Key Highlights

- Businesses and institutions needing short-term cash can consider assets with better liquidity, high credit quality and overall greater potential returns compared to fixed deposits.

- Daily access to cash without three- or six-month lock-up periods is becoming a necessity in today’s fluid operating environment.

- Portfolios primarily invested in Monetary Authority of Singapore (MAS) bills and floating-rate notes (FRN) not likely to lag rising interest rates.

- Cash not needed within 12 months or more can be invested into portfolios designed to meet return targets set by the business or institution while maintaining suitable risk levels.

Businesses and corporations in Singapore on average make profit-before-tax of S$251.4 billion annually over the last decade, according to data from the Singapore Department of Statistics. This means that companies have been accumulating cash of S$196 billion each year over the last 10 years, after accounting for tax and fixed-asset investments.

Most businesses and institutions have different uses for accumulated cash, including working capital, short-term liquidity, long-term capital expenditure and reserves. It might seem intuitive to place the cash into a bank deposit for safety and liquidity. However, on deeper analysis, there is actually less liquidity and risk-returns than what it appears.

For example, let's say a company or institution needs access to cash in three to six months' time, and makes three- or six-month fixed deposits with banks or finance companies. There is a risk that an unexpected need for cash might arise during this period and this possibility has become more tangible now that operating environments have become more complex, with increasing uncertainties in supply chains, global regulation regimes and legislations as well as restrictions related to Covid-19 and other events. If the company or institution withdraws its fixed deposit before the end of the tenor, the interest rate is forfeited.

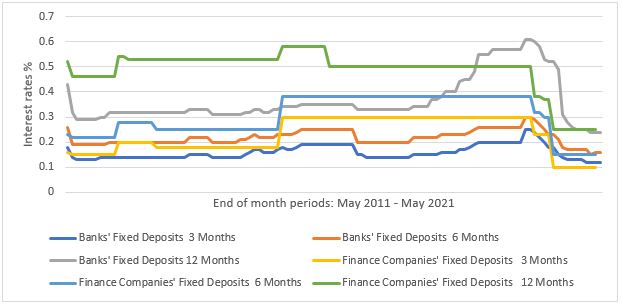

Figure 1: Interest rates at banks and finance companies in Singapore,

May 2011 – May 2021

Source: Based on data from the Monetary Authority of Singapore, May 2011 – May 2021

In addition, deposit interest rates have been near zero for several years, ranging from 0.12% to 0.20% p.a. for three-month bank fixed deposits from May 2020 to May 2021 and 0.15% to 0.25% p.a. for a six-month tenor, according to MAS data.

Interest rates can sometimes be higher at finance companies, ranging from 0.10% to 0.23% p.a. for three-month deposits and 0.15% to 0.30% p.a. for six-month tenors over the same period but finance companies may not have the same credit quality as the major banks.

Higher potential returns with less risk

By contrast, portfolios investing primarily into MAS bills and floating-rate notes (FRN) have higher potential returns while presenting less risk. In addition to MAS bills and notes, such portfolios have smaller investments in other governments' issues and short-term global corporate debt across a swathe of industries including utilities, industrials, consumer goods and services, communications and other sectors for the purposes of diversification, which is a way to manage risk while generating potentially higher returns than fixed deposits.

Such money-market portfolios have daily liquidity without penalties, and investors enjoy any returns earned even if they liquidate their positions prematurely due to unforeseen events. The credit risk of such a portfolio is low because more than half of the assets are allocated to MAS bills and FRN which are accorded the highest credit rating from all the major global credit rating agencies such as Standard & Poor's, Moody's and Fitch.

Figure 2: Fixed deposits vs diversified investment portfolios

| Instrument | Daily liquidity | Penalties for early withdrawal | Potentially higher returns | Risk of making losses | Negatively impacted by rising interest rates |

| Fixed Deposit | No | Yes | No | Yes if the deposit-taking institution has low credit quality | No |

| Short-term Investment Portfolio | Yes | No | Yes | Yes but the risk is reduced by a diversified portfolio primarily invested in MAS bills and notes | Limited. Portfolio sensitivity can be managed |

| Long-term Investment Portfolio | Yes | No | Yes | Yes but the risk level is kept within the investor's tolerance and is managed through a diversified portfolio | Yes. Portfolio duration and maturity can be actively managed |

Source: UOB Asset Management

In addition, money-market portfolios are managed for their duration, which is an indication of how sensitive the price of a fixed income instrument is to changes in interest rates. For example, if a bond has a duration of three years, its price will decline by 3% if interest rates rise by 1%. Conversely, if interest rates fall by 1%, the fixed income's price will rise by 3%. In an environment where interest rates are expected to rise, portfolio managers can steer the portfolio to have a duration of less than one year as a way to manage volatility.

