The following paper “Investing in innovation: Disruption is everywhere – March 2021” is contributed by Wellington Management, the sub-manager of the United Global Innovation Fund. All views expressed are based on available information as of the date of publication.

Key highlights:

- Innovation extends far beyond tech and health care. It happens across sectors, geographies, and market caps, ranging from a disruptive new technology to a radically improved business model.

- This broad definition of innovation gives us a much larger opportunity set. To capture this opportunity, we compare innovative companies across industries using our Trend, Innovation, Barriers, and Risks (TIBR) Framework.

- Our robust research capabilities — including our private-equity mindset and strong ESG expertise — are critical to accessing and evaluating this enormous opportunity.

- Our approach to innovation can function as several different client portfolio solutions, offering potential return enhancement, growth opportunities, diversification, or a liquid complement to privates.

Investing in innovation: Disruption is everywhere

We are at the dawn of an age of disruption as innovation triggers exponential change across industries. The opportunities this environment creates extend far beyond technology and health care — and to every geography and market cap. From changing consumer behavior to the ubiquity of “big data” to adapting to climate change, we believe investors need to harness the numerous long-term structural trends driving innovation. For example, the decarbonisation of the US power grid will likely require a roughly US$4.5 trillion investment over the next 10 to 20 years1.

As the world rapidly evolves, we are looking to invest in where we think it is heading. The future for nearly every sector of the economy will look very different. We think there are extremely few companies that do not have the potential to be disrupted or disruptive in their industries. If a company is not driving or leveraging progress, we believe they are likely to be left behind. Importantly, though disruption is not a new concept, the pace of change is quickly accelerating. For example, the telephone took 75 years to reach 50 million users, while Pokémon Go took 17 days. In addition, we think there is untapped value in underappreciated firms creating or benefiting from nonlinear change. These opportunities are crucial as we expect a structurally lower growth environment over the long term.

What is innovation?

The definition of innovation is very broad — it can be a technology, a piece of intellectual property, a business model, or a unique asset, among numerous other features. It can also happen across sectors, geographies, and market caps — from an established large-cap company transforming its business to a new small-cap firm disrupting an industry. Truly innovative companies control their own destiny by creating a new industry or meaningfully altering the playing field in an existing industry, driving revenue and profit growth that is not tied to economic cycles. For example, a major apparel company says 60% of consumers are wearing the wrong shoe size2. To combat this issue, cut down on costly product returns, and gather data on customer foot size to improve their design research, they leveraged machine vision and AI to create an app feature that properly measures foot size before each purchase.

How does innovation extend beyond technology?

Innovative companies are often fueled by a new technology, such as machine learning, electric vehicles, immuno-oncology, digital payments, or e-commerce. Much of this progress has been enabled by the falling cost of processing, memory, and sensors. But companies across every industry can be just as disruptive by improving processes or harnessing structural trends. For instance, we find a logistics real estate company to be innovative for multiple reasons. It uses the cloud to facilitate and customise customer experiences, focuses on facilities in urban areas to capture the same-day delivery trend, and has built innovation into its business model by launching a “sandbox environment” to test new technologies and product ideas. Many types of innovation can drive the nonlinear change we find compelling and we believe markets are bad at pricing material change.

What differentiates your approach to investing in innovation?

Innovation can happen across sectors, geographies, and market caps — from an established large-cap company transforming its business to a new small-cap firm disrupting an industry.

Our emphasis on a range of innovative companies across industries, geographies, and market caps means we are not wedded to the macro environment or short-term hype, but instead to the long-term structural trends driving innovation. Investors in disruptive innovation often chase the next big tech or health care idea and are generally concentrated in those sectors. In addition, the market often gets overexcited and becomes far too optimistic driving up valuations. We focus on identifying when companies are beginning to deliver the growth that will justify the prices. We may favour a company because we believe it can be a long-term structural winner with innovation-driven durable growth through macroeconomic cycles, not because it has exposure to a growth factor. Our process causes us to have a much broader opportunity set and to generally prefer the names that we believe are least appreciated by the market, leading us to avoid areas we consider overvalued, and helping us avoid the hype cycles of markets.

How do you evaluate innovation across industries?

