Japanese stocks are all the rage among foreign investors. Having been underweight Japan for years, these investors are now following in Warren Buffett's footsteps and increasing their stakes in large, well-known Japanese firms.

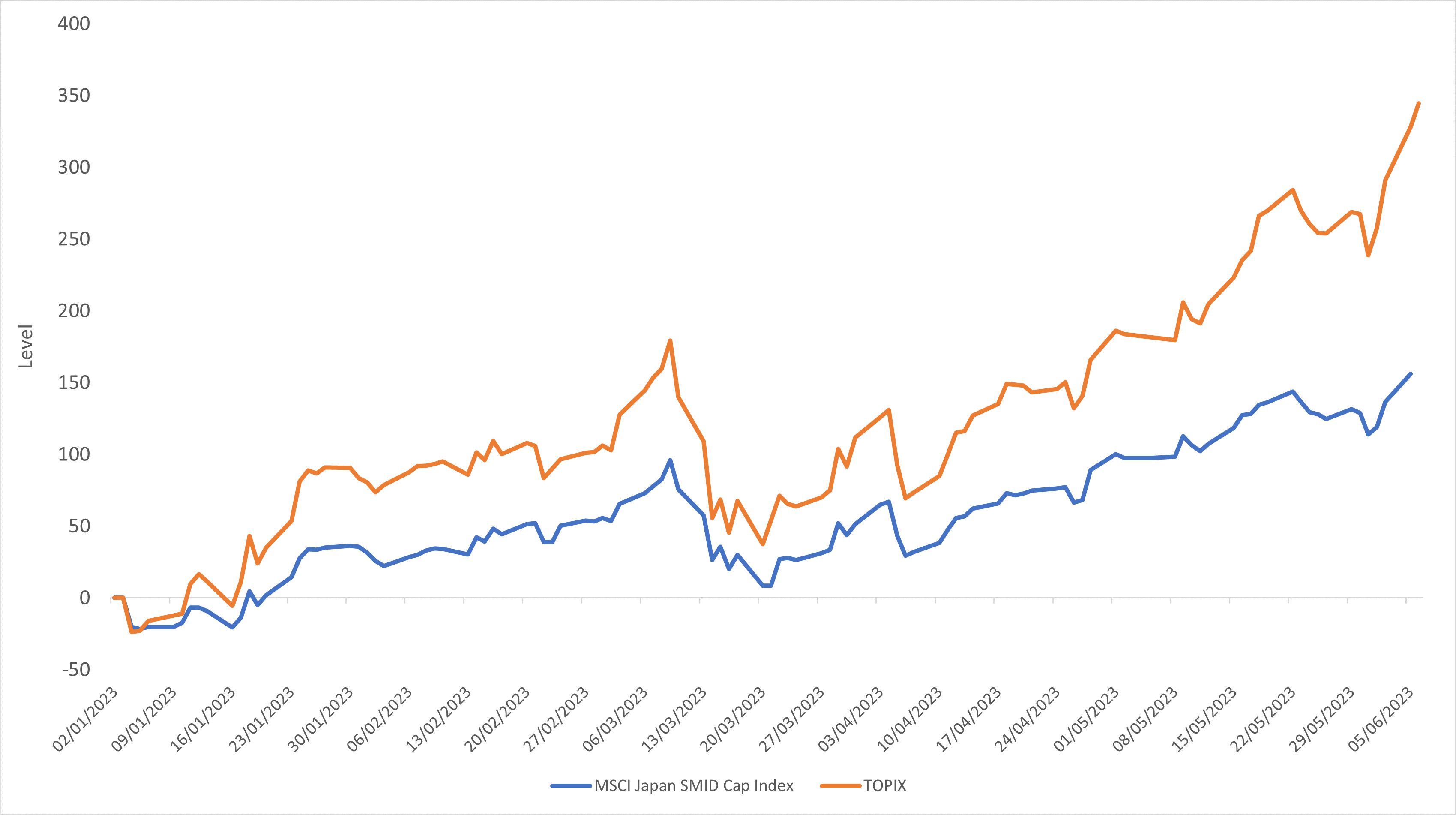

As a result, the country’s broad market indices such as the Tokyo Stock Price Index (TOPIX) have risen to multi-decade highs. Meanwhile, small and mid-cap stocks are lagging behind significantly. This despite the fact that small and mid-sized companies represent more than 80 percent of Japan’s investment universe.

