With a focus on high-quality companies, the United Global Quality Growth Fund looks to outperform in both up and down markets.

As investors navigate the new normal of high inflation, high interest rates, climate change and geopolitical tensions, there is growing appreciation for quality companies – businesses that can do well in both good times and bad.

So what is the criteria for a quality company? Lazard Asset Management is the sub-manager of UOB Asset Management’s United Global Quality Growth Fund which focusses on quality investing. Antony Creighton, Lazard’s Head of Strategy, Asia Pacific ex Japan, characterises quality companies as those that can demonstrate persistently high levels of financial productivity. This means they always have a sustainable competitive advantage and are event-agnostic.

Watch UOB Asset Management Chief Investment Strategist, Dharmo Soejanto interview Antony on Lazard’s quality strategy and outlook for global equities.

About the United Global Quality Growth Fund (“the Fund”)

High exposure to “compounders”

The investment objective of the Fund is to achieve long-term total returns by investing in equity and equity-related securities of companies listed and traded on stock exchanges globally.

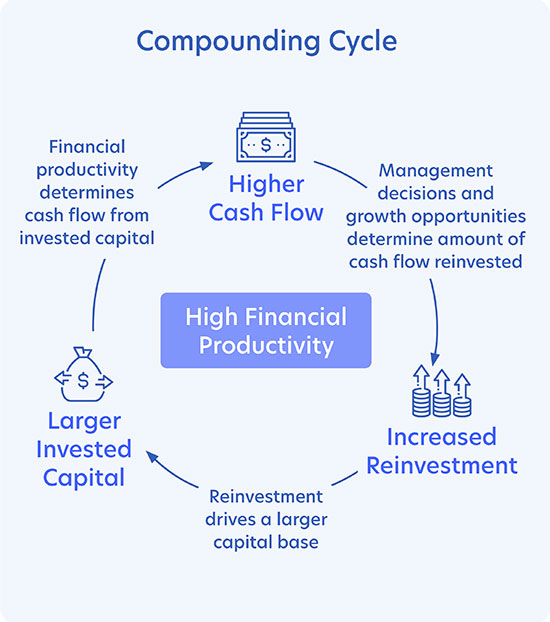

To do so, the Fund focusses on identifying and investing in “compounders” i.e. financially productive companies that are able to invest a significant portion of their cash flows back into their business. Lazard believes this leads to higher efficiency, better products, and higher profits which then generates even more cash for reinvestment, thereby driving a compounding effect as shown below.

Figure 1: The compounding cycle

Source: Lazard Asset Management

Some of the world's leading companies such as Alphabet, Microsoft and Visa are deemed to be compounders. They feature among the Fund’s top holdings.

Figure 2: Fund top 10 holdings

| Company name | Weight | Description |

| Alphabet | 5.02% | A global technology conglomerate and parent company of Google |

| Microsoft | 4.78% | The world’s largest computer software maker |

| S&P Global | 3.85% | A provider of financial intelligence solutions including credit ratings and benchmarks for global capital markets |

| Aon | 3.84% | A global professional services firm providing risk, retirement and health solutions |

| Accenture | 3.53% | A global professional services firm providing strategy, consulting, digital, and technology services |

| Visa | 3.16% | A global digital payment company and one of the most recognised financial services brands worldwide |

| IQVIA | 3.14% | A global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry |

| Zoetis | 3.09% | The world's largest producer of medicine and vaccinations for pets and livestock |

| Thermo Fisher Scientific | 2.98% | A global supplier of analytical instruments, life sciences solutions, specialty diagnostics, pharmaceutical and biotechnology services |

| Adobe | 2.85% | A global leader in digital media and digital marketing solutions |

Source: Lazard Asset Management, as of 31 July 2023

Strategically diversified

Although the Fund is a relatively high-conviction portfolio of only 40 to 50 companies, the portfolio manager avoids taking large stakes in any single holding to minimise concentration risk.

