Key highlights

- The use of hydrogen is set to grow as a viable solution to decarbonise carbon intensive sectors and pave the transitions towards a low-carbon future for the global economy

- Multiple 'colour' shades of hydrogen exist but the most ideal for a sustainable energy future lies in green hydrogen

- Cost of green hydrogen have fallen and will continue to fall as costs of renewable energy continues to fall

- Global government support and commitment is accelerating towards the development of sustainable hydrogen economies

Why the Hype in Hydrogen?

In 2020, some of the world's largest nations have committed to net-zero emissions targets – Japan and South Korea by 2050; China by 2060 while hydrogen has emerged as a potential technological solutions1 to reach these targets.

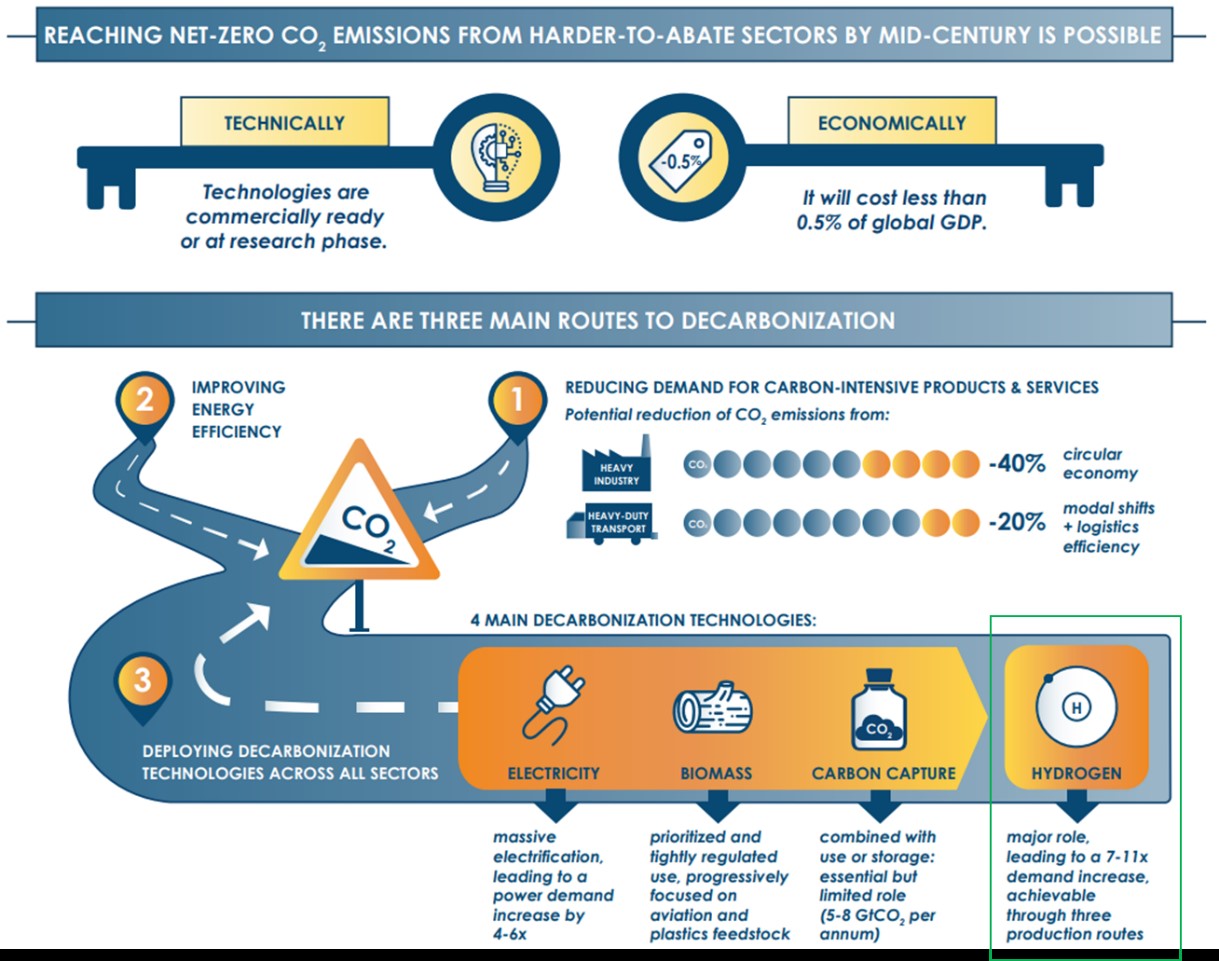

Figure 1: Reaching net-zero carbon emissions is possible through key decarbonisation. Source: Energy Transitions Commission

