Key Highlights

- Zero-Covid policies are starting to undermine foreign business confidence

- Economic data suggests that growth will moderate but not drastically

- Specific sectors have rebounded amid regulatory support and attractive valuations

Impact of Covid curbs

As many had expected, China’s zero-Covid lockdowns are turning out to be a never-ending story. While outbreaks earlier this year are now subsiding and normality is returning to Shanghai after two months of lockdowns, a new “ferocious” outbreak in Beijing linked to a 24-hour bar has thousands back behind closed doors. And a single case detected in Shenzhen last week put several neighbourhoods back into fresh lockdowns.

These no-nonsense restrictions have caused frustration and despair, not only among the local population, but also among foreign businesses and employees. Restricted personal freedoms, extremely limited domestic and international travel and stalled operations have depressed foreign investor sentiment, with no real end in sight.

As a result, foreign direct investment (FDI) into China, that is, business investment not including stock market flows, looks set to slow down dramatically in the coming months. The American Chamber of Commerce said about half of its members surveyed in May 2022 had already delayed or decreased their China investments, while the European Chamber of Commerce said a quarter of their members were planning to do so. In Shanghai, the number of FDI contracts for April were 98 percent lower than a year ago.

Economic data surprises

Despite these challenges, China’s equity markets saw a revival in May and June. The Shanghai Stock Exchange (SSE) Composite Index reached this year’s bottom on April 26 and has since climbed about 15 percent. And in stark contrast to the S&P500, which has been dragged down by over 4 percent in the last week due to rate hike concerns, the SSE managed to continue its upward trend.

Having taken fright earlier in the year, equity and bond investors are starting to warm to the attractive valuations within select Chinese companies and sectors. They are also drawn to China’s easing path with its one-year loan prima rates (LPR) continuing to hold at 3.7 percent, and its five-year LPR cut from 4.6 to 4.45 percent in May, the largest reduction on record. However, the Peoples Bank of China (PBOC) resisted any further cuts to its LPR and MLF (medium term lending facility) rates last week, possibly because May’s economic data was better than expected.