Figure 1: TOPIX outperforms MSCI Japan Small and Mid (SMID) Cap Index

Source: Bloomberg. Data from 1 Jan 2023 to 5 June 2023

Small caps pack a big punch

These enterprises operate across a range of industries and form the backbone of Japan’s domestic economy. As such, they are just as likely to benefit from the economic stabilisation, domestic demand potential and corporate reforms that are driving Japan’s current market rally.

In fact, over the past 20 years, Japanese small caps’ earnings growth has been almost twice that of their large cap counterparts1. Yet, due to the lack of research coverage and limited profile on the global stage, many of these companies tend to be undervalued.

United Japan Small and Mid Cap Fund (the “Fund”)

UOB Asset Management (UOBAM) offers investors exposure to Japanese small and mid-cap stocks via the United Japan Small and Mid Cap Fund. The Fund is sub-managed locally by Sumitomo Mitsui DS Asset Management Company, a subsidiary of Sumitomo Mitsui Financial Group, one of the largest financial groups in Japan.

As an actively managed fund, the Fund aims to achieve long term capital growth by focusing on small and mid-size companies that are:

- Growing in developing business sectors

- Have unique business models or superior technologies

- Still able to grow earnings through innovation despite the mature market

Focused on Japan’s structural changes

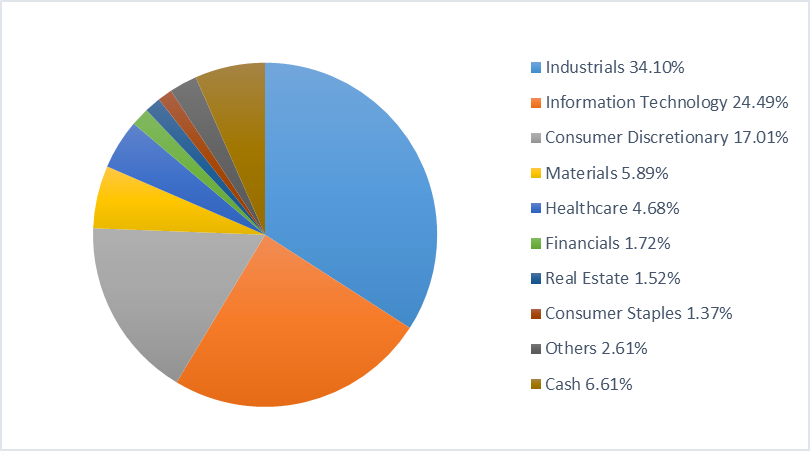

The Fund offers diversified exposure to various Japanese industries, with industrials and information technology (IT) currently the largest sector allocations. This reflects the Fund’s strategy of selecting companies able to significantly benefit from the unique structural changes taking place in Japanese society today.

Figure 2: Sector allocation of the United Japan Small and Mid Cap Fund

Source: UOBAM, 30 April 2023

This includes the shift by the Japanese corporate sector towards digital transformation in an effort to boost efficiency. Many firms are also facing manpower shortages as a result of Japan’s aging society and tight work permit restrictions. Both these trends provide growth opportunities for smaller companies and make up several of the Fund’s top holdings.

Figure 3: Top 10 holdings

| Company Name | Weight | Description |

| JBCC Holdings Inc | 1.85% | IT services company involved in software development, cloud and security solutions |

| Star Micronics Co Ltd | 1.74% | Manufacturer of printers and electronic components |

| Monogatari Corp | 1.65% | Restaurant and franchise chain operator |

| NSD Co Ltd | 1.57% | Software development and real estate rental company |

| Open Up Group Inc | 1.56% | Provides personnel staffing services for the manufacturing, machinery, electronics and IT software sectors |

| Relo Group Inc | 1.52% | Provides leased corporate housing management services |

| Seiren Co Ltd | 1.51% | Producer of silk, synthetic fibres, and textile products |

| Nifco Inc | 1.48% | Manufacturer of industrial plastic products and components |

| Meitec Corp | 1.47% | Provides high-end engineering outsourcing services for various industries |

| Stanley Electric Co Ltd | 1.47% | Manufacturer of automotive lighting and electric components |

