Key Highlights

- Vietnam’s growing affluent class as well as meeting the increasing needs for wealth management has contributed to the remarkable growth of the e-commerce sector

- Vietnam was one of the few countries that saw its GDP grow in 2020 and is projected to have significant growth in 2021

- Multinational companies have been making a beeline to Vietnam as part of the diversification of their production bases and supply chains

Speaking as one of the panellists in a webinar Fitch on Vietnam: Pandemic, the economy and credit markets (15 April), Ms Le Thieu, CEO, UOB Asset Management (Vietnam) said it is banking on the strength of the group’s expertise to offer digital solutions to expand its reach to investors in Vietnam.

The webinar was hosted by The Asset Magazine with its editor-in-chief, Daniel Yu as the moderator. Other panel members included Allan Redimerio, managing director at Mizuho Bank and senior directors from Fitch Ratings who handle ratings for energy and utilities, industrials, property & consumer as well as infrastructure and project finance in the region.

“The key drivers for expanding in Vietnam include favourable demographics, its growing affluent class as well as meeting the increasing needs for wealth management as we have seen how the tech savviness of the younger population has contributed to the remarkable growth of the e-commerce sector over the past five years”, said Ms Le.

“Being a leader in innovation, the UOBAM group has already been moving forward to offer more digital options for investors across the region. That’s where we like to bring both the experience and the expertise of the group to tap the potential we have here in Vietnam,” she added.

UOBAM Vietnam became a full-fledged unit within the UOBAM group network in January 2021 which is timely as foreign investment interest in the country has revved up ever since the onset of the Covid-19 pandemic on account of the country’s highly lauded and successful virus containment measures as well as the realignment in global supply chains in the wake of continuing US-China trade tensions.

By minimising the economic and health impact of the virus, Vietnam was one of only a handful of countries in the world that saw its GDP grew – by 2.91% in 2020 and is projected to expand by 6.5% to 7% in 2021, owing to the return of domestic consumption and manufacturing activities.

| GDP contributors in 1Q2021 | |

| Weighting (%) | |

| Agriculture | 11.7 |

| Industrial & construction | 36.5 |

| Services (Including Financial) | 42.2 |

| Others | 9.6 |

| Vietnam GDP growth (%) | 4.49% |

Source: GSO (Vietnam General Statistics Office)

Due to the increasingly favourable economic landscape and Vietnam’s participation in multiple free trade agreements (FTAs), foreign direct investment (FDI) had topped US$17 billion in 2020 bringing the total amount invested to date to US$382 billion.

Investors are mostly from within the region targeting the manufacturing, processing, real estate and electrification sectors. Multinational companies (MNCs) too have been making a beeline to Vietnam as part of the diversification of their production bases and supply chains.

These developments have led to an increasing need to raise capital for the numerous projects being carried out or planned by both private and state-run firms. A bulk of capital raising is currently via fixed income instruments, especially through corporate bonds as companies need new capital raising channels besides bank credits.

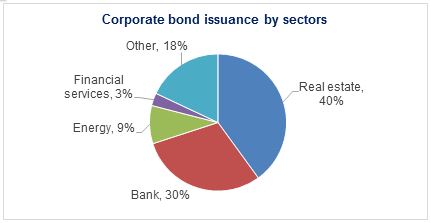

In fact, the issuance of corporate bonds has seen a compound annual growth rate of 59% between 2015-2020, noted Ms Le, who added that the bulk of onshore bond issues in 2020 – about 80% – came from the real estate, banking and renewable energy sectors.

The corporate bond market size in 1H2020 was about 13% of the national GDP, which is quite modest compared to government bonds, stocks and bank credits, and hence has a lot more room to grow.

Source: VNDirect, FiinPro, HNX

Due to the cap on foreign ownership, foreign exchange risks and a perceived lack of transparency with regards to corporate governance among state-owned enterprises, participation of big offshore institutional investors in the domestic equities market is still limited while that for corporate bonds have been hampered by a lack of credit ratings.

However, the appetite among local investors has been robust with the number of newly opened retail trading accounts more than doubling in 2020, especially among the younger segments of the country’s population who are more tech-savvy and quick to adapt to the latest online technology.

Average daily market liquidity has risen by fourfold over the past year to US$800 million with retail investors accounting for 70% to 80% of daily trades, motivated in part by the better potential returns especially from open-ended fixed income funds compared to bank deposit rates.

In the past, buyers of corporate bonds were mainly institutions like banks, insurance companies and securities firms. But with the availability of open-ended fixed income funds in recent years, corporate bonds have also become more accessible to retails investors which helps companies to tap a potential market for capital raising besides traditional institutional buyers.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.