- Middle East conflict likely to continue to simmer

- Markets remain calm but are turning more nervous

- Investors should take the opportunity to hedge against increased volatility

Markets on edge

It appears for now that Iran and Israel have stepped back from the brink. Although it is the first time in nearly half a century that Iran and Israel have directly attacked each other’s sovereign territories, the damage was not serious. Iran has signaled that it has no further plans for retaliation, and world leaders have called for a de-escalation of tensions.

In a knee-jerk reaction to Israel’s retaliatory strikes against Iran last week, US, European and Asian markets such as Hong Kong and Korea fell steeply but have since more than recovered. Similarly, oil prices and the US dollar (USD) spiked on Friday but have since eased. US bond yields, driven by a variety of factors including inflation fears, have been climbing since the start of April and are back to the highs seen late last year.

Three escalation scenarios

It is UOBAM’s view at this point that escalation into a full-scale war between Israel and Iran, or involving multiple Middle East countries, is unlikely. However, to help plan future investment moves, it is important to consider a range of scenarios. Here are three scenarios and their potential implications.

| Scenario | Details |

Impact on Oil |

Impact on Equities |

Impact on Yields |

Impact on Gold |

| Confined war |

|

Limited impact as markets are already pricing in such a scenario | |||

| Proxy war |

|

Significant rise: +$10 -$20 / bbl similar to 2006 & 09 impact | Volatility rises, causing a near-term drawdown in equities (-5% to -10%) before recovery |

|

|

| Escalated Direct war |

|

Extreme rise: +$10-$30 / bbl similar to 1990-91 gulf war impact or 1973 Israel Arab war | Larger drawdown in equities (up to -20%) (e.g. 1973 Middle East war) |

|

Significant rally (>20%) due to risk-off sentiment similar to 1990-91 gulf war and 2003 Iraq war |

Source: UOBAM

Which asset classes will benefit?

It would appear that, after a very strong run since the start of the year, the potential for conflict escalation in the Middle East is causing investors to take some risk off the table. For example, the US’s Nasdaq Composite index has fallen 7.1 percent from its record high in just over one week as investors rushed to take profit on their tech stocks.

However, these funds are not necessarily being shifted into bonds. Over the past month, fears that inflation could stay sticky caused 2-year US Treasury bond yields to rise by around 8.0 percent (bond prices move in the opposite direction to bond yields). An oil price shock will put further pressure on inflation, delay the Fed’s rate cuts and further elevate yields. This means that short term bonds are not necessarily a good hedge against equities volatility at the present time. Longer-duration bonds could see safe-haven demand, but any rally will also be limited by inflation concerns.