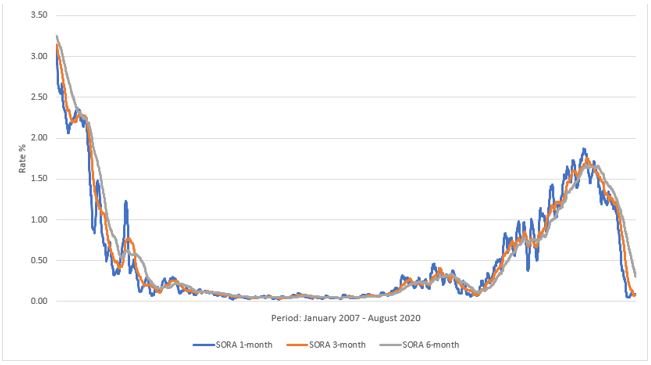

There is one more major reason why such a portfolio will likely not lag rising interest rates. A meaningful proportion of the portfolio's assets can be allocated to MAS FRN which is based on the Singapore Overnight Rate Average (SORA), which is the unsecured overnight rate at which financial institutions lend to each other.

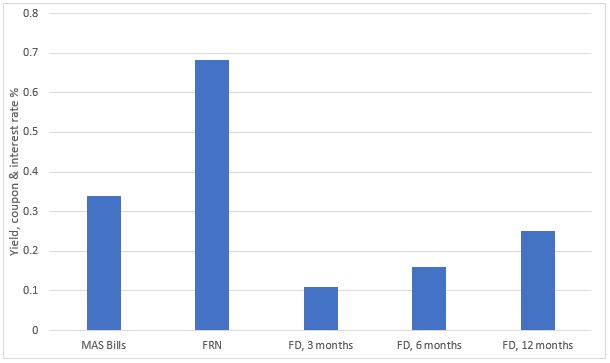

Figure 3: Fixed Deposit (FD) Interest Rates vs MAS Bills and Floating-Rate Notes (FRN)

January - May 2021

Note 1: MAS Bills yield is based on all issues with maturity dates of March 2021 to 7 June 2021.

Note 2: FRN is an estimate based on the cut-off spread of competitive bids at auctions from January 2021 to early June 2021, added to average historical Singapore Overnight Rate Average (SORA).

Note 3: Fixed deposit rates are the average of rates offered by banks and finance companies for their respective tenor from January 2021 to May 2021.

Source: Based on data from the Monetary Authority of Singapore

MAS FRN coupons are determined by competitive bids at FRN auctions added on to SORA, which means that these notes are very likely to have returns above SORA and fixed deposits (see Figure 3).

Cash not needed within 12 months or more can be invested into portfolios with a greater variety of asset classes to meet specific financial goals while maintaining a risk level that is appropriate for the company or institution.

Figure 4: Singapore Overnight Rate Average (SORA)

Source: Based on data from the Monetary Authority of Singapore,

January 2007 – August 2020

Growing long-term cash with prudent risk management

Businesses and institutions often have several cash pockets: one pocket with daily liquidity as mentioned above and another for longer-term investment over 12 months or more. The latter has even higher potential returns than short-term cash because investments with longer horizons have the luxury of time to ride through market swings within acceptable risk levels. Investors can set target returns by a certain date, define their risk tolerance and figure out the initial investment as well as regular contributions needed to meet the target returns. Investors can adjust their investment scenario and receive a portfolio suited to their risk and return profile from UOB Asset Management's algorithm-based platform, UOBAM Invest, which offers access to tailored portfolios at low cost.

For example, a company or institution plans to expand into new markets and estimates that they will need S$15 million in three years' time. With a moderate risk profile, they can expect returns of 5%. Starting with S$8.3 million and a plan for cash injection of S$210,000 each month during the first year, and S$101,368 monthly over the subsequent two years, with no withdrawals over the investment period, the company has a high probability of meeting its investment goals via a portfolio comprising mainly government bonds, global investment-grade corporate bonds, US equities, and smaller allocations to Asian investment-grade corporate credit, global high-yield bonds and Asia ex-Japan equities. This portfolio may be adjusted when needed, either by UOBAM Invest's quarterly rebalancing or by the investor's revision of risk profile or investment scenario.

Click here to learn more about UOBAM Invest for corporates

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.