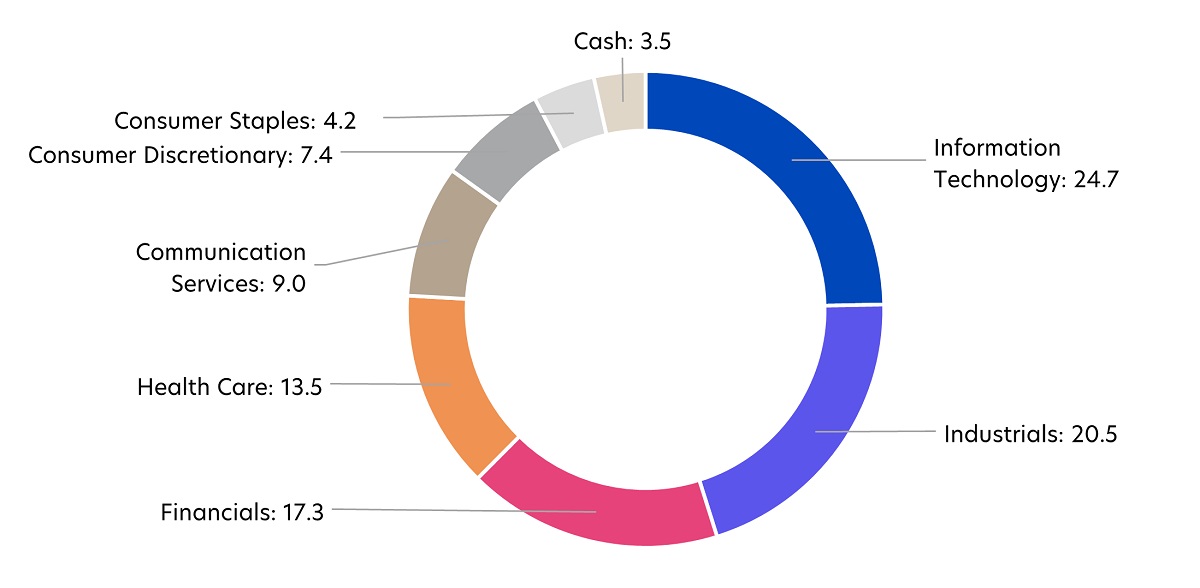

The Fund is also well diversified across different sectors with Information Technology (IT), Industrials and Financials being the three largest allocations.

Figure 3: Fund sector allocation (%)

Source: UOBAM, as of 31 July 2023

Consistent outperformance across market cycles

Over the past decade, the underlying manager, Lazard Asset Management, has delivered an annualised return of 11.8 percent p.a, beating its broad global benchmark by 3 percent1.

Figure 4: Fund performance vs benchmark (annualised)

| 10 years | Since inception (1 Feb 2011) | |

| Lazard Global Quality Growth | 11.8% | 10.8% |

| Global Equities | 8.8% | 8.0% |

| Outperformance | 3.0% | 2.8% |

Source: Lazard, 30 June 2023, USD terms. Performance is presented in a gross fee basis. Past performance is not an indicator of future results. Global equities refer to MSCI ACW Index.

Moreover, this outperformance has been maintained across different market conditions.

Since inception, the underlying strategy, Lazard Global Quality Growth, has delivered an average of 6 percent higher returns than its benchmark during months when market returns were positive, and 8 percent better during months when the market declined2 .

By focusing on quality companies, the Fund has been effective in balancing return generation and risk mitigation.

Fund Details

| United Global Quality Growth Fund | |

| Investment objective | To provide long-term total returns by investing in equity and equity-related securities of companies listed and traded on stock exchanges globally. |

| Sub-Manager | Lazard Asset Management (as of 1 September 2023) |

| Top 5 geographical allocation (%)* | United States: 64.0 Japan: 5.8 Netherlands: 5.8 Canada: 4.8 Sweden: 3.3 |

| Fund Classes Available3 | Class SGD Acc, Class SGD Acc (Hedged); Class USD Acc, Class USD Dist; Class SGD Dist Class SGD Dist (Hedged); Class B SGD Acc; Class C SGD Acc (Hedged) |

| Subscription Mode | Class SGD: Cash & SRS Class USD and Class B: Cash Class C: CPF-OA |

| Minimum Subscription | Class SGD, Class USD and Class C: S$1,000/US$1,000 (initial); S$500/US$500 (subsequent) Class B: S$500,000 (initial), S$100,000 (subsequent) |

| Subscription Fee | Class SGD, Class USD and Class B: Currently up to 5%, maximum 5% Class C: Currently none, maximum none |

| Management Fee | Class SGD and Class USD: Currently 1.5% p.a., maximum 2.5% p.a. Class B and Class C: Currently 1.0% p.a., maximum 2.5% p.a. |

Source: Lazard Asset Management, as of 31 July 2023

1Lazard, 30 June 2023, in USD terms. Performance is presented in a gross fee basis. Past performance is not an indicator of future results

2UOBAM, Lazard, 30 June 2023

3Investors should refer to the Fund’s prospectus for more details on the different classes available. Please check with our distributors on the availability of the Fund classes.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z