The Fed’s 25 bps rate cut this week had been widely anticipated, and at least one more cut is expected before year-end. This easing path has implications for the global bond and currency markets, so now is a good time for investors and income seekers to review their portfolios.

Wayne Lau, Vice President, Multi-Asset Strategy

A cut was strongly on the cards

After five consecutive meetings since December 2024 when rates were held steady at 4.25 – 4.5 percent, the Fed on Wednesday cut its rate by 25 bps to 4.0 – 4.25 percent.

This announcement was as close to certainty as it is possible to get. There was already a high level of confidence when Powell spoke at the recent Jackson Hole symposium. In his possibly last major speech as US Federal Reserve Chair, Powell noted that the US economy was at an inflection point, but “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

Since then, new US unemployment and inflation data has further tilted the balance towards rate cuts. The most recent jobs report puts US unemployment at 4.3 percent, a post-pandemic high. At the same time, the pace of hiring has slowed down, with a mere 22,000 jobs added in August, 79,000 in July, and 13,000 jobs lost in June. This compares to an average of 127,000 new jobs added per month in the first three months of 20251.

Despite evidence of economic headwinds, Powell and other Fed governors were concerned that lowering interest rates could fuel inflation just as tariffs were set to raise US consumer prices. The CPI numbers released last week showed a 2.9 percent year-over-year rise in August - at the top-end of expectations but not as bad as feared. Equity investors cheered this as final confirmation of a rate cut and pushed the S&P 500 up by 1.7 percent in the five days running up to the Fed meeting.

The yield curve is evolving

Bond investors have also tentatively welcomed the rate cut, causing bond prices to rise and yields to fall. 10-year US Treasury yields are now around 4.0 percent, having started the year at 4.6 percent. However, investors remain less convinced about the prospects for very long-term bonds, and over the past one year, 30-year Treasury yields have actually risen from 4.0 to around 4.7 percent currently.