The answer to the question "why the hype in hydrogen" lies in how it can play a key and cost effective role in the decarbonisation of several of the harder-to-decarbonise sectors, supporting residential heating and flexibility in power generation and distribution as well as the capability to be exported via global supply chains. As a quick summary, hydrogen is able to:

- Function as a low-carbon2 or a zero carbon3 energy carrier4 for electricity that can be easily stored and transported5

- Enable a more secure energy system where hydrogen will reduce fossil fuel dependence6 and utilised as fuel and for heating;

- Substitute fossil fuels in major harder-to-decarbonise sectors such as heavy industry and heavy-duty transport7 and help to decarbonise this sectors since the only by-products of pure hydrogen fuel are heat and water which do not emit pollutants or any greenhouse gases8

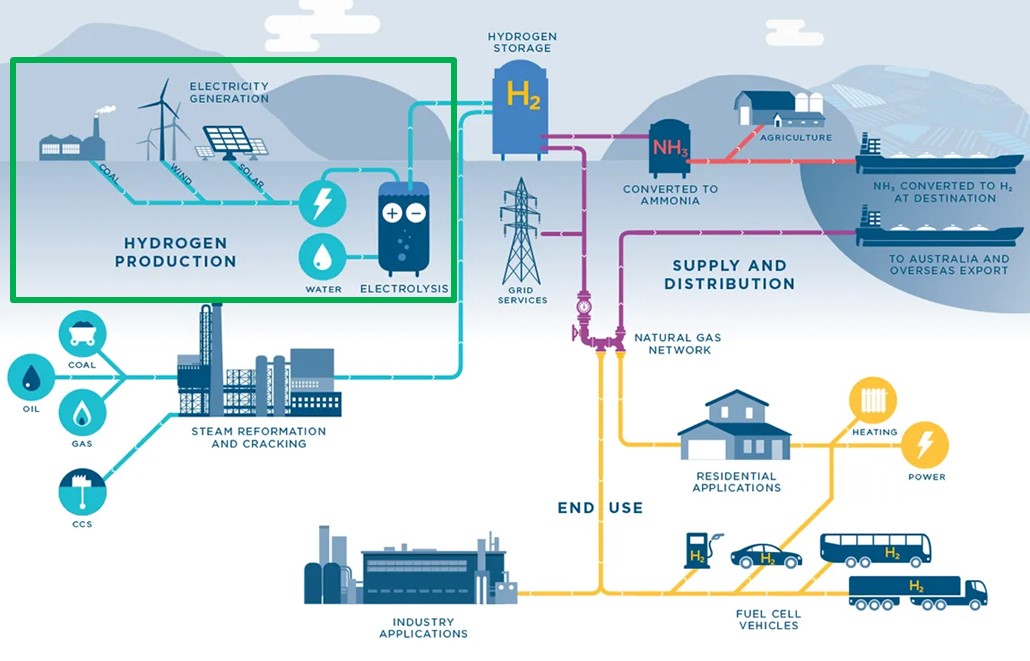

Figure 2: Opportunities and key uses of hydrogen as an energy carrier. Source: Herbert Smith Freehills.

Hydrogen is very versatile. It functions as an energy carrier and can be integrated into existing infrastructure. More importantly, ‘green hydrogen' produced entirely from renewable energy will be a zero-carbon carrier that is clean, abundant, reliable and sustainable across multiple sectors and play a sizeable role in decarbonising economies.

In this aspect, it has been projected that hydrogen will become one of the world's fastest-growing energy carriers9 and potentially help to meet about 8% of primary global energy demand by 2030 and about 15% by 2050. Given this accelerated growth, a zero-carbon energy carrier – green hydrogen – will play a key role towards enabling a net-zero carbon future that many of the world's economies are looking to achieve.

