Last month, the United Greater China Fund received the Refinitiv Lipper Fund Awards Singapore 2023 Winner, Best Equity Greater China Fund Over 3 Years1. From May 2023, it has also been upgraded by Morningstar from a four to a five-star rating, and since 2020, the Fund’s performance has ranked within the first or second quartile against its peers2.

This result is particularly significant given that this was one of the first funds to apply UOBAM’s Artificial Intelligence Machine Learning (AIML)-and-analyst strategy. Three years ago, this 26-year old fund revised its approach to incorporate insights generated by a proprietary AI model.

Under the radar

It was felt then that the United Greater China Fund, along with a few other Asian equity funds would benefit from AI and machine learning technology given that there are many smaller stocks within the Asia region that do not receive sufficient attention from research analysts.

As of June 2023, within Greater China, comprising the China, Taiwan and Hong Kong markets, there are close to 10,000 stocks to choose from. As these economies evolve from traditional to advanced manufacturing activities, there are many companies with strong potential for growth that have emerged, but yet continue to fall outside analysts’ radars.

Human biases

There are also stocks that suffer from investor biases. A good example are China’s many property companies. Given the challenges faced by China’s real estate sector, both professional and retail investors will be tempted to steer clear.

However, there are always companies that manage to buck the industry trend and surprise on the upside. At the same time, there are companies that appear to be thriving but may be beset with internal issues. Of course, once these issues are well known, it is often too late to exit the stock.

What is UOBAM’s AIML-and-Analyst model?

The AI model ingests millions of datapoints related to the macro environment, company fundamentals and technical market factors. These are then grouped and arranged according to specific variables in order to enable the early-detection of patterns and trends. Using this, the model is able to assign a lower score to stocks that display problematic patterns and a higher score to ones that show positive patterns.

These scores serve as a guide for managers to conduct more targeted and meaningful research. Managers make the final decision on the stocks they wish to include in their portfolios.

Greater China offers diversification benefit

In the past, the China and Taiwan markets were more co-dependent, meaning that when the China market fell, the Taiwan market would follow suit. Today, given global geo-political tensions but also Taiwan’s strong growth in advanced engineering, the two markets have shown that they are no longer so strongly correlated. Year-to-date in 2023, Taiwan’s TAIEX market is up by 18 percent, as compared to China’s SSE Composite index which has only gained 3.2 percent.

In the short term, UOBAM’s approach has turned less constructive on China due to weak investor sentiment and soft Purchasing Managers’ Index (PMI) data suggesting continued weakness in economic activities. On the other hand, we are upgrading our outlook on Taiwan. This tech-centric market looks a likely beneficiary of the global secular interest in and adoption of AI.

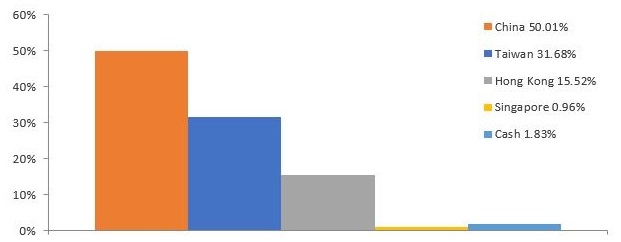

United Greater China Fund: Allocation

The investment objective of the Fund is to achieve long-term capital growth primarily through investment in companies with assets or revenues being in or derived from the People’s Republic of China, Hong Kong SAR and Taiwan.

Over the longer term, China retains its appeal over the long term given its post-reopening opportunities in terms of retail consumption, and participation in sunrise industries such as new energy and electric vehicles.

However, since earlier this year, the Fund’s AI indicators have been giving China a low score and scoring high for Taiwan. As a result, the Fund has been heading towards being more underweight China and overweight Taiwan, an allocation that has helped the Fund outperform most of its peers3.

Figure 1: United Greater China Fund country allocation

Source: UOBAM, 30 April 2023

This Taiwan overweight is reflected in the Fund’s biggest holdings. Half of the names in its top 10 holdings are in Taiwanese companies, and as a result, the largest sector allocation - about 25 percent - is to the information technology industry. The second largest, about 16 percent, is to the financial sector while consumer discretionary and consumer staples each make up about 9 percent of the Fund.

