COP27, the 27th United Nations Climate Change conference, ended last week following intense negotiations between developed and developing nations. UOBAM’s Sustainability Office picks out the developments that could benefit Asian investors.

5 key takeaways

After 14 days of heated debate, discussion and wrangling, here are the key global takeaways:

- Energy Security: Renewables remain key for energy security amid the current energy crisis, and greater policies and regulations have been implemented to advance green transition.

- Climate financing: There is a pick up on climate financing to support ongoing energy transition efforts, through multi-lateral blended finance, energy transition financing and financing of the hydrogen economy.

- Methane emission reduction: COP27 saw more focus on high impact sectors beyond fossil fuels - oil and gas industries are under increased scrutiny due to enhanced commitments on methane emission reduction, and are at risk of being the next potential stranded asset.

- Climate adaptation: The interest in climate adaptation is rising. This initiative seeks to enhance resilience for people living in vulnerable communities. It includes for instance, increasing funding commitment and new projects to aid adaptation in water, food and agriculture.

- Global carbon market: The conference discussed an Energy Transition Accelerator proposal to accelerate clean energy transition in developing countries, establish bilateral trade of carbon credits between countries, and increase local carbon markets.

Progress made by Asian countries

Asian countries achieved some important milestones as part of COP27 discussions.

Firstly, multilateral development banks will help provide financing for countries and companies to wind down and retire coal plants and advance investments to renewables. This includes Asian Development Bank’s Energy Transition Mechanism (ETM), which seeks to retire existing coal-fired power plants on an accelerated schedule and replace them with clean power capacity. Countries are also coming together to create partnerships. This includes the US-Indonesia climate finance deal which provides $20 billion for Indonesia to pivot away from coal and Vietnam's announced Just Energy Transition Partnership.

Secondly, Singapore, Vietnam, the Philippines and Indonesia are among the 150 signatories of the Global Methane Pledge (GMP), which aims to cut methane emissions by at least 30 percent by 2030. While China – one of the largest methane emitters – has not signed the pledge, it has drafted a national plan to curb methane emissions.

Thirdly, Singapore is establishing several carbon market agreements with other countries, and has already set up one with Papua New Guinea. Singapore is also discussing similar trade deals with 20 other countries, and have signed agreements with Vietnam, Morocco, Thailand, Ghana and Colombia.

Investment opportunities to look out for in Asia

The two-pronged approach for tackling climate change – mitigation and adaptation – provide some clear investment outcomes for Asian countries.

Mitigation is the reduction of emissions and stabilization of levels of heat-trapping greenhouse gases in the atmosphere, through reducing sources of these gases and enhancing the ‘sinks’ that accumulate and store these gases (e.g. oceans, forests and soil). Several investment opportunities arise from mitigation strategies ie

-

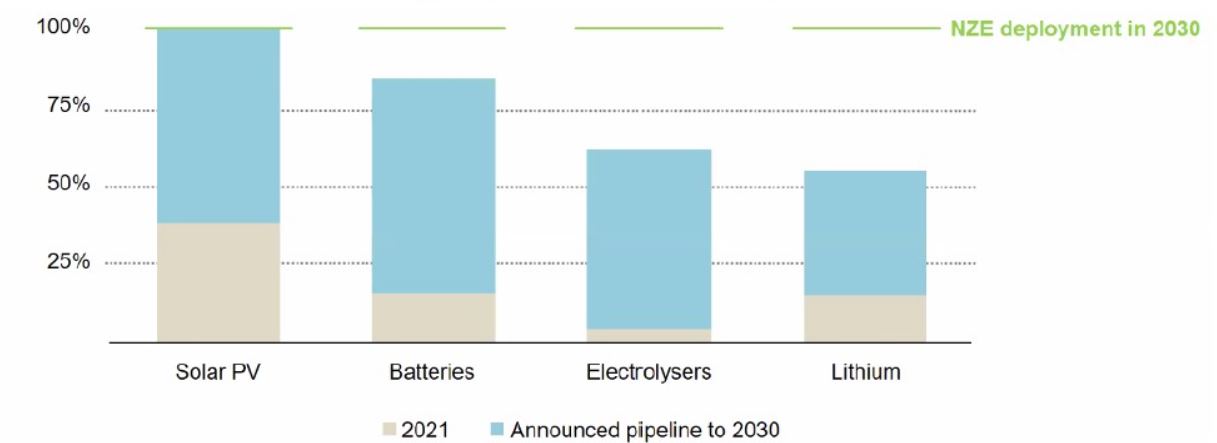

- renewables and clean energy – these remain key to energy security and energy transition. To meet the target of Net Zero Emissions (NZE), there is a need to scale up manufacturing capacity of clean technologies. The current difference between the current capacity levels and required capacity to achieve the NZE target is substantial.

