Key Highlights

- An Evergrande default is unlikely to cause a Lehman-scale shock in the Chinese market

- Sectors most at risk are those that are not aligned to China’s long term strategic goals

- For other sectors, current restrictions may lead to more sustainable long term growth

Lehman comparisons

Over the past few weeks, analysts watching increasingly twitchy equity markets have started to ask whether Evergrande could precipitate a “Lehman moment”. As detailed in our September 21 Research Note, Evergrande is China’s second largest developer, its US$300 billion of liabilities is no small amount, and warnings of the possibility of default are getting more persistent. The recent announcement that coupons are to be paid on some onshore bonds does not lessen this possibility.

However, the emerging consensus appears to be that Evergrande’s troubles are serious though unlikely to trigger a Lehman-like crises. Despite a worsening picture for the company, it constitutes just 2% of China’s multi-trillion dollar real estate sector. And while it is the country’s largest high yield bond issuer, making up about 16% of outstanding high yield notes, significant defaults are not new to the market. Last year annual dollar bond defaults reached US$20 billion and renminbi bond defaults hit around US$ 30 billion.

We note that an Evergrande default may well have a knock-on effect on other high yield issuers. However, built in expectations of high yield bond defaults suggest that the widespread shock and withdrawal of interbank funding as seen in the Lehman crisis looks unlikely to materialise.

Industry crackdowns

That said, Evergrande is a victim of the Chinese authorities’ recent regulatory crackdowns and there are fears that there may be more. Well before Evergrande issues took centerstage, the slew of new regulations, aimed at the tech, entertainment, gaming, property, education and other industries, had already badly spooked investors.

In fact, in the six months following their highs in February 2021, China indices have fallen dramatically, some by as much as half. Specific sectors have sold down even more, with some firms in the education sector dropping 90%.

Strategic Priorities

The focus now among investors is to identify future Evergrandes also set to fall on the sword of tighter regulations. To do this, we believe that there is a need to understand the underlying drivers of these rules.

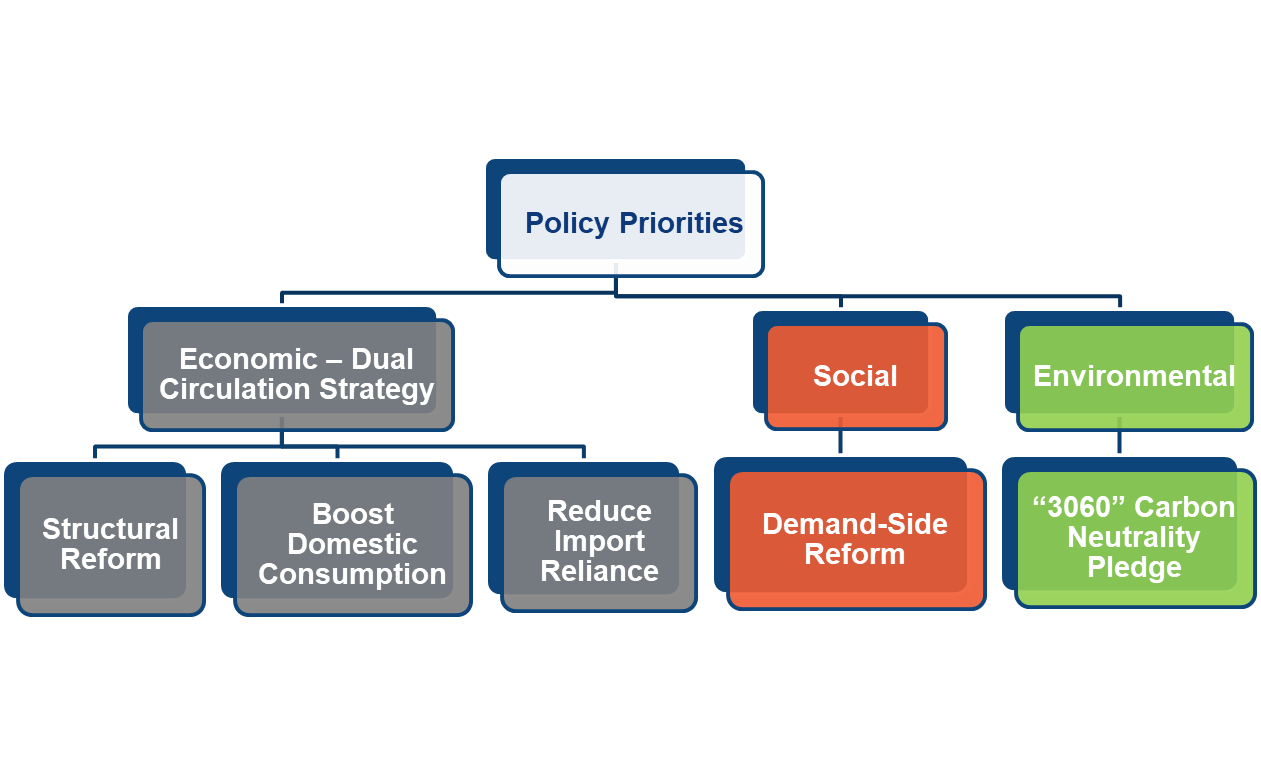

Fig 1: China's Policy Priorities

Over the past few years, global developments including the pandemic, trade restrictions and climate-related events have caused China to review its economic, social and environmental policies. This has yielded new priorities such demand side reform, domestic market focus (the so-called dual circulation strategy) and carbon neutrality.

The new rules currently being enforced can certainly have a bruising short term impact on targeted industries. However, in our view, their wider purpose is to help the government achieve its long term strategic priorities. The companies and sectors most at risk and where the new rules are likely to bite the hardest are therefore those not aligned with these priorities. Those that actually flounder also have lower prospects of a government bailout.

Sectors at risk

To ensure that we comprehensively assess the impact of China’s regulatory crackdown, the UOBAM Investment Team uses a number of economic, social and environmental screens.

For example, on the economic front, the “dual circulation strategy” that first came to light at the March 2021 National People’s Congress involves both the fixing of supply side issues for more global relevance, and the boosting of domestic consumption and production. We see this strategy played out in terms of greater restrictions on the activities of fintech, internet and property sectors as well as some state-own enterprises (SOEs).

On the social front, President Xi Jinping spoke in August 2021 of the need to "achieve common prosperity while pursuing high quality development". This has translated into a number of social reforms designed to reduce inequalities and improve labour protections. This has the potential to hurt margins in the healthcare, private education and gaming sectors.

And on the environmental front, China’s goal of peak carbon emission before 2030 and the “3060” Carbon Neutrality Pledge made in September 2020, leads us to expect we expect tighter controls on sectors with high carbon emissions

Not all bad news

The repercussions of China’s regulatory crackdown are far from over. In the short term, this spells danger for investors and the possibility of more Evergrande-type crises cannot be ruled out. As a result, we remain underweight China within both our bond and equity portfolios.

However, we are confident in the country’s long-term prospect and see its strategic policies making room for some high-quality companies and policy-supportive sectors to achieve more sustainable growth. For these sectors, the new government rules are to be welcomed rather than dreaded.

This means we have our sights on sectors that can elevate China’s production and innovation value chain, such as 5G, autonomous vehicles, and biotechnology companies. Players that specialise in machinery automation, social-housing development, cost-efficient insurance and green energy also look set to benefit from the government's stated common prosperity and environmental policies.

We are continuing to keep a close watch on when this regulatory crackdown cycle may be coming to an end and our investment strategy towards the Chinese market continues to be that of investing at a reasonable price. As such, we see recent market corrections as an opportunity to buy on dips when the time is ripe.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.