Key highlights

- A robo-advisor is like your personal fitness instructor, assessing you before telling you what kind of exercise you may need and choosing from a wide range of options that may suit your risk profile the best.

- With UOBAM Invest, you can tweak your investment time frame, contribution amounts, risk profile and goals anytime. The app intuitively rebalances your personalised portfolio to ensure you are still on track to reach your targets.

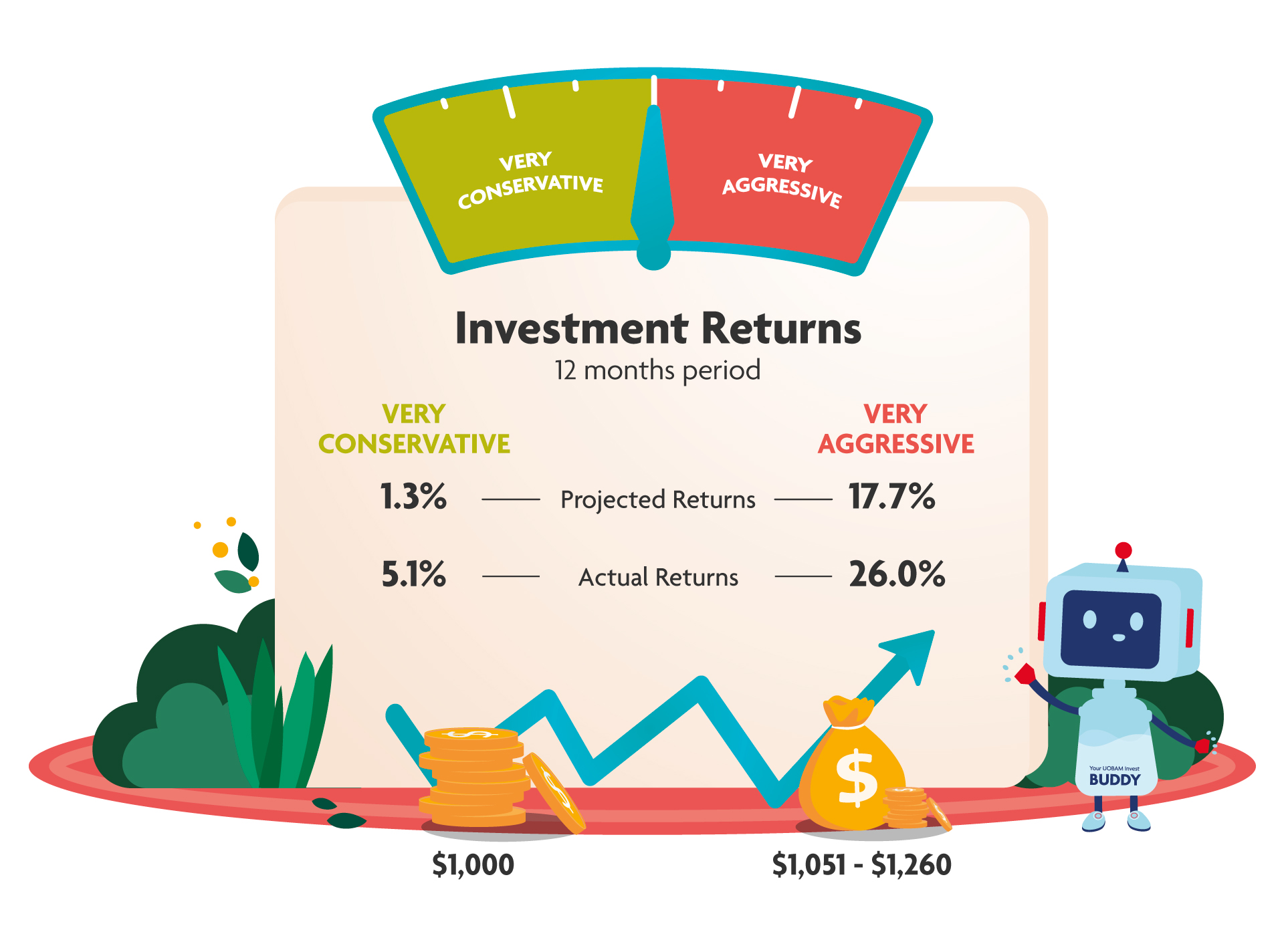

- The portfolios recommended by the UOBAM Invest Digital Adviser, delivered 1-year returns of between 5.1% and 26.0% ranging from the "Very Conservative" to the "Very Aggressive" portfolio by 30 July 20211.

The first time you attempt a handstand, you probably won’t be able to get it right. It is a difficult manoeuvre to pull off. You need to have a good understanding of your body, a keen sense of flexibility and balance, and strength in your arms, core and shoulders. But not being able to do it right away does not mean you will never be able to master the complex move. You can always develop a fitness regime to help you reach your goal.