The Colour Spectrum of Hydrogen

You may have also heard about other colours of hydrogen but is important to note that from the point of view of applications that hydrogen of all 'colours' are the same and can be used in identical ways. The hydrogen colour spectrum10 exists as a means to identify the energy source and/or processes used to produce hydrogen.

| Colour of Hydrogen | Feedstock / Energy Source | Process |

| White | Produced as a by-product of artificial means | In nature, hydrogen exists in its gaseous molecular form (H2) but is rarely found existing naturally which is why various processes are required to produce it artificially and why the various colours are used to identify the energy source and/or process used to produce H2. |

| Brown | Coal | Gasification generally converts organic or fossil-based hydrocarbons into carbon monoxide, dioxide as well as hydrogen. |

| Grey | Natural Gas (Methane) | Most hydrogen comes from natural gas and can be separated via a process involving water called "steam reforming" which also generates CO2. Hence the colour "grey" is designated whenever the excess CO2 is not captured. |

| Blue | Coal/Natural Gas | Hydrogen is considered blue whenever the emission generated from the steam reforming process are captured and stored underground via industrial carbon capture and storage (CSS). |

| Pink/Purple/Red | Nuclear Power | Pink/Purple/Red Hydrogen is obtained from electrolysis of water using nuclear energy. |

| Yellow | Grid Electricity | Yellow hydrogen refers to hydrogen produced via electrolysis using only solar energy as a power source. However, it can also be used to indicate hydrogen produced via electrolysis using electricity generated from mixed sources (ranging from renewables to fossil fuels) based on availability. |

| Green | Renewable Energy Sources (e.g. Solar, Wind, Hydro, Geothermal, Tidal)s | Green hydrogen, also often referred to as "zero-carbon or clean hydrogen", is produced via electrolysis of water using electricity generated from renewable energy sources. It is envisioned as the most ideal for use across industries11 |

The Cost of Hydrogen Production

For green hydrogen to be able to truly support a net-zero carbon future and a viable alternative to compete with conventional fuels, the price of green hydrogen has to fall to around US$2.0/kg H2 by 2030.

Latest research by Bloomberg New Energy Finance (BloombergNEF) indicates that this is achievable by 2030. The price outlook for green hydrogen is quite promising with prices expected to be halved to about US$1.0/kg H2 by 205012.

The production cost for green hydrogen is primarily determined by three key factors:

- Price of renewable energy

- Capital cost of electrolyser

- Electrolyser capacity factor13

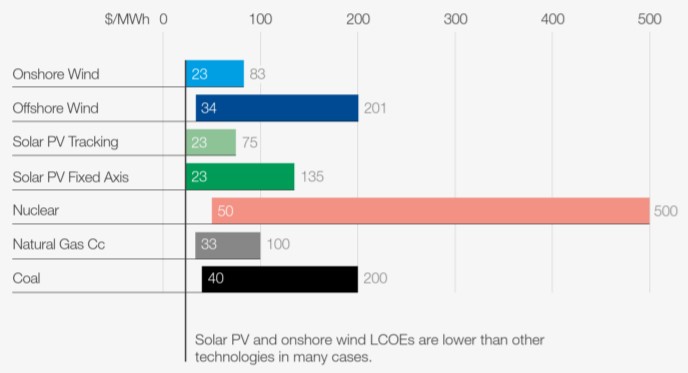

On the matter of the price of renewable energy, it is worthy to note that up to 60% of green hydrogen costs14 can be attributed to the levelised cost of renewable energy. Key statistics from the International Renewable Energy Agency (IRENA) has reported that renewable energy has become increasingly cheaper compared to any new electricity capacity using fossil fuels.

In 2020, renewable energy was report to have become the cheapest source of power in many parts of the world, according to an update of Levelised Cost of Energy (LCOE15) in H2 2020 by BNEF where the LCOE of renewable energy (such as from solar cells and onshore wind) is lower than coal and natural gas in some countries16.

Figure 3: Global LCOE Ranges – H2 2020 updates by BloombergNEF. Source: BloombergNEF: New Energy Outlook, October 2020.

As the technology for renewable energy production, storage and distribution improves, it is projected that the best-in-class solar and wind projects will be able to push prices below US$ 20 per megawatt-hour (MWh) by 203017. While the low-cost of renewable electricity is a necessary condition for competitive green hydrogen, capital costs for electrolysers have also to fall significantly and in tandem.

