The United Global Financials Fund (the "Fund") invests in the Robeco New World Financials (the "Underlying Fund"), which is managed by Robeco Institutional Asset Management B.V., an investment specialist in sustainable investing and a subsidiary of ORIX Corporation Europe N.V. (formerly known as Robeco Group N.V.). This paper is contributed by Robeco and all views expressed are based on available information as of the date of publication.

Key highlights:

- Digitalisation of financial services still a powerful driver of growth

- Hints of potentially higher rates trigger hopes for the industry

- Swift recovery should support Financials in many emerging markets, albeit with bouts of volatility, e.g. in currently Covid impacted countries like India and Brazil

2020 has truly been an epic year for the financial sector. Yet despite all the havoc triggered by the Covid-19 pandemic, some things did come out unscathed by the turmoil, such as the structural growth trends upon which Robeco’s New World Financials strategy is built. As we enter 2021, these trends continue full steam ahead and underpin some of the key themes investors should focus on this year.

The financial services sector seems caught at a time of protracted low bond yields. Yet reasons for hope remain. Vaccination campaigns are rolling out across the globe and many countries – especially those in emerging markets – have already made significant progress. In developed markets the economic impact from the lockdowns triggered by the second and the third waves of the coronavirus (Covid-19) should be more muted than that of the great lockdown in the spring of 2020, and prospects of looser restrictions from the second quarter onwards should support market sentiments.

Most importantly, the trend of digitalisation in finance which was greatly accelerated by the Covid-19 shock, remains a powerful driver of growth for the industry. Meanwhile, opportunities offered to the financial sector by an ageing global population and the rising of emerging countries remain intact.

Although the gradual recovery that started in the second quarter of 2020 is still on course, the coming months remain uncertain. Depending on the speed and success of vaccination campaigns, especially in developed countries, as well as the ability of governments to avoid further waves of contagion, mobility restrictions may ease at a faster or slower pace, which will have important consequences for business activity.

Moreover, the consequences of the economic ravages suffered in 2020 could become more visible for the financial services sector as fiscal support lessens globally. Many companies might go bankrupt once it becomes clear they are no longer economically viable, and banks and insurance companies will have to take losses. Robeco expects these to be more problematic for bank lending than for corporate bonds. The latter should face relatively less pressure, except for the more challenged sectors such as travel and traditional energy.

Meanwhile, interest rates are likely to remain under pressure, as major central banks keep their monetary policies loose to support the economic recovery. This could be both good and bad news for the financial sector. While such policies might be positive for business activity, and therefore the financial services sector, a protracted low-yield environment also brings additional challenges.

In this context, although many banks and insurers remain relatively cheap from a historical perspective and attractive pockets of growth remain (see Box 1), many investors are staying on the sidelines. And with good reason, Robeco believes.

For one, many incumbent financial services providers still need to make significant Information Technology (IT) investments in order to keep up with the ongoing digitalisation of the financial world, which has been accelerating since the start of the pandemic.

Box 1: Looking for GARP (growth at a reasonable price)

While the historically low valuation multiples currently seen for the Financials sector may be justified at industry level, given the formidable challenges it faces, this is not necessarily always the case at a more granular level. Despite dire circumstances, some banks and other financial institutions are still managing to thrive. In fact, through Robeco's investment process, they are able to find pockets of earnings growth at reasonable valuation multiples.

Key portfolio characteristics

| 31 March 2021 |

Robeco New World Financials |

MSCI AC World Financials Index |

| Market Cap – average (USD bn) |

46.5 |

95.0 |

| Large Cap (> USD 10 bn) |

82.5 |

93.1 |

| Mid Cap |

16.2 |

6.8 |

| Small Cap (‹ USD 2 bn) |

1.2 |

0.1 |

| Price/Earnings (FY2) |

11.6 |

11.5 |

| P/E using next 12 months Est. |

12.7 |

12.4 |

| Dividend Yield |

1.5% |

2.4% |

| LT Debt/ Capital |

43.0% |

42.5% |

| EPS Growth (3-5 years estimate) |

11.8% |

10.6% |

| PEG Ratio |

1.0 |

1.1 |

| Return on Equity (RoE) |

12.6% |

10.7% |

| Return on Asset (RoA) |

2.7% |

2.2% |

| Active Share |

83.3% |

- |

| Assets under Management |

EUR 1.7 billion |

- |

Source: Robeco, FactSet. Positions subject to change. For information purposes only.

