In a world dominated by inflation fears, wars, tariffs, fiscal deficits and an unpredictable US president, gold has become a place of refuge for many investors.

So, it is perhaps not surprising that the price of gold bullion today is about 40 percent higher than it was just a year ago, and gold prices have hit new highs this year. In March, gold prices crossed the landmark US$3,000 per oz level and reached an all-time high of US$3,500 the following month. The last gold price peak, adjusting for inflation, was in 1980.

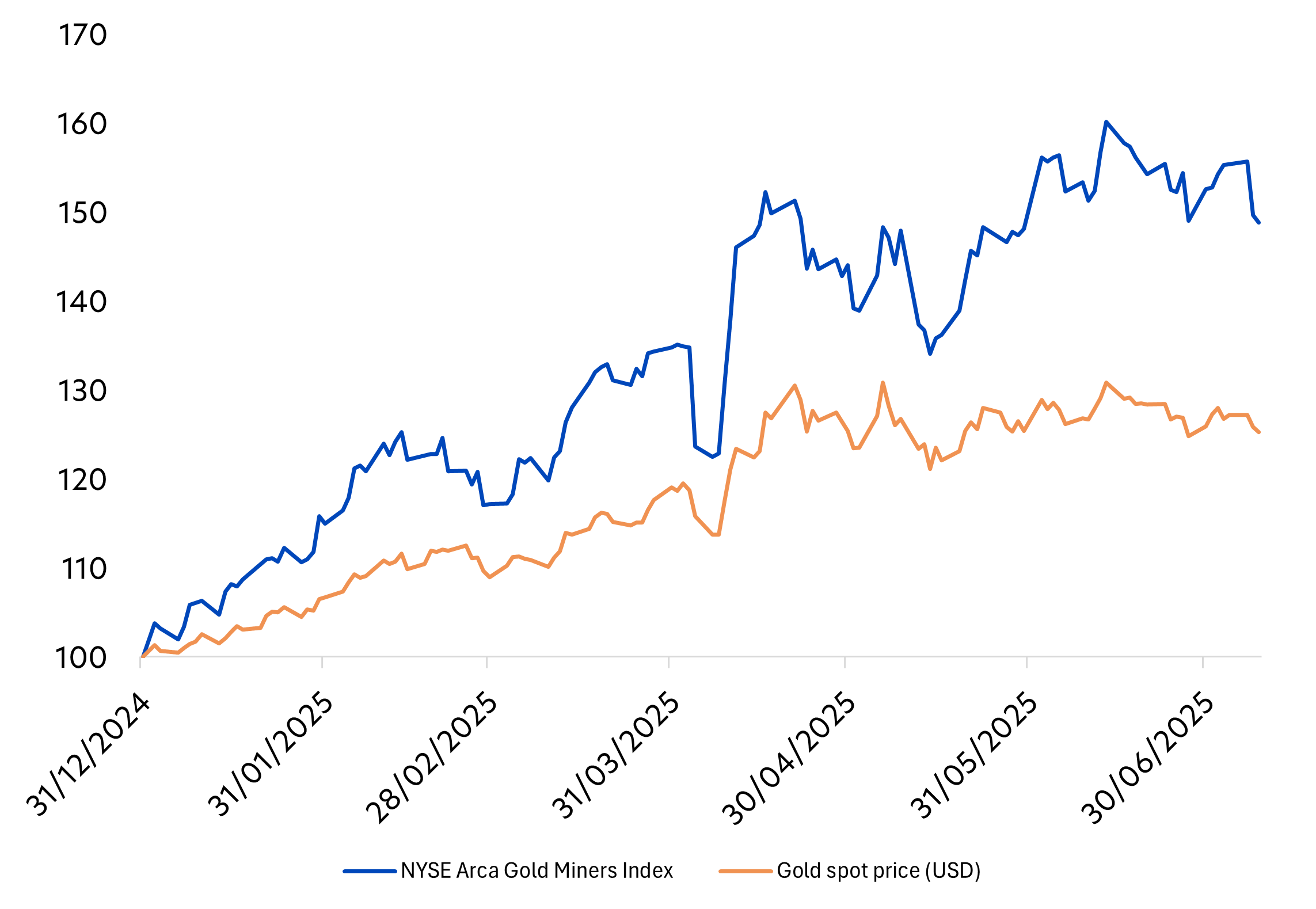

After such a relentless pace, gold prices have since stabilised, and from April onwards, gold has been trading in a range around US$3,300/oz. Meanwhile, gold miners have picked up the baton and gold mining stocks have started to deliver much stronger returns than gold bullion. The sector has delivered 50 percent returns so far this year, outstripping gold’s 26 percent rise.