Figure 2: Fund’s Top 10 holdings as of 30 April 2023

| Company Name | Weight | Country | Description |

| Taiwan Semiconductor Manufacturing Company | 4.94% | Taiwan | Leading semiconductor manufacturer and chip foundry |

| Wistron Corporation | 4.06% | Taiwan | Specialises in electronics, including contract manufacturing for consumer electronic brands |

| PetroChina Co Ltd | 3.86% | China | Oil and gas producer with operations in development, refining, and distribution of petroleum products |

| Global Unichip Corporation | 3.32% | Taiwan | Semiconductor design services company engaged in the research and development, production, testing and sales of application-specific integrated circuits (ASICs) and wafers |

| Swire Pacific Ltd | 3.19% | Hong Kong | Operates business units in property development, aviation, marine serves, beverages and trading |

| Delta Electronics Inc. | 3.16% | Taiwan | Manufacturing and sales of power supplies and components |

| Kerry Properties Ltd | 3.15% | Hong Kong | Invests in and develops real estate, and owns and operates logistics, freight and warehouses business |

| Bank of China | 3.13% | China | State-owned commercial bank in China, and the fourth largest bank in the world |

| Momo.com Inc. | 2.98% | Taiwan | E-commerce services company offering TV shopping and internet shopping services |

| GF Securities Co Ltd | 2.93% | China | Engages in the operation of large-scale comprehensive securities broking and trading services |

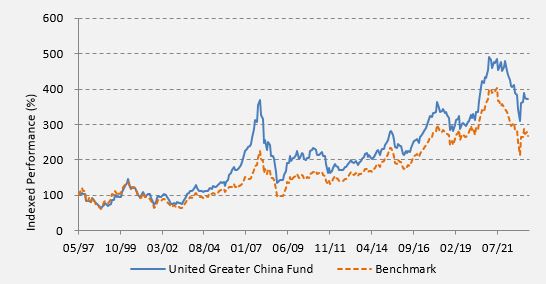

United Greater China Fund: Performance

Over the past 10 years, the Fund has delivered average returns of over 6 percent per annum, net of fees. And in the last six months, amid the Taiwan market rally, the Fund returned a healthy 14 percent, despite China’s market weakness.

Figure 3: United Greater China Fund returns vs benchmark

Source: UOBAM. Fund performance is calculated on a NAV to NAV basis. Benchmark: MSCI Golden Dragon Index

Figure 4: Fund performance over various time periods

| Performance (Class A SGD Acc) | Cumulative Performance (%) | Annualised Performance (%) | ||||

| 6M | 1Y | 3Y | 5Y | 10Y | Since Inception | |

| Fund NAV to NAV | 20.29 | -9.39 | 3.44 | 1.85 | 6.77 | 5.19 |

| Fund (Charges applied) | 14.28 | -13.92 | 1.69 | 0.81 | 6.23 | 5.03 |

| Benchmark | 24.99 | -9.07 | -2.45 | -0.80 | 5.33 | 3.88 |

Source: Morningstar. Performance as at 30 April 2023, SGD basis, with dividends and distributions reinvested, if any. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns. Benchmark: MSCI Golden Dragon Index. Past performance is not necessarily indicative of future performance.

^Includes the effect of the current subscription fee that is charged, which an investor might or might not pay.

Limited, but continued exposure in China

This Fund provides investors with the opportunity to stay invested in China given the many structural advancements in this - the world’s second largest economy. However, ahead of policy adjustments that will act to lift sentiment, the Fund’s holdings in Taiwanese and Hong Kong-listed companies provide investors with alternative opportunities at attractive valuations, assisted by AI tools.

1Refinitiv Lipper Fund Awards 2023 Winner Singapore, United Greater China Fund A SGD Acc | Refer to uobam.com.sg/awards for a full list of awards by UOB Asset Management Ltd

2United Greater China A SGD Acc, Morningstar, as of June 2023

3United Greater China A SGD Acc, Morningstar, as of June 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing.You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z