In this aspect on the reduction in cost of electrolysis facilities, hydrogen experts at the CERAWeek conference (2 March 2021) noted that the supply chain for hydrogen production has broadened. The supply chain now includes established companies which are also involved in other synergistic industries (such as energy solutions company) with growing attention devoted towards development efforts and scaling to reduce capital costs. It is projected that as electrolyser plants continue to scale up and built on industrial scale – at a Gigawatt (GW) scale, capital costs are likely to further decline18 due to economies of scale. This is exemplified in an announcement by hydrogen tech supply firm Nel ASA where the costs of its electrolysers is set to reduce by about 75% as it looks to launch a 2-GW electrolyser factory19.

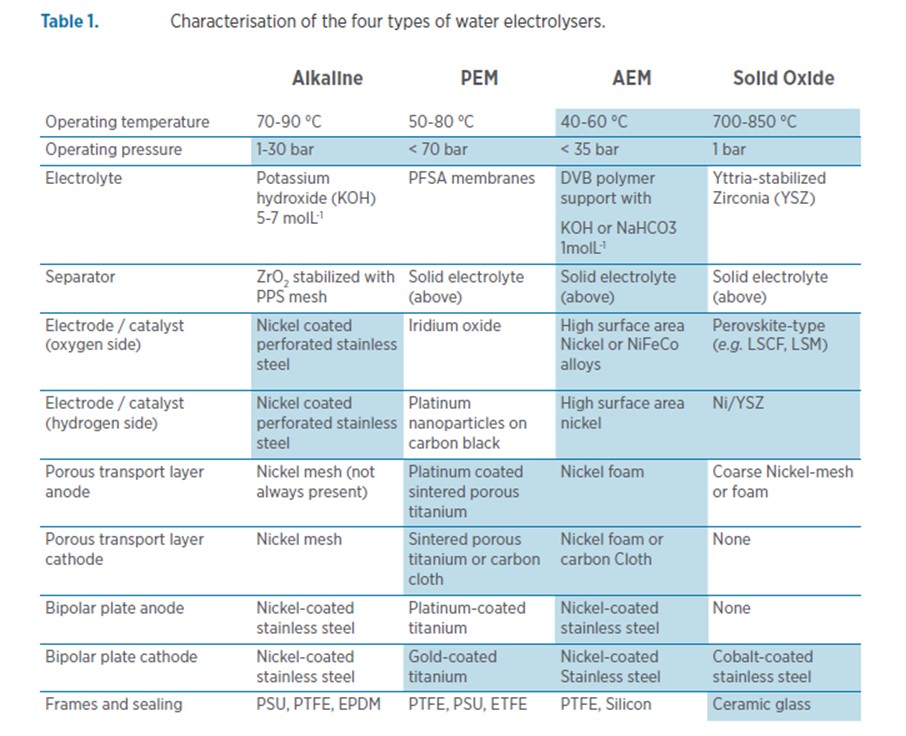

As to capacity factor, more research and development (R&D) will be needed to boost the efficiency of electrolysers. There are primarily four types of electrolysers namely alkaline, polymer electrolyte membrane (PEM), anion exchange membrane (AEM) and solid oxide which key characteristics are outlined below (Figure 2).

Figure 4: Characterisation of the four key types of water electrolysers. Source: IRENA, Green Hydrogen Cost Reduction.

The R&D efforts will have to be targeted at improving efficiency of these four types of electrolysers at the cell, stack and system level system level as shown below (Figure 3).

Table 1: Analysis of potential R&D to improve green hydrogen electrolysers. Source: IRENA, 2020.

| Electrolyser Level | Key Areas Identified for Further R&D |

| System | • Hydrogen compression vs operating pressure • Simplification of power supply equipment |

| Stack | • Size • Stacking potential |

| Cell | • Membrane thickness • Membrane thickness • Catalyst amount and type • Coatings • Electrode architecture |

With the analysis conducted by IRENA on key areas identified for R&D, it was also mentioned that to ensure advances in electrolysers, government support is pivotal due to the complexity and cost-intensive nature of R&D required in order to improve the commercial viability as well as achieve breakthroughs in electrolyser technology in order to enhance improve electrolyser capacities.