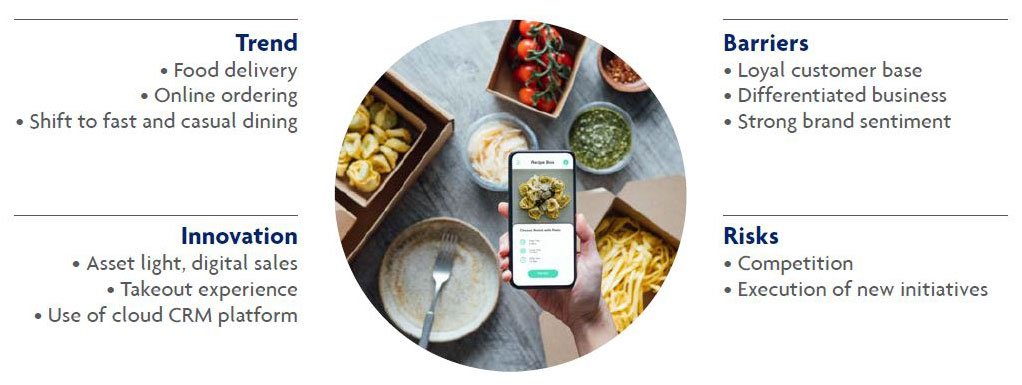

As we extend our lens beyond the typical innovative industries of technology and health care, we need a framework to identify and compare disruptive companies across sectors. As most investors focused on innovation limit their approaches to tech/IT and health care, they do not need to compare how an apparel company may offer innovation-driven growth opportunities relative to traditional tech. However, our universe is unconstrained and focused solely on sustainable growth opportunities regardless of industry. Our fundamental TIBR Framework helps us assess companies’ innovation potential across the opportunity set.

Figure 1 - The TIBR Framework – A deep dive

What does the TIBR Framework look like in practice?

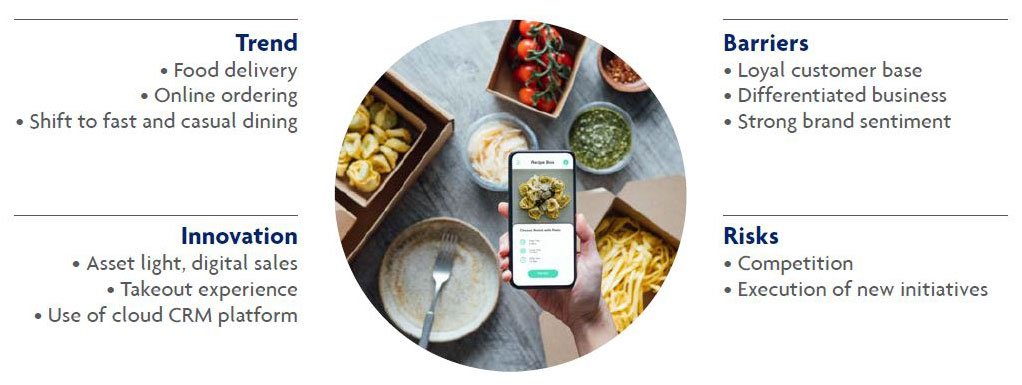

There are a lot of obvious innovative sectors of the economy, but the restaurant industry is probably not the first to come to mind. However, we view multiple restaurant businesses as compelling innovators that are leveraging technology to disrupt their industry. One example is a US-based chicken-wing company. This small-cap firm has a radical business model that harnesses the rise in delivery services, the cloud, advanced software systems, and the fast-casual-dining megatrend to drive attractive growth (Figure 2). The growth of digital tech in this sector is transforming food delivery, providing customers with improved convenience and transparency, which is particularly relevant in a post-COVID world.

Figure 2 - Digital dining disruption

Notably, TIBR is a screening process that allows for a “relative” assessment of the strengths and weaknesses of companies in different industries. The framework does not have explicit minimum thresholds but instead helps us think about “relative” conviction. For example, we can compare our TIBR analysis of the chicken-wing restaurant to an Argentina-based e-commerce company we find compelling (Figure 3). In our view, this firm has the potential to be the most important e-commerce and payments company in Latin America. We believe it benefits from key secular trends, a strong record of innovation, a unique business model, and high barriers to entry. The e-commerce trend is changing the way we shop and offering customers greater convenience, while the payments trend is democratising finance, increasing access and opportunities for new populations.