Above table illustrates Robeco's quest for growth at a reasonable price. It shows some of the key characteristics of the portfolio resulting from their New World Financials strategy, including price-earnings, (P/E) ratios and expected earnings growth, relative to the MSCI All Countries (AC) World Financials Index . Robeco's portfolio exhibits both higher growth prospects that the index and lower average valuation multiples.

As the world emerges from the pandemic, Robeco expects their positioning in the most dynamic segments of the financial sector, particularly in the emerging markets, to pay off. Helped by the rapid turnaround of the Chinese economy, emerging countries have been propelled to the forefront of the recovery. Indian banks, such as HDFC bank, and other Asian banks, such as Bank Rakyat Indonesia and Bank of the Philippine Islands, look well positioned to benefit from the rebound.

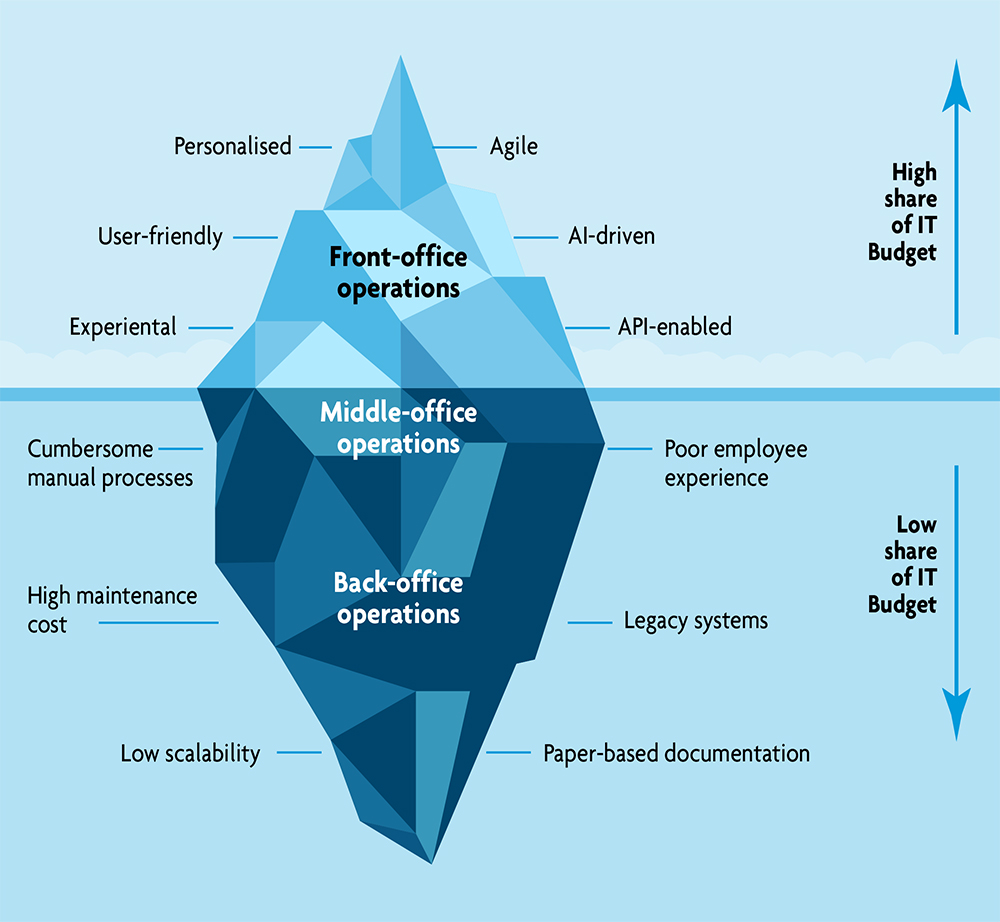