Fig 1: Percentage growth in gold mining stock returns vs gold prices, YTD

Source: Bloomberg, as of 9 July 2025

We asked George Cheverly, Portfolio Manager and metals and mining specialist in the Ninety One Natural Resources team, to help us make sense of the situation.

1. Why have gold miner share prices run much faster than gold prices this year?

Gold miners have outperformed the metal itself due to several factors:

- Operating Leverage: As gold prices rise, miners' revenues increase faster than costs, leading to higher margins and earnings.

- Lower Oil Prices: This year oil prices - one of the larger cost inputs for the gold mining industry - have fallen year-on-year, helping pave the way for improved profits.

- Increasing Reserves: Higher gold prices can increase reserves, as more ounces become economic, thereby prolonging mine lives and increasing long term valuations.

- Investor Sentiment: Investors are favouring miners for their potential to deliver higher returns in a rising gold price environment.

2. It is said gold miner margins start to accelerate once gold prices rise above US$3,000/oz. Do you share this view?

Yes, I agree that US$3,000/oz is an important technical and psychological level. The longer the price remains above this level, the more confidence the market and companies will have. The current consensus is for the long-term gold price to average around US$2,200/oz. As such, a sustained period at US$3,000 or above will likely have a very positive impact on valuations.

In my view, even if prices fall below US$3,000/oz, margins will still be very healthy. Only if prices fall back down below around US$2,500/oz will gold mining companies find it necessary to review their mine plans and capex expenditure.

3. That said, do you see gold prices staying sustainably above US$3,000/oz?

A number of economic and geopolitical factors have a strong impact on gold prices and could dictate whether prices stay above the US$3,000/oz mark. These factors, including the presence of persistent inflation, currency fluctuations, and geopolitical tensions all help to support higher gold prices.

Notably, we believe the US dollar could be entering a long term down-cycle which would be very positive for gold. This is because four significant forces, namely trade and geopolitical shifts, interest rate and growth differentials, cross-border investment flows, and FX intervention appear to be converging.

The result is a potentially prolonged period of USD weakness, paving the way for a concerted migration towards non-US assets such as gold. This is captured in our latest paper “The unstoppable dollar meets the immovable Mr Trump” available here.

4. In the event that gold prices correct, will gold mining stocks be able to maintain their momentum for the rest of the year?

Any resolution of current global uncertainties could lead to a gold price correction. If indeed gold prices start to trend downward, miners will once again face pressure on margins. However, companies with strong balance sheets, efficient operations, and diversified portfolios are better positioned to maintain their momentum. Long-term contracts and hedging strategies can also provide some stability.

We believe current valuations include the consensus market view that over time, prices will fall back down to a US$2,000 - US$2,500/oz range. Therefore, unless prices fall sharply, current equity valuations are likely sustainable.

5. Why is there a wide disparity across the gold mining sector, with some miners showing much better profitability than others?

Profitability varies due to factors like operational efficiency, cost structures, and geographic locations. The cost structures for most mines are fairly fixed, so it is production volumes that have a large impact on costs per oz of gold mined.

Also, some companies may have hedged part of their production, which will also affect their margins. In general, miners with lower production costs and operations in stable regions tend to be more profitable.

George is a portfolio manager and metals and mining specialist in the Natural Resources team. George is a portfolio manager for the Global Gold strategy and co-portfolio manager for the Natural Resources strategy. He covers all aspects of metals and mining supply and demand including, most recently, the impact of renewable energy and electric vehicles on metals demand.

Prior to joining the firm, George was a market analyst for three years at BHP Billiton, working in The Hague and Singapore. He was recruited to BHP Billiton in 2004 from CRU (Commodities Research Unit), an independent metals/chemicals related research company based in London. At CRU, he spent three years in the Carbon Steel team and five years as a Research Manager – Copper, providing in-depth research and forecasts to the industry, banks and hedge funds. George began his career in 1990 in operations at British Steel Strip Products, working for three years in the Tinplate division.

George graduated from the University of Oxford in 1989 with an honours degree in Classics and in 1995 was awarded a Master of Business Administration from Warwick University.

Ninety One Singapore Pte. Limited is the submanager of the United Gold & General Fund

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Gold & General Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z