Source: UOBAM, 30 April 2023

Long term outperformance

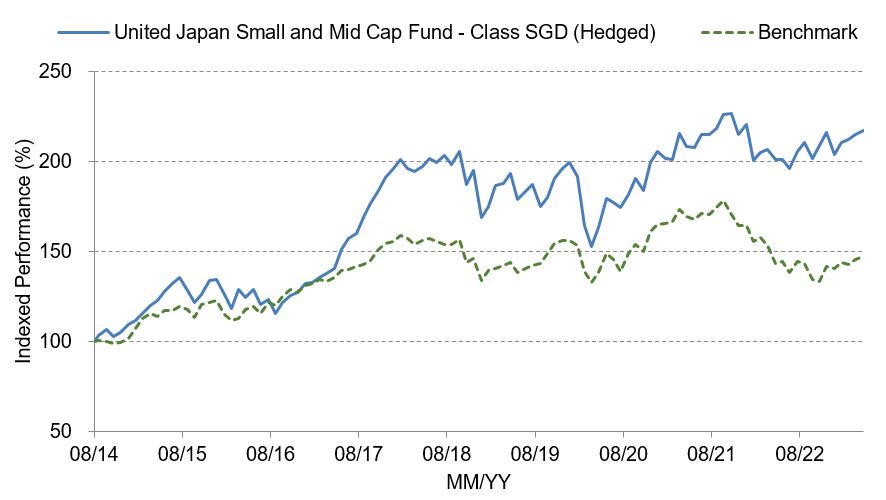

Since its inception in 2014, the Fund2 has delivered annualised performance of 8.66 percent, outpacing its benchmark by nearly 4 percent.

Figure 4: Fund returns vs benchmark since inception (Aug 2014)

| Performance (Class SGD (Hedged)) | Annualised Performance (%) | ||

| 3Y | 5Y | Since Inception | |

| Fund NAV to NAV | 9.99 | 1.95 | 9.30 |

| Fund (Charges applied^) | 8.13 | 0.91 | 8.66 |

| Benchmark | 2.10 | -1.20 | 4.53 |

Source: Morningstar. Performance as at 30 April 2023, SGD basis, with dividends and distributions reinvested, if any. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns. Benchmark: MSCI Japan SMID Cap Index. Past performance is not necessarily indicative of future performance.

^Includes the effect of the current subscription fee that is charged, which an investor might or might not pay.

Figure 5: Fund details

| Fund Name | United Japan Small and Mid Cap Fund |

| Fund Classes Available3 | Class JPY Class SGD/SGD (Hedged) Class USD |

| Subscription Mode | Cash – JPY, SGD and USD SRS – SGD |

| Minimum investment | Class JPY: ¥100,000 (initial); ¥50,000 (subsequent) Class SGD/SGD (Hedged): S$1,000 (initial); S$500 (subsequent) Class USD: US$1,000 (initial); US$500 (subsequent) |

| Management Fee | All Classes: Currently 1.75% p.a.; maximum 2.5% p.a. |

Source: UOBAM, as of 9 June 2023

Risks to note

Although Japan’s small and mid-cap stocks have room to run, investors should be aware that small caps tend to exhibit higher volatility than large-cap stocks do.

For instance, the MSCI Japan SMID Cap Index has a 3-year standard deviation of 17.4 while the TOPIX has a standard deviation of 7.84. Standard deviation is a measure of volatility; the higher the standard deviation, the higher the risk.

This can be attributed to smaller companies typically having fewer financial resources and less established businesses as compared to large firms. While small caps can offer higher growth potential, they may also be more susceptible to weakening economic conditions and negative investor sentiment arising from any bad news on interest rates or inflation.

1Source: Jefferies, Factset, as of July 2022

2Performance reflected for United Japan Small And Mid Cap Fund – Class SGD (Hedged)

3Investors should refer to the Fund’s prospectus for more details on the different classes available. Please check with our distributors on the availability of the Fund classes.

4Source: Bloomberg, as of 7 June 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing.You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z