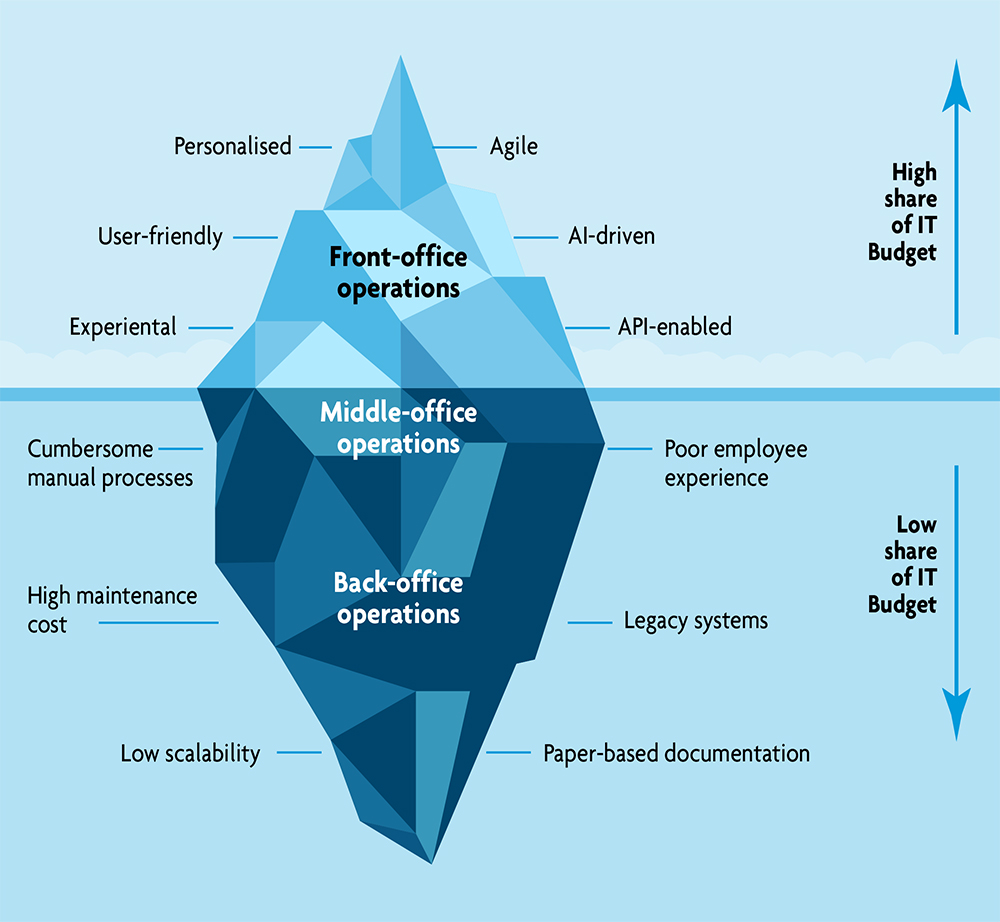

Such investments have become especially critical for back and mid-office operations, which brings us to Robeco's first and most important investment theme to watch in 2021: going fully digital. The other two themes to watch include rising yields and elevated volatility, and the swift recovery seen in many emerging countries (albeit with bouts of volatility, e.g. in currently Covid impacted countries like India and Brazil). The following sections will explain why Robeco believes these three themes offer attractive investment opportunities, and how Robeco intends to play them.

1The information provided in this article does not constitute a buy, sell or hold recommendation for any particular security. The information shown is only available for illustrative purposes only. No representation is made that these examples are past or current recommendations, that they should be bought or sold, nor whether they were successful or not.