UNDERSTANDING YOUR STARTING POINT

One’s investment – or exercise – plan may look very different from that of someone else’s, because not everyone has the same starting point. If you haven’t hit the gym for a while, you may want to avoid doing 100kg weighted squats, or go speed racing on a treadmill.

The best way to start is probably to consult an experienced fitness coach, who will assess you and tailor an exercise regime that fits your profile.

UOBAM Invest is like your personal fitness instructor, assessing you before telling you what kind of exercise you may need and choosing from a wide range of options that may suit your risk profile the best.

WORKING OUT YOUR GOALS

Some people like to bulk up, while others want to go lean. A few may want to raise their strength levels but many will just want to lose weight.

Each exercise plan will change according to your goals. If you want to get muscles, running on the treadmill is unlikely to get you bigger biceps.

Likewise, let UOBAM Invest work your money for you, based on your specific targets and objectives.

Do you intend to buy a house, put aside cash for your retirement, or are you looking to do both? Based on your risk profile and goals, UOBAM Invest’s Digital Adviser Portfolio Planner propose a customised portfolio to help you work towards these goals.

DIVERSIFICATION IS KEY

Using data from your risk appetite and your needs, your customised portfolio recommended by UOBAM Invest’s Digital Adviser, comprises exchange-traded funds (ETFs) across various asset classes and geographical spread. Think of this combination as the exercises in your workout plan to help you get fitter and stronger.

A good fitness plan will comprise a variety of exercises, such as weights training and cardio workout, to help you build stamina and gain strength and flexibility. Similarly, UOBAM Invest aims to provide you with a robust and diversified portfolio that is prepared for any market situation.

RESULTS TAKE TIME

Keeping to a fitness regime takes discipline and persistence. You are unlikely to see or feel major changes to your body on a day-to-day basis. But when you do it consistently over time, you will start to notice changes in a big way.

The same holds true for investing – it requires patience and a long-term view. Tracking your portfolio daily may make you frustrated at the slow crawl. You might even be tempted to react to market fluctuations and stray from the strategy built for you. But getting to your goals will take time. And UOBAM Invest has time and again proven to deliver – if you let it do its job.

The portfolios recommended by the UOBAM Invest Digital Adviser, delivered 1-year returns of between 5.1% and 26.0% ranging from the "Very Conservative" to the "Very Aggressive" portfolio by 30 July 20211. The performance exceeded the projected return of 3.8% to 8.3%2 calculated by the UOBAM investment team for the respective risk levels.

1Source: UOBAM. Performance from 31 July 2020 to 30 July 2021 in SGD terms, on a Net Asset Value basis, before fees.

2Projected annual portfolio return based on UOBAM’s in-house proprietary market assumptions and the historical performance of various asset classes. Past performance is not a guarantee of future return and figures stated above should only be used as a reference.

For example, if you had invested S$1,000 with UOBAM Invest between July 2020 and July 2021, your investment would have grown between $1,051 to $1,260.

GROW AND EVOLVE

As you go deeper into your fitness journey, you might find your goals evolving as you get stronger and fitter. What started as an attempt to master the handstand might lead to you discovering other more complex moves, such as a one-arm handstand, or even walking on your hands. As your goals shift, your plan changes too. The same goes for your investing journey – it does not have to stay constant.

But even if you are not actively managing your investment goals, it is fine too. UOBAM Invest’s team of investment experts will keep an eye on your portfolio and make adjustments from time to time to ensure its performance, just like a professional fitness trainer keeping an eye on your progress.

And as you get nearer to the end of your investment period, the app will automatically shift your portfolio allocation from higher-risk assets to safer ones gradually based on its unique ‘glide path’ formula, to balance long-term growth with risk capacity. This is why we believe UOBAM Invest stands out – it is a dynamic and intelligent platform that understands the path to reaching one’s goals is often not a straight line.

Embarking on a fitness journey is an important decision, but it does not have to be an overwhelming one. The same goes for your investing journey. With careful planning and pacing, UOBAM Invest can help you get closer to your goals, no matter where you are in life.

Click here to learn more about robo-investing

This document is for your general information only. It does not constitute investment advice, recommendation or an offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit Trusts”, ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to take part in any particular trading or investment strategy. This document was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. If any information herein becomes inaccurate or out of date, we are not obliged to update it. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of any Fund and the income from them, if any, may fall as well as rise, and may have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in any Fund involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. Market conditions may limit the ability of the platform to trade and investments in non-Singapore markets may be subject to exchange rate fluctuations. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the respective Fund’s prospectus. The UOB Group may have interests in the Funds and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Funds, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Any reference to any specific country, financial product or asset class is used for illustration or information purposes only and you should not rely on it for any purpose. We will not be responsible for any loss or damage arising directly or indirectly in connection with, or as a result of, any person acting on any information provided in this document. Services offered by UOBAM Invest are subject to the UOBAM Invest Terms and Conditions.