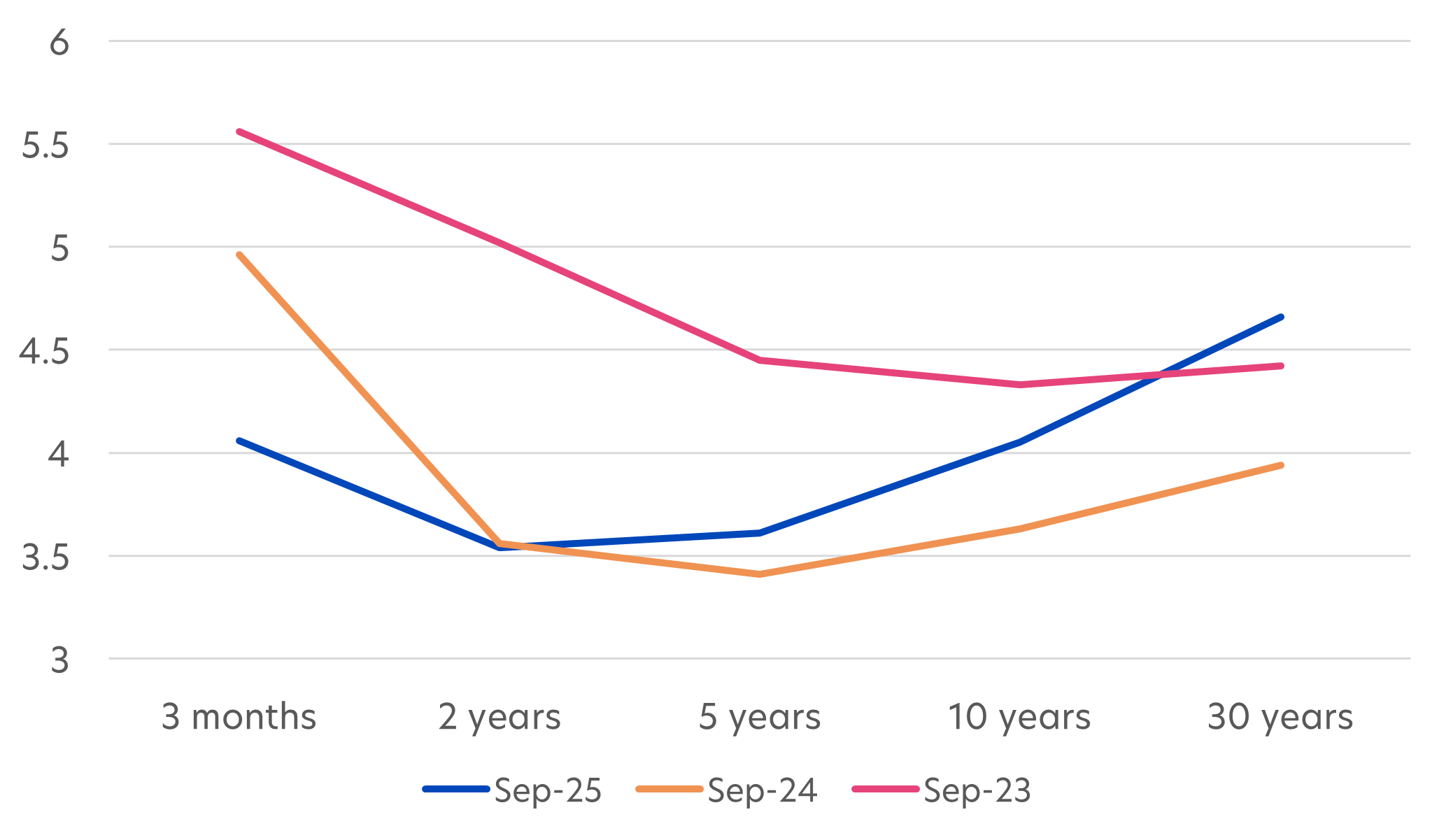

Fig 1: US Treasury Yield Curve: Sept 2023, Sept 2024 and Sept 2025

Source: US Dept of the Treasury, as of 15 Sept 2023, 16 Sept 2024, 15 Sept 2025

As a result, the US Treasury yield curve has steepened, especially at the long end. A yield curve indicates the prevailing yields for the same type of bond across different maturities. It is normally upward sloping, that is, the longer the maturity, the higher the yield.

This however was not the case in 2023. At the time, US interest rates were high in an attempt to quell inflationary pressures and markets remained wary of an imminent recession. Anticipating rate cuts and to lock in yields before they fall, investors bought longer term Treasuries and pushed down their yields.

In 2024, as recession fears began to recede, interest rates stabilised and the yield curve started to flatten out. However, it is not until recently that the 2Y – 30Y curve has started to show a distinct upward slope. Nevertheless, the 0.5 percent yield spread (i.e. the yield difference between 10-year and 2-year Treasuries) is still below the historical average of 0.8 percent. The term premium for 10-year yields (i.e. the excess return investors require to hold longer term bonds) also appears to be fairly priced.

Bond strategy adjustments

With the Fed resuming its easing cycle, it appears that we are entering a new phase in bond markets. Here are a few revisions that investors can consider making to their bond portfolios:

- Slightly lengthen your duration

Investors take on additional risk – called duration risk – when they lengthen the average duration of their bond holdings. This is because longer term bond prices are more sensitive to interest rate movements and are therefore potentially more volatile.

Unlike previous years when the curve has been inversely sloped, we think the current upward sloping nature of the yield curve argues for more exposure to longer-term bonds. Given our expectations of 10-year bond yields to be within the 4.0 to 4.5 range, we advocate long-term investors take a neutral position. Those looking for a higher yield can extend the average duration of their bond portfolios to around five years. - Watch out for falling and rising yields

Tactically, investors should expect yields to turn more volatile amid intense speculation about when and by how much the Fed will continue to cut rates. A sustained rise in 10-year yields to 4.75 percent and above suggests that the market may be over-pessimistic and points to further duration opportunities.

On the other hand, a sustained fall in 10-year bond yields to significantly below 4.0 percent, despite continued economic growth, suggests that the bond markets could be getting ahead of themselves. In such circumstance, investors may want to exercise caution and return to a shorter duration portfolio. - Consider non-US bonds

The USD has already fallen by around 10 percent relative to other major currencies. Given diverging monetary policies due to US easing, European Central Bank (ECB) holding to current levels and Bank of Japan (BOJ) hiking, it seems unlikely that the USD will regain its strength any time soon. In fact, structural forces, including Central Banks’ de-dollarisation policies, and the US losing some of its flight-to-quality status, point to a weakening path for the USD, although this is likely to be gradual. A softer dollar is generally positive for emerging economies and also for global alternatives to US Treasuries.

There are therefore good reasons for investors to ensure a more geographically diversified bond portfolio. Although spreads have tightened significantly, we still expect ongoing demand for Asian bonds, including those offered by the Chinese government and corporates, as well as for Singapore’s AAA-rated government securities. - Avoid going too far up the Treasury curve

With the debt ceiling lifted and the Big Beautiful Bill promising lower taxes, the US’s federal debt is expected to mushroom by as much as US$3.4 trillion over the next decade. For now, analysts believe the Treasury will only issue very short maturity bills and tariff revenues should slow down the pace of deficit widening. These could delay any disruption to broader bond prices. But in order to plug the fiscal gap, it is possible that sooner or later, longer maturity US Treasuries could increase in supply and prices could become more volatile.

There are of course some potential mitigants. Moves to re-regulate industries, higher productivity from AI implementation and higher tariff revenues could help to promote growth as well as stimulate higher demand for long term Treasuries. However, until there is greater clarity, we do not think the potential returns justify the potential risks of holding very long term bonds.

1Source: Federal Reserve Bank of St Louis

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asian Bond Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z