Going fully digital

As we move towards a still elusive "new normal", one thing is clear: we have transitioned to a much more digital world. This is obvious for consumers, who have massively embraced e-commerce and digital payments (see Box 2) and for employees for whom remote working has become commonplace. But this is also true for companies, and central and local governments that have been forced to adapt to social distancing almost overnight.

For those financial institutions that had barely started moving their IT systems to the cloud, the shock was a wake-up call. Meanwhile, those banks and insurers that had already embarked on that journey experienced a smoother transition. Still, most players are expected to keep investing heavily in 2021 despite economic uncertainty. Even as the pandemic recedes and mobility restrictions are lifted in 2021, the bitter lessons learned from the 2020 lockdowns will keep pushing investments (see Figure 1).

In this context, banks that have few or no branches and were often ‘born digital’, like FinecoBank, Axos Financial or SVB Financial, seem better positioned than their peers to benefit from the recovery in 2021. Higher-quality traditional banks that generally feature better digital capabilities such as KBC, Nordea and DBS Group also stand to benefit from a combination of rising digitalisation and better economic prospects.

KBC Group, for instance, recently said it aims for its bank and insurance sales to reach respectively at least 40% and 25% digital by the end of 2023, up from 31% and 14% at the end of 2020. Meanwhile, the bank is also aiming for its straight-through-processing ratio, the percentage of services that can be offered digitally and processed without human intervention, to be above 60% by the end of 2023, up from 22% at the end of 2020. If successful, this would be very positive for the group’s profitability.The digitalisation tide has become so pressing that banks and insurers can no longer wait for their revenues to recover from the economic slump or for cost-cutting initiatives to eventually materialise to invest in their core IT systems or in areas such as artificial intelligence (AI) and cybersecurity. This should keep boosting demand for cloud-enabled solutions this year, including software as a service (SaaS), banking as a service (BaaS), and application programming interfaces (APIs).

In fact, over the past few months, many fintech enablers – companies that help incumbent financial institutions digitalise – have been working hard to figure out how to not only sell online but also how to implement and maintain their products and services remotely, even as mobility restrictions were eased globally. These advances should lead to additional efficiencies and potentially higher operational leverage for these companies going forward.

Robeco therefore sees enormous investment opportunities in fintech companies that are helping traditional banks and insurers digitalise further, in particular through technologies built around cloud computing and SaaS. Robeco also sees growing investment opportunities in AI-based lending and in firms that facilitate the trading, storage and custodian services of digital currencies, including cryptocurrencies.

Figure 1 | Unsupported middle-and back-office operations can spoil last-mile experience

Source: Robeco, based on: Capgemini Financial Services Analysis, 2020; World Retail Banking

Report, 2019; Celent, 2019; The Financial Brand, 2019; Signicat, 2018.

