Key Highlights

- China markets are attractively valued but continue to be mired in uncertainties

- Covid lockdowns have stoked growth concerns while sanction fears are dampening sentiment

- Over the longer term, investors fear a deepening of US-China tensions

China resumes its market decline

Following a range-bound year in 2021, hopes were high that 2022 would mark a turnaround for Chinese equities. The worst of its economic reshuffle and regulatory clampdowns on IT, property and energy sectors seemed to be over, and investors were waiting for the right time to re-enter the market.

Instead, the Shanghai (SSE) Composite index is down 11.4 percent since the start of March. Year-to-date, Chinese equities have forsaken most of its outperformance against the US market and is the worst performer in Asia, with the MSCI China index nearly 16 percent lower. Particularly badly hit are some of China’s most prominent internet and e-commerce companies.

The rest of Asia, while managing to fare better than China, has not been spared from oil price, inflation and rising interest rate concerns, and the MSCI AC Asia Ex Japan index has fallen 11 percent so far this year. That said, several ASEAN oil and commodity producing markets such as Indonesia and Malaysia have managed to buck the trend. The MSCI Indonesia index is the region’s star performer, returning a positive 7.5 percent since the start of the year.

Worrying developments

Just this week however, China has started to stand apart from its Asian neighbours for several reasons. Firstly, in contrast to the re-opening trend prevalent in rest of the region, China imposed strict lockdowns on several large population and industrial centres, sparking fresh fears that China’s growth prospects may be affected.

Of greater concern is news that some Chinese companies may be delisted from US stock exchanges over their failure to meet auditing and disclosure standards, despite Chinese authorities citing national security concerns. The US Securities and Exchange Commission (SEC) has identified five firms so far, but more are expected if this dispute cannot be resolved. Regardless whether these companies are solely listed on US exchanges or also elsewhere, a delisting will impact the stocks’ liquidity, rendering them less attractive.

The rift between the US and China seems to be only getting worse. On Sunday, Jake Sullivan, US National Security Advisor, had already warned that “there absolutely will be consequences” if China makes any attempts to undermine current global sanctions against Russia. And this was before US officials’ even more damaging claim on Monday that Russia is seeking China’s military assistance, something both China and Russia deny.

Internet companies under pressure

Over the coming period, it is possible that strained US relations, along with earnings concerns, will weigh on Chinese equity markets.

Internet-related stocks are of particular concern, given the potential for rising marketing cost amid intense competition, higher compliance costs to mitigate regulatory risks, and limited upside in consumption demand. As with the growth sector globally, the propensity to de-risk means investors have less tolerance for companies unable to demonstrate strong earnings, as in the case of some Chinese internet companies.

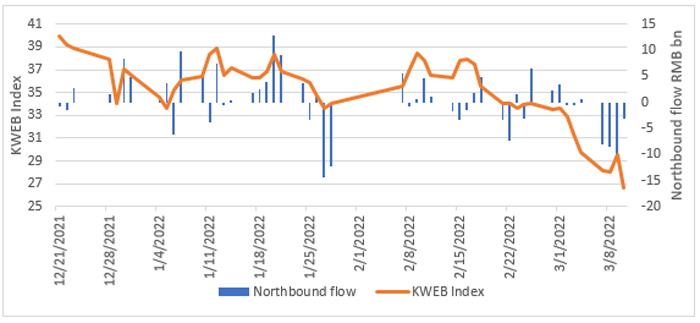

In addition, several of these stocks have already fallen victim to delisting fears, and more are likely to follow, given that the boundaries of the US’s delisting net are not yet defined. As the chart below shows, northbound fund flows ie flows into mainland-listed stocks from the Hong Kong Stock Exchange, have turned negative since the start of the month and this may continue in the near term until delisting uncertainties lift.

Figure 1: Declining flows into China securities is hurting internet stocks

Source: UOBAM, East Money, Investing.com

The real estate sector is also yet to emerge from its woes. Positive measures have been implemented over the past few months to strengthen demand by cutting mortgage downpayment ratios and shifting policy-making to a more local level. There have also been attempts to inject more stability into the sector though a number of mergers and acquisitions between private and state-owned enterprises. However, we are expecting more defaults to occur this year, and remain cautious that this may continue to weigh on investor sentiment.

Resilient growth…

Select sectors aside, and assuming the current lockdowns do not extend into many months, we maintain our benign outlook for China’s economy. China’s inflationary pressures are among the lowest globally, leaving room for the PBOC to continue to cut key interest rates, a counter-trend to most other major economies.

Meanwhile, China is better equipped to manage oil price rises than others in the region. Every US$10 oil price increase lowers China’s current account balance as a percentage of GDP by 0.2 percent compared to 0.4 percent for other Asian economies like Korea, India and Taiwan. The impact of oil price rises on inflation is also smaller than its regional counterparts.

As a result, although the Chinese government’s GDP target of 5.5 percent for 2022 is lower than the previous year, we believe this is achievable. Growth at this rate is still healthy enough to drive solid earnings and attractive valuations among China’s value sectors, such as financials and industrials.

…overshadowed by geo-politics

That said, we acknowledge that it is impossible to ignore the geo-political dynamics that has China at its centre. Many experts believe that China’s support for Russia is limited, especially given its offer to play the role of peacemaker and mediator in the Ukraine-Russia war.

This does not however lessen the clear deepening of tensions between China and the US. These tensions existed prior to the war and will likely outlast it, because they are underpinned by a structural shift in the global economic order. With China now closing the gap on the US as the world’s second largest economy, the jostling for global economic influence is set to intensify in the years to come. In the near term, this will rise to the surface as trade disputes, political face-offs and corporate tit-for-tats that will continue to unsettle investors.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.