Longer life spans, digital innovation, and climate change are examples of megatrends that are changing people’s lives. Companies that can capture such megatrends offer deeply-entrenched and multi-decade investment opportunities.

We ask Dharmo Soejanto, Head of Investment Partnerships and Solutions, about how investors can take advantage of these opportunities with the UOBAM Invest Megatrends portfolio.

Hi Dharmo, what the key themes in your Megatrends Portfolio?

The Megatrends portfolio is curated to allow investors to invest into long-term macro-level trends. We see these trends arising due to deep structural shifts in the world. This includes the fact that populations, especially in Asia, are becoming more affluent but also older. This has implications for example, for healthcare and consumer companies.

The same can be said for the environmental challenges that the world is facing. As populations grow and the climate changes, these trends are only going to intensify. So the companies that can transition into producing or consuming renewable energy stand to benefit greatly. We believe water recycling industries will see strong demand in the years to come.

Finally, we are very excited by the profound changes to people’s lives brought about by digital innovation and artificial intelligence. While we have the tech giants at one end of the scale, tech start-ups at the other end and many growth opportunities in between, it is important to find the ones that will still be here in the next 20 or 30 years.

How do you go about creating a Megatrends Portfolio?

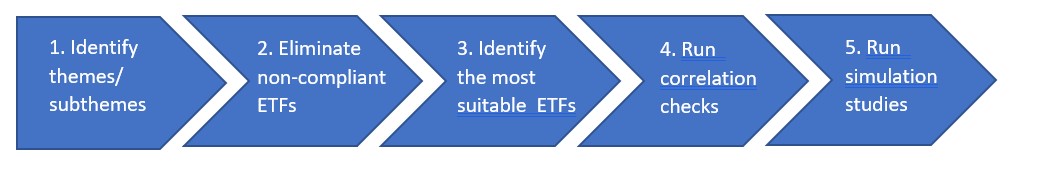

The first thing we do is to find ways to invest in our convictions. Essentially this means identifying the potential indices and ETFs (exchange-traded funds) that align closely to the above themes and sub-themes. There are over 2,600 ETFs1 traded in US stock exchanges and over 8,500 worldwide2. For our portfolio, we required the ETFs to be highly liquid, i.e. they must be US$100m or larger.

After shortlisting the ETFs, we optimise the allocation of the ETFs based on a methodology to generate the highest possible return for the lowest possible risk across time. This requires a good understanding of the correlation between ETFs. The lower the correlation, the higher the portfolio diversification.

Finally, we run detailed backtests on our portfolio. This allows us to simulate historical performances in various market scenarios. While past performance does not guarantee future performance, these tests allow us to make tweaks to the risk-return profile of the portfolio relative to appropriate benchmarks.

What is the current composition of the portfolio?

We have selected a total of nine ETFs for this portfolio. These ETFs represent the key themes and sub-themes mentioned earlier. The portfolio is more or less equally weighted across the three main themes, and then within each theme, we assigned a different allocation to each subtheme based on the risk-return profile of the ETFs.

Ultimately, we want to ensure that the portfolio is well diversified and able to perform under different market conditions without taking on excessive risk. Given that most of the selected ETFs were launched some time back, we are able to track their returns over the past three and five years. We also monitor the contribution that each ETF makes towards the portfolio’s overall returns and will replace ETFs if necessary.

Figure 1: ETFs within the Megatrends Portfolio

| Component ETF | ETF weight* (%) | |

| Changing Demographics | iShares Global Healthcare ETF | 17.5 |

| Global X Millennial Consumer ETF | 11.4 | |

| Columbia Emerging Markets Consumer ETF | 5.2 | |

| Subtotal | 34.1 | |

| Go Green | First Trust Water ETF | 14.3 |

| VanEck Low Carbon Energy ETF | 9.8 | |

| Invesco MSCI Sustainable Future ETF | 9.4 | |

| Subtotal | 33.5 | |

| Digital Economy | First Trust Nasdaq Cybersecurity ETF | 12.8 |

| Global X Artificial Intelligence & Technology ETF | 10.6 | |

| Amplify Online Retail ETF | 6.9 | |

| Subtotal | 30.3 |

Source: UOBAM | *ETF weights as of 31 December 2022, cash weight at 2.1%

What is the estimated performance of the Portfolio over the long term?

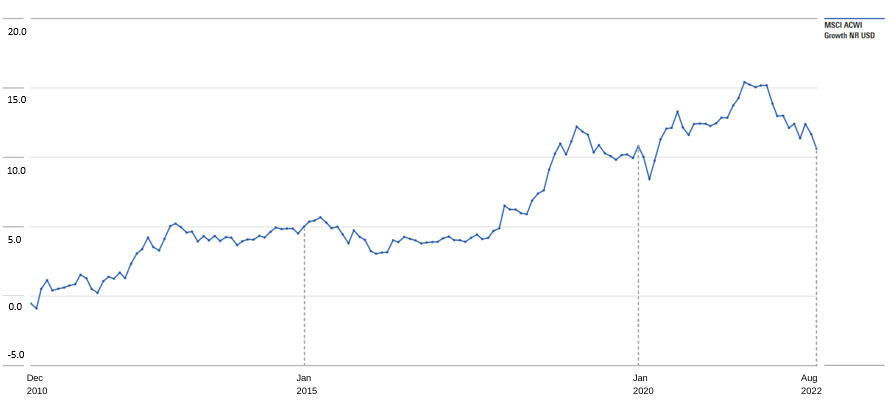

A global equities portfolio can experience high volatility in the short term. But as we are talking about long term megatrends, it is indeed important to understand whether longer holding period would allow investors to reduce the likelihood of negative returns.