Box 2: What’s next for payments after the 2020 digital tide

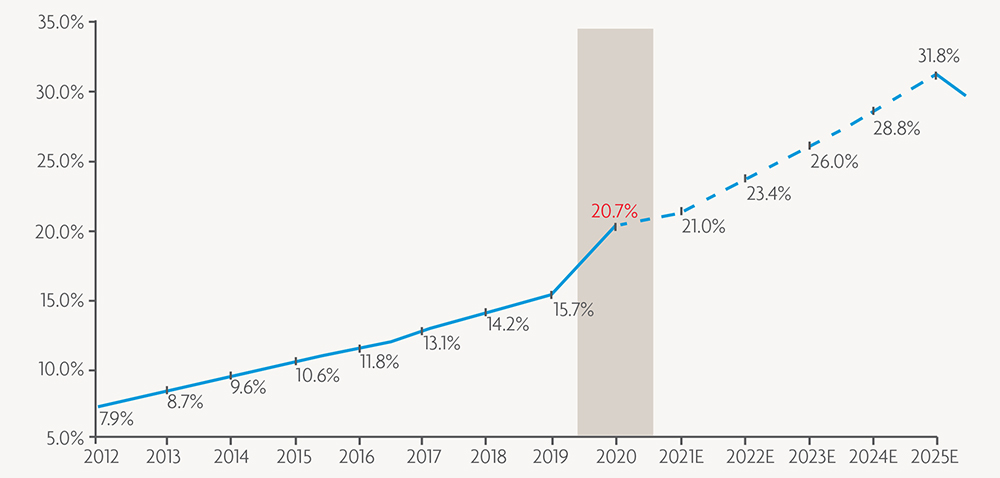

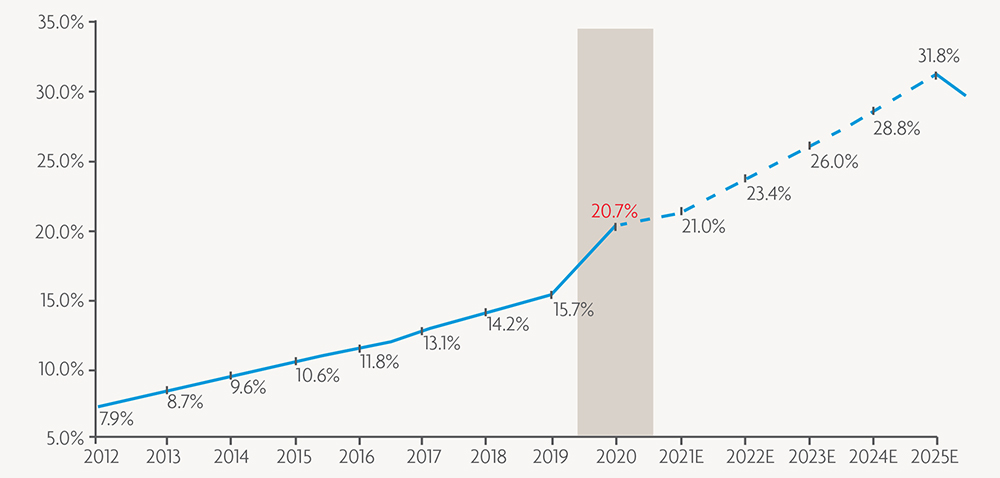

The rise of digital payments is one of the focus themes within the broad digitalisation of financial services trend that Robeco’s New World Financials strategy seeks to benefit from. Digital payments groups, such as PayPal, Adyen and Stripe, experienced tremendous growth in 2020 as e-commerce penetration surged across the globe during the great lockdown in the spring of 2020. Other players, however, went through a rougher patch, as payment flows from other areas dried up.

In the US, for instance, e-commerce jumped from 16% to 21% of total retail sales in just one quarter. This leap is close to the total rise seen over the four previous years, from 11% to 15% between 2016 and 2019. The shift from cash to plastic and digital is likely to continue, boosting the winners of 2020 even more. Moreover, payment companies which were left behind in 2020 in terms of share price performance will also likely catch up as the recovery unfolds.

Figure 2 | US e-commerce as a percentage of adjusted retail sales skyrocketed in 2020

Source: US Department of Commerce, J.P. Morgan, Robeco. Note: Adj. Retail Sales excludes food services & drinking places, automobile & other vehicle dealers, and gasoline stations.

