- The end of quarantine and testing restrictions for Chinese travellers likely to benefit ASEAN tourism

- Key destinations such as Thailand set to enjoy a direct economic uplift

- However, over-expectations regarding the pace of normalisation could lead to disappointment

Chinese tourists let loose

This week saw the lifting of China’s Covid-related travel restrictions for outbound travellers, with many Chinese residents already making plans to go abroad for the first time in three years. The pent up demand is likely to be huge given that, prior to the lockdown, Chinese tourism spending was the largest in the world. In 2018, Chinese tourists spent US$277 billion, almost double that of their US counterparts and almost a fifth of the global total1.

Figure 1: Top 5 countries with the highest tourism spending (2018)

| 1 | China | US$ 277 billion |

| 2 | United States | US$ 144 billion |

| 3 | Germany | US$ 94 billion |

| 4 | United Kingdom | US$ 76 billion |

| 5 | France | US$ 48 billion |

Source: United Nations World Tourism Organisation

ASEAN’s benefactors

While Chinese tourists are known to travel far and wide, the majority still head to their Asian backyard. Based on 2018 and 2019 online booking data, ASEAN countries comprised four out of the five most popular destinations for Chinese tourists.

Figure 2: Top 5 travel destinations for Chinese tourists (2018/2019)

| 1 | Thailand |

| 2 | Japan |

| 3 | Vietnam |

| 4 | Singapore |

| 5 | Indonesia |

Source: Ctrip (2018); Forbes (2018); China Travel News (2018); Travel China Guide (2019); ETC (2019).

Over 32 million of them visited the region in 2019, accounting for nearly a quarter of its total foreign arrivals into ASEAN countries2. Overall, the ASEAN region received 143.5 million foreign visitor arrivals in 2019. This figure dropped precipitously to 26.1 million in 2020, leaving a hole in the region’s economy that many countries hope Chinese arrivals can help to fill again.

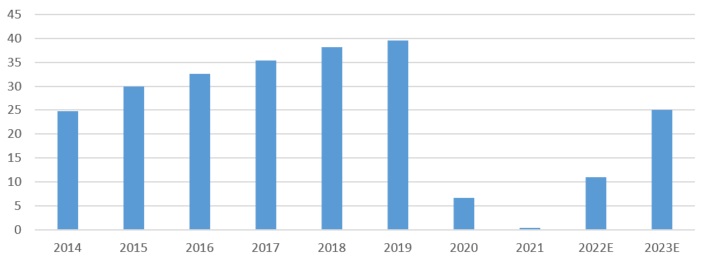

Thailand eyeing strong recovery

No country more so than Thailand. As the number one destination for Chinese tourists, Thailand welcomed eleven million such arrivals in 2019. In the wake of China’s re-opening, the country now expects a quick rebound to above seven million Chinese arrivals in 2023, up from an earlier estimate of five million3.

This is critical given the Thai economy’s high sensitivity to tourism. This sector contributes to more than 21 percent of Thailand’s GDP (direct and indirect exposure), considerably higher than for its neighbours, Singapore (10 percent) and Malaysia (13 percent). As such, we estimate that every one million additional tourist arrivals can help boost Thailand’s GDP by as much as 0.2 percent.

With 11 - 14 million more people expected to visit Thailand this year compared to 2022, the country’s forecast GDP could lift from 2.8 percent in 2022 to around 4.5 percent in 2023, which is in line with World Bank estimates. This lift would have a knock-on effect for some of Thailand’s other industries, including banking, commodities and healthcare.

Figure 3: Thailand tourist arrivals 2014 – 2023E (millions)

Source: UOBAM

The problem of over-optimism

While we believe that China’s re-opening has upside potential for some of Thailand’s key sectors, we think this may take time to flow through. A sudden large increase in tourist arrivals seems unlikely given that outbound flights from China are currently just one tenth of their pre-pandemic levels. It is likely that capacity by Chinese and more so foreign airlines will only be increased gradually.

This adds upward pressure on airline ticket prices. Adding in higher supply chain expenses and inflation, for some itineraries total travel costs have risen by as much as four times what they were pre-pandemic, not including extras such as travel insurance and Covid tests. Given this, in the short term, Chinese tourists may prefer to keep to traditional destinations such as Hong Kong and Macau in order to keep travel affordable. To date, Singapore hotels are reporting a surge of enquires from China but bookings have not yet materialised.

Investors interested in capturing sustained positive returns from China’s re-opening will therefore need to be patient.

1Forbes, "New Rankings of the World’s Fastest-Growing Tourism Destinations", September 2018

2China Daily, "Tourism lift seen closer to home first", July 2022

3Reuters, "Thailand U-turns on COVID vaccination rule for visitors", Jan 2023

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.