To do this, we looked at the MSCI ACWI Growth Net Return USD index as a proxy for the Megatrends Portfolio due to its growth tilt and larger allocations to growth sectors as compared to a broad equities index. For instance, both the Megatrends Portfolio and MSCI ACWI Growth Net Return USD index have considerably similar geographical allocation to North America, and sector allocation to sectors including technology and consumer cyclicals3.

The chart below (Figure 2) shows the annualised investment return of MSCI ACWI Growth index assuming an investor has invested since 2010. The date of the investment period ranges from Dec 2010 to Aug 2022.

Figure 2: Monthly rolling returns, annualised, %. Investment period ranges from Dec 2010 to Aug 2022

Source: Morningstar, UOBAM, September 2022 | MSCI ACWI Growth NR USD: MSCI ACWI Growth Net Return USD

Disclaimer: Please note that there are limitations to the use of such indices as proxies for the past performance. The historical performance presented is not indicative of and should not be construed as being indicative of or otherwise used as a proxy for the future or likely performance of the portfolio.

The chart shows that the return of these indices ranges from slightly below 0 to as much as 15 percent per annum since 2010. Those who had invested for 10 years, barring the first few months of 2010, would have avoided negative returns, regardless of market timing.

Given current market volatility, why invest in the Megatrends Portfolio?

I think there is little difference whether investors invest now or several months down the road. We are investing in very long term trends. By doing so, we hope to deliver solid returns year after year to investors who are building a nest egg for their retirement and other long term goals.

So instead of timing the markets with a single lump sum investment, investors who see the logic of investing in megatrends should do so by entering the market at regular intervals. Dollar cost averaging is one of the investment strategies for the volatile markets that we have seen since the start of the year.

UOBAM Invest Megatrends portfolio details, as at 31 January 20234

| What it is | A thematic portfolio which invests into long-term macro-level trends. These trends present investment opportunities that are expected to emerge or strengthen due to the structural shifts as the world changes and evolves rapidly. The Megatrends portfolio allows investors to capture growth supported by these structural tail winds. | |

| Geographical Allocation | United States – 67.84% | Canada – 1.62% |

| China – 7.75% | Germany – 1.54% | |

| Japan – 2.32% | France – 1.32% | |

| Denmark – 2.17% | Brazil – 1.30% | |

| India – 2.08% | South Korea – 1.29% | |

| Sector Breakdown | Basic Materials – 1.07% | Industrials – 14.83% |

| Consumer Cyclical – 18.78% | Technology – 26.81% | |

| Financial Services – 0.80% | Consumer Defensive – 2.99% | |

| Real Estate – 2.80% | Healthcare – 17.13% | |

| Communication Services – 7.29% | Utilities – 7.47% | |

| Energy – 0.02% | ||

| Portfolio Holdings | iShares Global Healthcare ETF – 17.5% | VanEck Low Carbon Energy ETF – 9.8% |

| First Trust Water ETF – 14.3% | Invesco MSCI Sustainable Future ETF – 9.4% | |

| First Trust NASDAQ Cybersecurity ETF – 12.8% | Amplify Online Retail ETF – 6.9% | |

| Global X Millennials Consumer ETF – 11.4% | Columbia Emerging Markets Consumer ETF – 5.2% | |

| Global X Artificial Intelligence & Technology ETF – 10.6% | ||

| Benchmark Index | MSCI ACWI Growth Net Return USD | |

| Minimum Investment | S$1 | |

| Rebalancing Frequency | Based on 2 scenarios:

|

|

| Currency | Singapore Dollar (SGD) | |

1Statista, Number of exchange traded funds (ETFs) in the United States from 2003 to 2021, August 2022

2Statista, Number of exchange traded funds (ETFs) worldwide from 2003 to 2021, May 2022

3Morningstar Direct, Thematic Portfolio - Portfolio Aggregation, August 2022

4UOBAM, Morningstar, January 2023

This document is for your general information only. It does not constitute investment advice, recommendation or an offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit Trusts”, ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to take part in any particular trading or investment strategy. This document was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. If any information herein becomes inaccurate or out of date, we are not obliged to update it. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of any Fund and the income from them, if any, may fall as well as rise, and may have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in any Fund involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. Market conditions may limit the ability of the platform to trade and investments in non-Singapore markets may be subject to exchange rate fluctuations. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the respective Fund's prospectus. The UOB Group may have interests in the Funds and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund's prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Funds, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Any reference to any specific country, financial product or asset class is used for illustration or information purposes only and you should not rely on it for any purpose. We will not be responsible for any loss or damage arising directly or indirectly in connection with, or as a result of, any person acting on any information provided in this document. Services offered by UOBAM Invest are subject to the UOBAM Invest Terms and Conditions.

UOB Asset Management Ltd. Company Reg. No. 198600120Z.