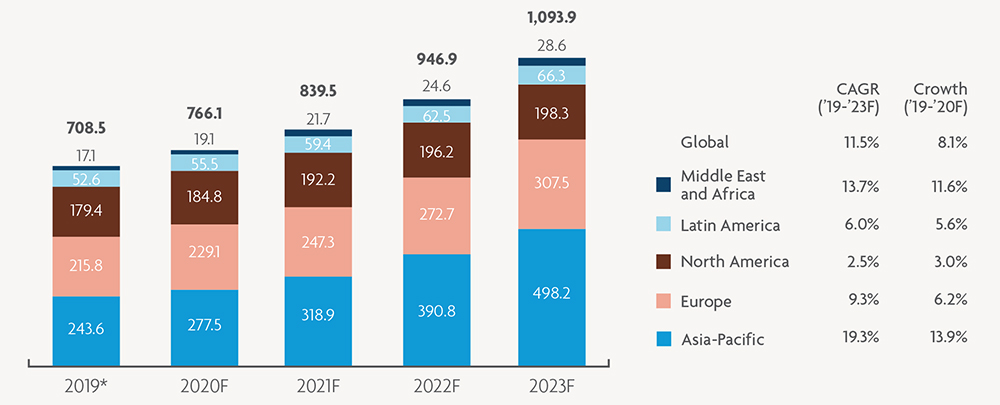

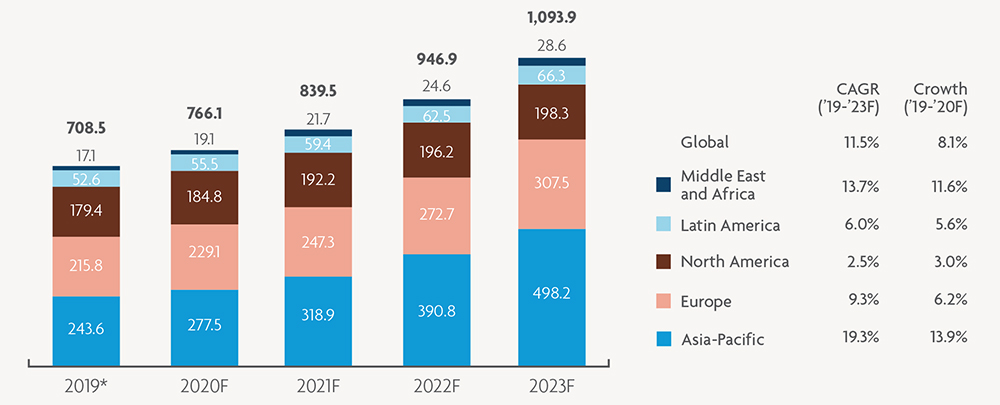

Figure 3 | Non-cash transactions set to keep rising

Source: Capgemini Financial Services Analysis, 2020; ECB Statistical Data Warehouse, 2018 figures released October 2019; BIS Statistics Explorer, 2018 figures released December 2019; Countries' Central Bank Annual Reports, 2019

The end of the growth road for Visa and Mastercard?

One oft-raised question on the future of payments concerns the growth opportunities left for the sector’s two giants, Visa and Mastercard, and the potential threat from rising competition. But these concerns are likely overdone. Global cash and cheque payments amounted to USD 18 trillion annually before the Covid-19 pandemic, while payments carried out with Visa and Mastercard credit and debit cards amounted to just USD 8 and 5 trillion respectively.

This leaves ample room for the two companies to continue to grow their share of global payments, especially as the USD 18 trillion payments carried out in cash and cheque annually are still rising between 2% and 3% every year. In addition, in the longer term Visa and Mastercard should benefit from business-to-business growth opportunities, as companies seek to digitalise their operations, including payments, further.

On the data collection front, 2021 should also be a very interesting year. As AI algorithms improve and growing amounts of data is collected around the world in areas ranging from customer preferences to corporate sustainability practices, databases and analysis tools for commercial applications are becoming increasingly critical, and might in some cases represent attractive investment opportunities. Rising demand for data on sustainability provides a good illustration of this.

As sustainability awareness improves and reporting requirements increase, gathering and providing data on ESG and related issues has become a fast-growing new business for many players. Index providers in particular such as MSCI or S&P Dow Jones, have stepped into the breach. But exchange operators like London Stock Exchange Group, Nasdaq and Intercontinental Exchange have also made significant investments in this area. Some of these firms are actually among our top holdings.