Governmental Support for Hydrogen Production Around the World

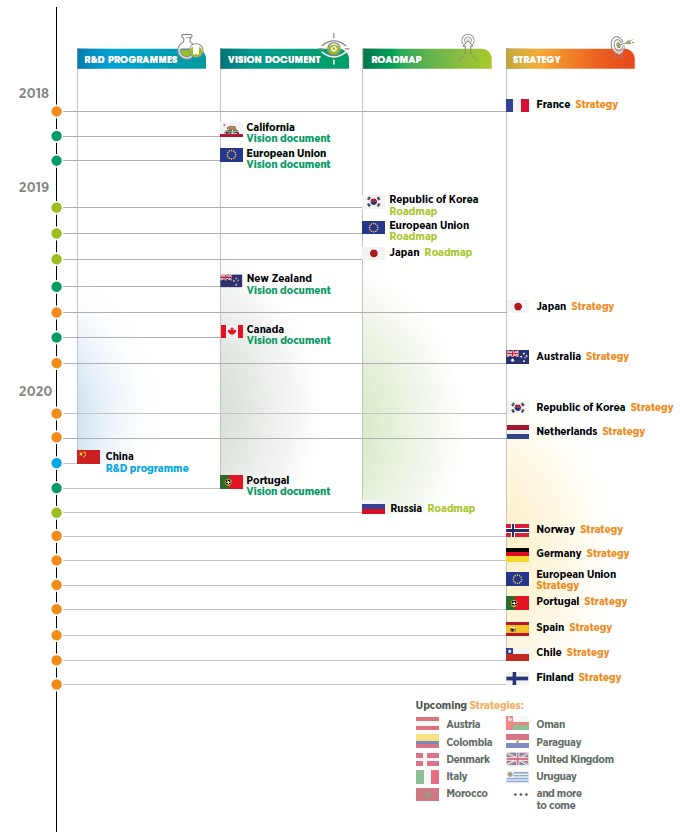

Despite various countries having hydrogen policies and strategies with differing scopes (such as a focus on green hydrogen, blue hydrogen, fossil-based, or a combination) and scale (from no targets to very ambitious, quantified hydrogen as well as electrolyser targets), there is widespread support for green hydrogen as the long-term sustainable solution which is testament to the key role that green hydrogen will play in the transition towards low-carbon economies and meeting net-zero targets.

Figure 5: Recent global developments in hydrogen policies and strategies. Source: IRENA (2020), Green hydrogen: A guide to policy making, International Renewable Energy Agency, Abu Dhabi.

Asia-Pacific countries have also been advancing their efforts to adopt a hydrogen economy as shown in the table below.

Table 2: Asia-Pacific Countries Accelerate Hydrogen Plans. Source: S&P Global Platts, UOB Asset Management Analysis

| Country | Policies & Plans | Infrastructure Developments |

| Japan |

Japan's launched its Basic Hydrogen Strategy in December 2017 and aims to pioneer the world's first "hydrogen society". The strategy aims to decarbonise key sectors such as transport, power, industry and residential sectors while strengthening energy security. Plans to incorporate hydrogen power into primary energy mix where H2 and ammonia is set to account for 10% of Japan's total energy mix in 2050. |

Kawasaki Heavy Industries in December 2019 launched the world's first liquid-hydrogen carrying ship. Several other Japanese firms including Toyota, are making sizable investments in the future hydrogen economy. In the transportation sector, Japan is targeting 800,000 new fuel cell passenger vehicles and 1,200 new fuel cell buses and coaches by 2030, in addition to 900 fuel cell refuelling stations. Japan H2 Mobility intends to launch at least 24 more hydrogen stations in Japan in fiscal 2020-21. This is part of Ministry of Economy, Trade and Industry's target to install 160 hydrogen stations in the fiscal year. |

| South Korea |

The government unveiled hydrogen blueprint in 2019, with the vision to sharply increase production of hydrogen-powered vehicles and electricity generation by hydrogen to use it as a major energy source for transportation and power generation. Under its "roadmap for hydrogen economy," South Korea will transform three cities into hydrogen-powered ones and produce 81,000 hydrogen-powered cars by 2022, which will increase to 6.2 million. |

Allocated USD$1.8 billion budget to subsidise car sales and build refuelling stations. South Korea's Hyosung Group has signed a deal with Linde, a chemical company, for a Won 300 billion ($244 million) project to build the world's largest liquid hydrogen plant. The plant will have a capacity of 13,000 mt/year by 2022 in Ulsan on South Korea's southeast coast. The plant can power 100,000 hydrogen vehicles on a single charge. Hyosung and Linde will also build 50 new hydrogen charging stations and expand facilities at 70 other hydrogen charging stations in South Korea by 2022. Plans to transform 30% of cities to be powered by hydrogen by 2040 and aims to be a global leader in Fuel Cell Electric Vehicle (FCEV) production. |

| China |

Announced over 50 mandates and policies supporting H2 economy with a focus on transport production. Beijing is considering subsidies on fuel cell vehicles and trying to find ways to encourage hydrogen consumption in new sectors. Development of reliable and durable carbon capture technology remains at the forefront of hydrogen production in China through coal gasification. |