The growth of digital tech in the restaurant sector is transforming food delivery, providing customers with improved convenience and transparency, which is particularly relevant in a post-COVID world.

Figure 3 - LATAM e-commerce

How does the TIBR Framework integrate into your overall process?

We look for stocks to have both a strong TIBR score and an attractive valuation. Importantly, as we evaluate each company, we use a long-term valuation lens (5 – 10 years) to seek to understand a range for its market size, market-share potential, and margin structure. We then translate these views into an earnings-per-share trajectory on a relative and absolute basis. During the portfolio construction phase, a combination of TIBR scores, a valuation overlay, and a measure of contribution to risk help to determine position size. When building our final portfolio (typically around 50 stocks), we look to ensure that each stock brings a different risk and alpha source to the portfolio and seek to build diversification by avoiding country, sector, and innovation concentrations.

If innovation is everywhere, how can you fully capture the opportunity?

In a world that is undergoing massive growth and profound transformation, we believe that a contextualised, nuanced understanding of the shifts in enabling technologies, science, and policy across industries and geographies is one key to success in innovation investing. Our long history of understanding and investing in innovation and disruption across a range of sectors — including semiconductor, internet, software, and gaming companies — has taught us how to look through the volatility and stay long-term focused. But the breadth and depth of potentially innovative companies requires additional research capabilities that match the opportunity set.

We therefore aim to combine this experience with insights from our firm’s broad research resources. Our team leverages a global network of 55 career global industry analysts with expertise in every segment of the economy and covering 90% of the MSCI All Country World Index. In our view, this allows us to have insights on all the companies in a given opportunity set, from early-stage private firms to mega-cap companies, helping us to know the management teams, boards, and leaders of each industry inside and out. We believe this gives us a greater understanding of what the world will look like in 5 – 10 years and enable us to harness the insights of sector specialists to find opportunities outside of the industries and geographies traditionally thought of as “innovative.”

How does private-company innovation impact your public-company research?

We think investing in innovation requires a private-equity-like mindset. As we evaluate opportunities, we need to understand the pipeline of innovative companies in the private-equity space. We believe it is critical to have relationships with privately held companies to incorporate the themes and disruptors that have not yet emerged in public markets but may impact the industries in which we invest. As these companies move toward the public markets, we aim to already understand their potential for future disruption. For example, our lens into the private-equity market helps us assess how the mega-cap advertising ecosystem may evolve by identifying how new direct-to-consumer merchants are shifting their ad dollars. In addition, our private-equity research offers potential real-time insights on how businesses may be impacted by and adapt to significant events like the pandemic, allowing us to reflect these insights across our public company research.

Do you consider ESG factors?

Innovation — and in particular technology — is often thought to not emphasise ESG considerations. However, our approach to investing in innovation is highly aligned with an ESG mindset as our long-term five to 10-year view requires our investments to be sustainable. ESG factors have a direct impact on how management teams and boards think about long-term value, are inputs into the barriers and risks companies face over the long term, and also help to assess management quality, which is key to business durability. In addition, the business models we favor are often focused on driving positive ESG outcomes because they help their customers achieve ESG-related goals like automating energy management, reducing the need for in-house data centres, and democratising information, among other trends.

How are ESG factors incorporated into your investment analysis?

We integrate ESG research into both our bottom-up philosophy and process, as well as our major secular “trends” in our TIBR Framework. For example, an Irish packaging company we find compelling offers environmentally friendly products. Though this does not score especially high on innovation, it does score very well in the trend bucket — for both sustainability and e-commerce. While we believe ESG research is a critical input into company analysis, we do not always agree with our ESG Research Team or the market’s ESG views. For instance, founder control is often seen as an issue with innovative companies, from a reputational and regulatory perspective. However, we think the founder’s vision is often key to our investment thesis.

Importantly, we also believe active ESG engagement with companies can support changes in corporate behavior and actions to help mitigate ESG-related risks. Finally, we consult with the ESG Research Team for additional insights on how ESG risks and opportunities may differ between companies within regional and sector peer groups.

Where does innovation fit as a client portfolio solution?

We believe our long-term, low-turnover approach to harnessing global innovation allows investors to avoid chasing the next big innovation trend while still evolving to capture new ideas. In our view, this approach to investing in innovation can function as several different client portfolio solutions.