Rising yields and elevated volatility

Over a decade into the global low-yield environment created by historically loose monetary policies, predicting when long-term interest rates will finally rise again remains a tough call. Yet the Covid-19 shock may have shifted the status quo, given the enormous amounts of public debt issued to contain the crisis. As vaccination campaigns unfold and the global economy gradually recovers, governments and central banks are likely to roll back their support which will be reflected across the financial markets.

Although major central banks will try to keep interest rates relatively low with further bond buying in 2021, some of the disinflationary trends seen over the past two to three decades appear to be coming to an end. This is the case, for instance, for the global disinflationary trend driven by China’s export-powered economic growth model of the past 40 years. This is also the case for some of the technology-driven disinflation seen over the past decades.

In this context, current long-term bond yields appear to be already 200 to 300 basis points below warranted levels and therefore poised to move upwards. Inflation expectations have been rising since March 2020 and are at the highest levels since 2018. Meanwhile, yield curves have been steepening too. Such a rise would be a boon for insurers, banks and asset managers, provided the path upwards is gradual enough to make it manageable for them.

For instance, life insurers, which Robeco invests in as part of their Ageing finance trend, would greatly benefit from higher long-term interest rates. Although many of these companies have been making considerable efforts to shield their businesses from the impact of interest rate changes over the past few years, they still stand to benefit from a rise as the demand for real returns in a negative real rates environment remains strong.

Banks would benefit from rising long-term interest, too. Although this would not necessarily be good news for the valuation of bond portfolios held by developed market banks, it would bode well for other more market-oriented business lines. Meanwhile, rising long-term interests would be great news for many emerging market financials.

An improving macroeconomic environment combined with higher long-term interest rates would also be good news for alternative asset classes such as commodities and real estate. Such a backdrop might also bring potentially higher market volatility, as well as increased cross-asset investment flows between various asset classes, which would boost trading volumes and therefore bode well for exchanges.

Emerging markets at the forefront of the recovery

Emerging finance is expected to be a strong contributor to performance in 2021. The swift economic recovery seen in large parts of east Asia relative to developed countries in America and Europe means that loan losses in many Asian countries should peak early on. Moreover, despite the 2020 turmoil, many stocks of financial service providers from countries such as Indonesia, China, India, Russia and the Philippines still exhibit sound fundamentals and attractive valuations.

However, the situation remains much more uncertain for banks and insurers of developed countries with exposure to emerging markets. Bank loan growth may start picking up in the remaining of 2021, but the full impact of the Covid-19 crisis on their balance sheets will become visible only later in the year when fiscal stimulus measures come to an end. Another key question for these financial institutions has to do with the expected impact of Brexit and of dividend restrictions imposed by the European Central Bank (ECB).

In early 2021, emerging markets represent around 17% of New World Financials portfolio, which is slightly less than their weight in the MSCI All Countries World Financials Index. Robeco will be proactively looking for investment opportunities to increase their positions in emerging markets throughout the year, but remain mindful of political and currency, and liquidity risks as well as sometimes excessive valuations.

For example, Robeco sees attractive opportunities in China and Russia, but realise political risk is elevated in these countries. Meanwhile, valuations tend to be much less attractive in India. Some countries, such as Vietnam and some continents, such as Africa, remain in the early stages of their financial development, but are clearly worth monitoring in search for new investment opportunities. For one, the next billions of digital customers live in Latin America, Africa, Central Asia and the Far East.

Concluding remarks

Despite an uncertain macroeconomic outlook for 2021, reasons for hope have not disappeared for the financial sector. Vaccination campaigns are rolling out across the globe and the economic recovery that began in the second quarter of 2020 is still on track. Moreover, Robeco sees attractive pockets of growth for the financial sector, in particular around the digitalisation of financial services, which remains a powerful driver of growth for the industry. Other attractive themes to watch in 2021 include rising yields and elevated volatility, and the swift recovery seen in many emerging countries, albeit with bouts of volatility, e.g. in currently Covid impacted countries like India and Brazil.

Download PDF