China has introduced fuel cell vehicles in a small number of pilot cities, a policy which helped kick-start the widespread use of electric vehicles. A Draft Development Plan for the New Energy Vehicle Industry 2021-2035, realised in 2019, places focus on the development of hydrogen vehicle technology and the construction of fuel storage. Targets to produce 100,000 FCEVs by 2025 and 1,000,000 FCEVs by 2030. |

| India |

State-owned Indian Oil Corp. is working on a long-term energy transition strategy, which would involve producing hydrogen in a cost-effective way and developing technology to combine compressed natural gas with hydrogen. |

IOC is working on technology to develop hydrogen-spiked Compressed Natural Gas (CNG), or H-CNG, which would involve partly reforming methane and CNG. Under this process, the entire CNG of a station would pass through this new reforming unit and part (17-18%) of the methane converted into hydrogen. IOC is collaborating with the Society of Indian Automobile Manufacturers and other vehicle manufacturers to undertake field validation exercises to arrive at the optimal hydrogen percentage to be spiked in CNG. |

| Singapore |

Five Singapore and two Japanese companies have recently signed an agreement to study how hydrogen as a low-carbon alternative can contribute to a clean and sustainable energy future for Singapore. The companies involved are PSA Corp. Ltd., Jurong Port Pte. Ltd., City Gas Pte. Ltd., Sembcorp Industries, Singapore LNG Corp. Pte. Ltd., Chiyoda Corp. and Mitsubishi Corp. |

Singapore companies will be working with Chiyoda and Mitsubishi to evaluate the technical and commercial feasibility of hydrogen usage, and to develop a business case for hydrogen import and utilisation in Singapore. Jurong Port says it is working with Chiyoda as it believes that the port is well placed to accelerate the development of hydrogen as a viable fuel option for power generation in Singapore's transition to a low-emissions future. |

| Australia |

Australia has crafted out a national strategy for hydrogen with the aim to be major global player by 2030. A key element of Australia's approach will be to create clusters of large-scale demand -- such as ports and cities. These will be complemented by other early steps to use hydrogen in transport, industry and gas distribution networks. |

The Australian government has created a AUS$300 million ($191.5 million) fund for new hydrogen projects that align with the country's National Hydrogen Strategy. This would involve areas such as advancing hydrogen production, developing export and domestic supply chains, establishing hydrogen hubs and backing projects that build domestic demand for hydrogen. |

Investment Opportunities in Powering the Future via a Hydrogen Economy

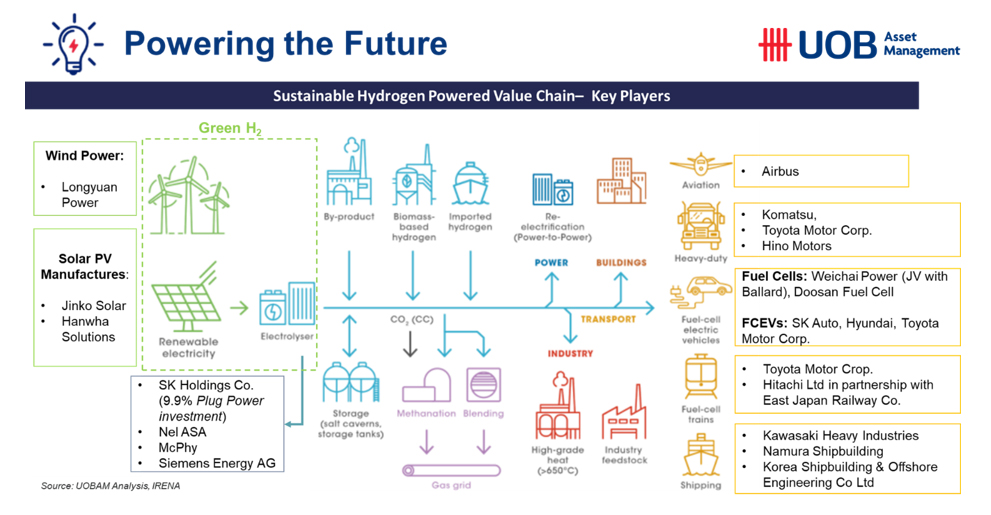

Figure 6: Key players identified in the sustainable hydrogen powered value chain. Source: UOB Asset Management Analysis, IRENA Hydrogen Value Chain

As governments and countries around the world continue to grow and develop their plans for use of hydrogen, several companies have been identified as key players supporting the hydrogen economy.