Figure 1: Manufacturing capacity in 2021 vs required capacity in 2030

Source: IEA

Clean energy manufacturers have also announced aggressive pipelines to scale up manufacturing capacity. In addition, Singapore and Cambodia signed a memorandum of understanding in September to deepen cooperation on clean energy transition, which will help facilitate the development of regional power grids and cross-border grid interconnections for electricity between both countries.

-

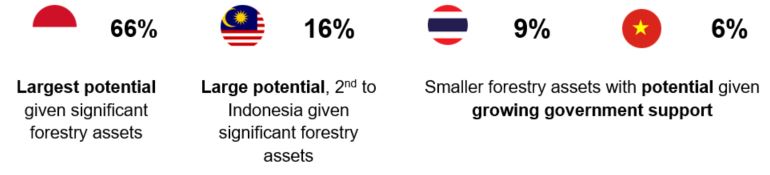

- Supplementing the proposed Energy Transition Accelerator, countries are setting out bilateral agreements and launching their local carbon markets. ASEAN countries in particular have rich carbon stock, with large swathes of investible forestry assets. They are therefore potential net providers of carbon credits and could become major beneficiaries of this trend.

Source: UOBAM

-

- The Breakthrough Agenda is a master plan to accelerate decarbonisation of five major sectors – power, road transport, steel, hydrogen and agriculture. The Agenda’s target to deploy net-zero emission industrial plants will likely create demand for hydrogen to act as a decarbonisation solution for fertiliser, steel and cement industries. According to IEA, US$1.2 trillion of low-carbon hydrogen funding is required to reach global NZE by 2025, and Asia plays a vital role in the hydrogen supply chain.

Adaptation to climate change includes building a resilient society that allows companies to bounce back through building infrastructure that can withstand extreme weather events. Implementing early warning systems can also help to evacuate areas prone to extreme weather. Several investment opportunities arise from adaptation strategies ie

- Asia is currently facing severe water stress issues with the growing water demand, where water demand will increase by 245 percent by 2050. As such, water efficiency is crucial to companies. To enhance a company’s resilience against climate change through water, some adaptation opportunities would include:

- Cloud seeding to spur rainfall

- Plant drought-resistant seeds

- Atmospheric water capture systems

- Efficient clean seawater pressurization

- Groundwater availability prediction

- Yield optimisation via data

These adaptation strategies would normally be supported by innovative technology, disaster management and infrastructure upgrades, which are promising themes that can be considered for investment.

Stranded risks increase for companies unable to transition

Along with the opportunities are also the risks especially to companies and sectors unable to achieve the required transition. Value at risk is a measure of risk of loss for an investment and this tends to have a strong correlation with the average sector emissions intensity.

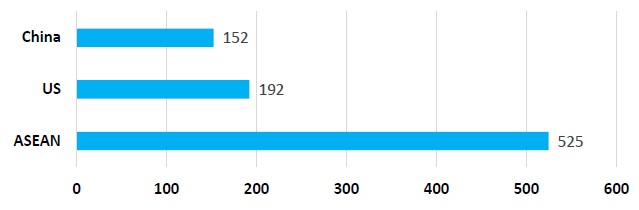

By using a fair-share production approach to estimation, estimated methane emissions were attributed to companies. In particular, ASEAN stands out significantly in terms of its current methane emissions intensity when compared to the US and China. The average methane emissions intensity shows how much methane is emitted by companies in the region, divided by revenue and shows that ASEAN’s intensity is more than triple that of China’s.

Figure 2: Estimated Average Methane Emissions Intensity (CH4 tonnes/million USD)

Source: UOBAM, Climate Trace, IEA

Value-at-risk is a measure of risk of loss for an investment and this tends to have a strong correlation with the average sector emissions intensity. Companies with high methane intensity therefore stand to have a higher value-at-risk, something that the UOBAM Sustainability Office will be keeping a close eye on.

Despite China’s lower methane intensity expected expansion of its national Emissions Trading Scheme by 2025, especially for the eight hard-to-abate sectors, could impact certain power, iron and steel, and building materials companies.

Also China, along with South Korea and Taiwan, are home to some of the largest operational coal plants in the world. These are set to become obsolete as the world moves towards its net zero goals. The estimated global net present value of stranded assets in coal power generation through to 2050 ranges from $1.3 to $2.3 trillion. However, there remains a lack of energy transition mechanisms in countries with significant coal assets. By not adequately addressing the problem of divesting or retiring these coal assets, the risk of stranded assets increases.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z