Global Purchasing Managers’ Index (PMI)*

Source: S&P Global, May 2023

* where available composite PMI otherwise manufacturing PMI*. The PMI is an index of the prevailing direction of economic trends in the manufacturing and service sectors.

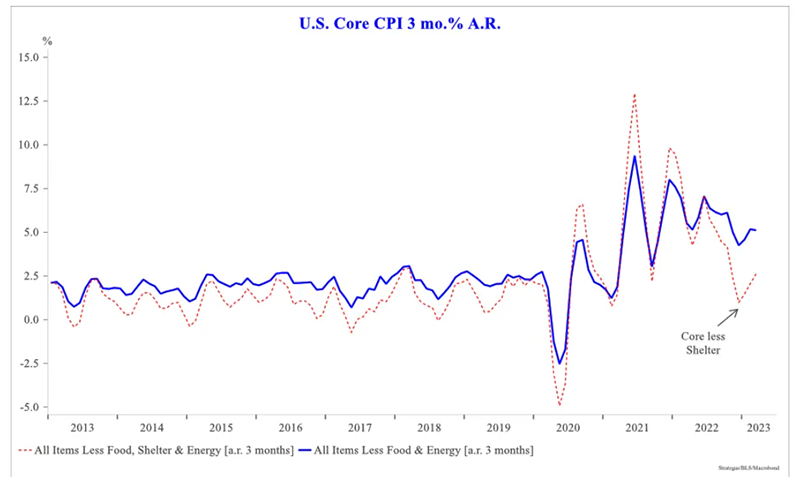

2. Inflation to improve further, but rate cuts unlikely this year

While most economists had called for a recession in 1H23, many are now delaying their recession expectations to 4Q23 or early 2024. This is because headline inflation is down and core inflation (i.e. ex food and energy) has moderated but perhaps not fast for all central banks to end interest rate hikes.

Figure 2: US Core CPI 3 month % A.R

Source: Macrobond, March 2023

3. Uneven trends, but no hard landing

We still expect an economic slowdown or technical recession in the later half of the year. However, this is unlikely that to involve significant increases in unemployment. Rather, we increasingly think the global economy is suffering rolling recessions where certain goods sectors will experience recession-like conditions, but broad service sectors will not. As such, over the full year, global GDP is unlikely to be negative.

Figure 3: GDP weighted composite: China, India, Korea, Indonesia and Taiwan (%)

| 2023F (Previous) | 2023F | 2024F | |

| Global | 2.4 | 2.5 | 2.8 |

| US | 1.0 | 1.1 | 0.8 |

| Eurozone | NA | 0.6 | 1.0 |

| Japan | NA | 1.0 | 1.1 |

| Asia ex Japan | 5.1 | 5.3 | 4.9 |

| China | 5.3 | 5.7 | 5.0 |

Source: UOBAM, Bloomberg, 16 May 2023

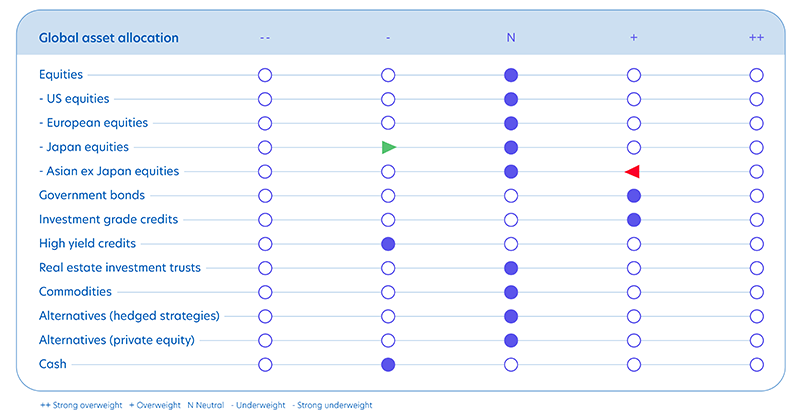

4. Positive high grade fixed income, neutral equities

We continue to overweight high grade fixed income as a beneficiary of higher yields and the expected near term pause in interest rate hikes. Equities have room to surprise if the global economy proves more resilient than expected. However, this asset class carries greater risks on a risk adjusted basis. As such, we maintain our neutral weighting across all major regions, while noting that there are good stock and sector picking opportunities.

Figure 4: Global investment strategy, 3Q23

Source: UOBAM, June 2023

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z