Now the question beckons – Just who are they key players promoting the sustainable hydrogen economy?

The answer to that question lies within the assessment of the sustainable hydrogen powered value chain which will be the need to lower the LCOE of green hydrogen. To do so, production of renewable energy will need to increase in capacity and scale. This is where we see renewable energy solution providers such as Longyuan Power, one of Asia's largest wind power producer and Jinko Solar, the world's largest solar panel manufacturer potentially benefitting from such growth.

Next in the value chain are electrolysers which will be the key to driving the competitive price of green hydrogen lower via R&D and scaling up the production of electrolysers.

As we move further down the value chain, green hydrogen can potentially be utilised in many areas such as power, industry, buildings and transport. Zooming into the area of transport, there are big opportunities in hydrogen fuel cell vehicles due to their inherent advantages. For example, hydrogen powered heavy-duty vehicles have a competitive advantage over battery electric vehicles as they are able to take heavier loads over longer distances with shorter refuelling times. Key players in the Asia market to look out for include Komatsu, Toyota Motor Corp. and Hino Motors.

Moving further down the transport sector would be the shipping industry. A key player to look out for is Kawasaki heavy Industries which has developed the world's first liquefied hydrogen carrier.

Over the next decade, the development and use of hydrogen looks to be promising as evident by long-term national commitments and roadmaps as well as business strategies from various companies. For the sustainable investor, the developments in the hydrogen space and more importantly, green hydrogen, will be something to keep an eye for in their investment.

By Kenneth Tay, Sustainability Office, UOB Asset Management

1 World Economic Forum: Achieving net-zero emissions by 2050 will rest on these 3 pillars

2 Low-carbon hydrogen refers to blue hydrogen, produced through steam reforming with carbon capture added

3 Zero-carbon hydrogen refers to green hydrogen, produced through electrolysis from renewables

4 An energy carrier able to store energy when not needed and then makes the stored energy available when the primary energy source is not available or sufficient

5 International Energy Agency Technology Roadmap: Hydrogen and Fuel Cells , Paris, 2015, D. Hart , J. Howes , B. Madden and E. Boyd , Hydrogen and Fuel Cells: Opportunities for Growth. A Roadmap for the UK , E4Tech and Element Energy, 2016, Hydrogen Council Hydrogen scaling up: a sustainable pathway for the global energy transition , 2017

6 M. Pudukudy , Z. Yaakob , M. Mohammad , B. Narayanan and K. Sopian , Renewable Sustainable Energy Rev., 2014, 30 , 743 —757, T. Abbasi and S. A. Abbasi , Renewable Sustainable Energy Rev., 2011, 15 , 3034 —3040

7 Energy Transitions Commission: Mission Possible

8 European Commission: Q&A – A Hydrogen Strategy for a Climate Neutral Europe

9 BP Energy Outlook 2020

10 There is currently no official definitions for the colours of hydrogen and this colour spectrum takes reference to the colour spectrum that was developed by the by the North American Council for Freight Efficiency (NACFE) which represents common industry nomenclature

11 Yale Environment 360 – Green Hydrogen: Could it be key to a carbon-free economy?

12 BloombergNEF: Hydrogen Economy Outlook, March 2020

13 Capacity factor refers to how often the electrolysis plant operates over a specific period of time and is expressed as a percentage and calculated by dividing the actual unit H2 output by the maximum possible plant H2 capacity output

14 S&P Global Ratings: Green hydrogen costs need to fall over 50% to be viable

15 The LCOE of an energy-generating asset can be thought of as the average total cost of building and operating the asset per unit of total electricity generated over an assumed lifetime

16 World Economic Forum: Wind and Solar PV will keep taking the lead, August 2020

17 Bloomberg Green: Solar and Wind Cheapest Sources of Power in Most of the World

18 S&P Global Market Intelligence: Experts explain why green hydrogen costs have fallen and will keep falling

19 Recharge News: Nel to slash cost of electrolysers by 75%, with green hydrogen at same price as fossil H2 by 2025

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.