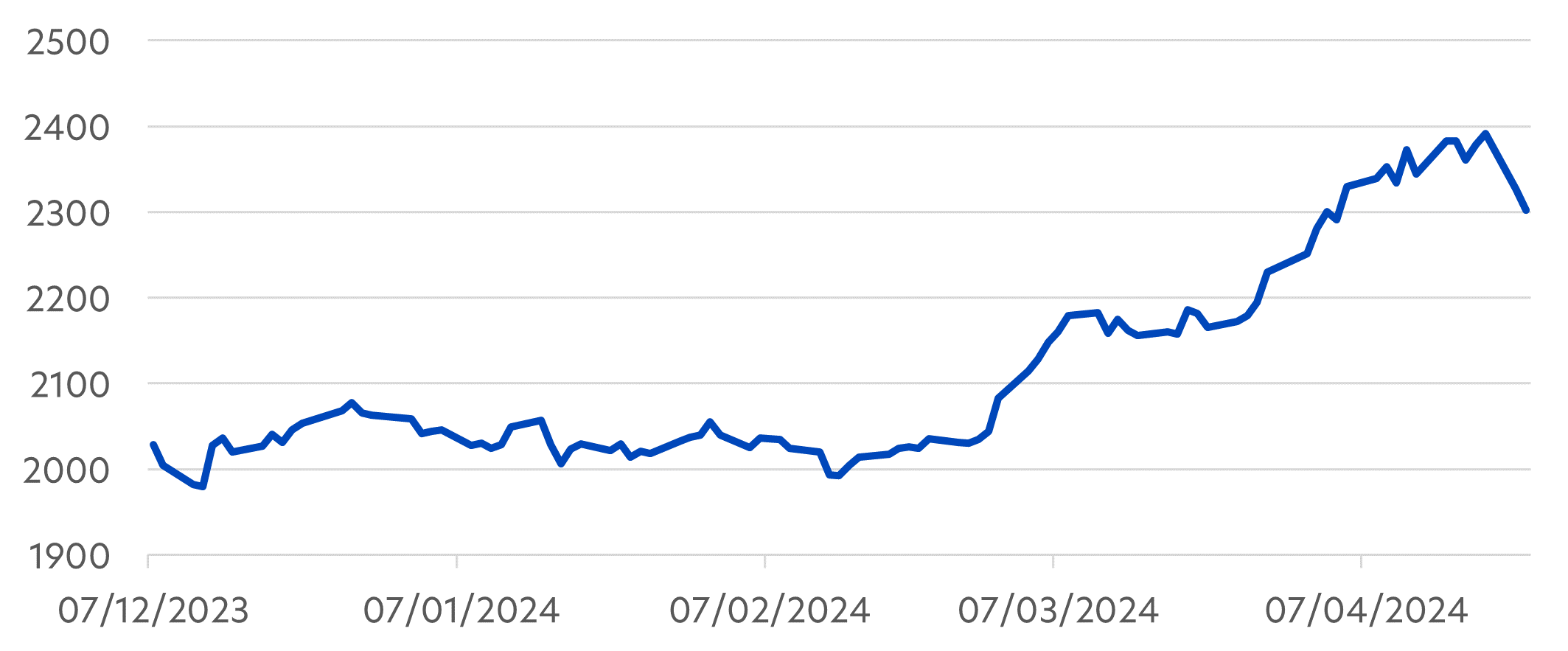

We would expect investors to adopt a more defensive positioning by turning instead to other flight-to-quality instruments such as gold and the USD. Physical assets such as gold are a traditional go-to in times of crisis. In fact, gold prices have already seen a substantial lift over the past few months, and show no signs of losing steam. Meanwhile the USD, held in a fixed deposit or money market fund, offers the additional advantage of interest income.

Fig 1: Gold prices, 7 Dec 2023 – 23 April 2024 (US$)

Source: Bloomberg/UOBAM

Risk of an oil price surge

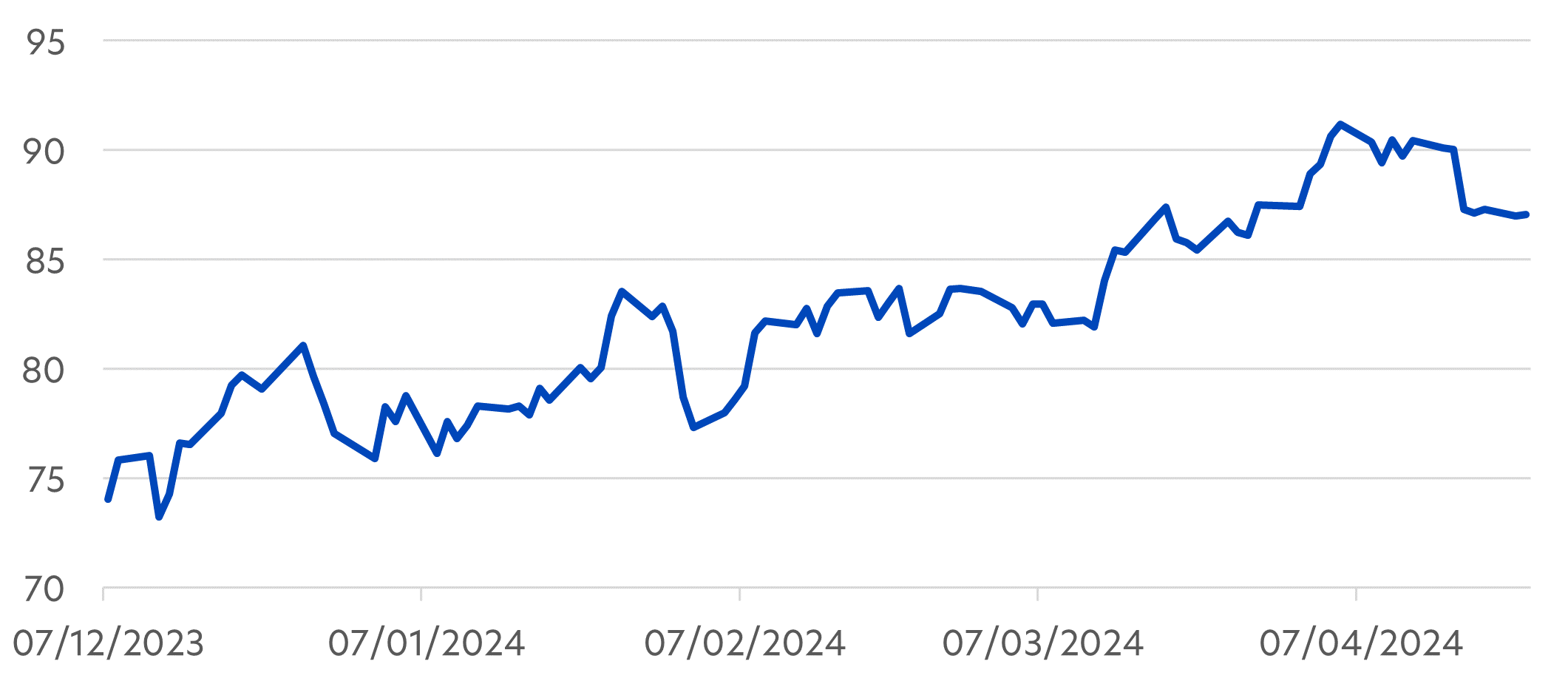

Oil prices are also expected to rise if the current conflict is seen to be on an escalation path. In the event of a limited or proxy war, we would expect gradual gains of 10 to 20 percent, bringing Brent Crude prices closer to US$100. This in turn could lead to a rise in core inflation in the US and around the world.

Fig 2: Brent Crude prices, 7 Dec 2023 – 23 April 2024 (US$)

Source: Bloomberg/UOBAM

However, should the Middle East erupt into a full-scale war, oil prices could surge even higher. Iran is a major oil producer, so a war could severely disrupt the supply, production and transport of Iranian oil through the Strait of Hormuz. Such disruptions risk an oil price surge of 30 percent or more and would cause global central banks to rethink their monetary strategies.

To hedge against such an eventuality, investors should consider investing in energy producers, facilities and service providers that are able to take advantage of an oil price hike.

| If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider: United Gold & General Fund United Global Resources Fund You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z