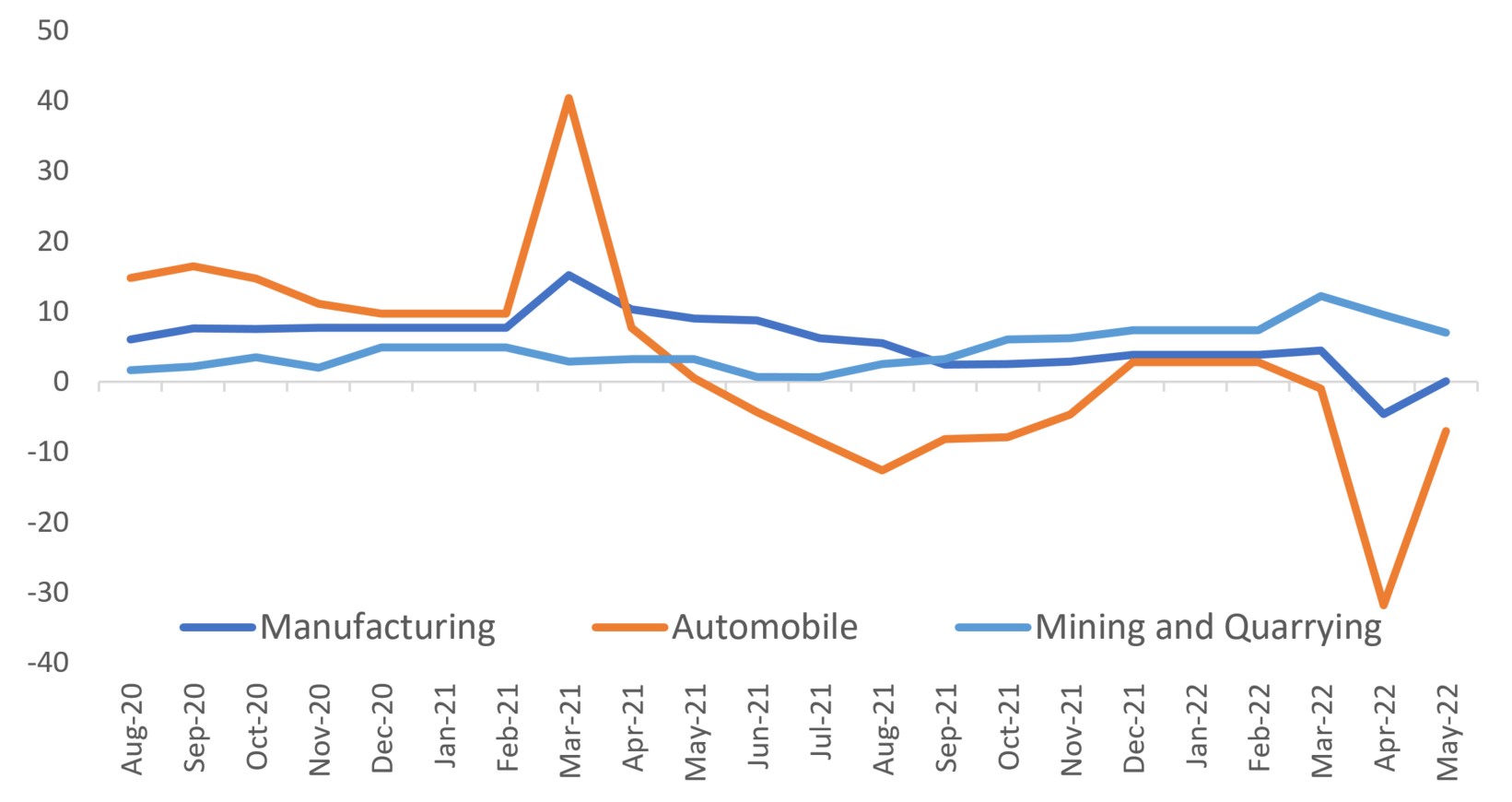

While retail sales contracted by 6.7 percent compared to a year ago, and for the third straight month, it beat market expectations of -7.1 percent. Meanwhile, industrial production actually expanded by 0.7 percent year-on-year versus an expected contraction, spurred by a strong rebound in export sectors, primarily autos and manufacturing.

Figure 1: China Industrial production year-on-year percent change, Aug 2020 – May 2022

Source: Bloomberg/UOBAM

US President Biden’s announcement this week that he is considering easing tariffs on some US$300 billion of Chinese imports will come as added welcome news. While the tariffs were imposed by his predecessor and will help address the US’s soaring inflation, some commentators suggest that this rare US olive branch to China could represent a more thoughtful and strategic approach to US-China trade relations going forward.

Growth moderating but still strong

These developments lead us to conclude that while China’s growth may come in under its 5.5 percent forecast for 2022, the final number may not be too far off. It is possible that the second half of the year will see the country’s economy growing at a rate above 5.0 percent, bringing the full year number to above 4.0 percent.

However, China’s determination to maintain of its zero-Covid policies, at least until the all-important Chinese Communist Party’s 20th National Congress in November 2022, points to many uncertainties still ahead. While inflation remains low at 2.1 percent in May compared to its Western counterparts, a potential recession in these economies could have a knock-on effect on China’s growth prospects.

China will also need to work restore its FDI inflows which in 2021 reached US$173.48 billion. As a mark of FDI’s importance to the economy, Chinese authorities had recently updated its negative list for foreign investment, reducing the number of sectors in which foreign investors are restricted or prohibited. Last year, service and high tech sectors were among the biggest beneficiaries of China FDIs.

Sector opportunities

Assuming these risks can be contained, we would expect to see a recovery in select sectors, especially those able to leverage new government incentives designed to help businesses resume industrial production. This includes auto manufacturers and those within the auto supply chain, given levy cuts for car purchases.

We also favour e-commerce firms given the likely focus on stimulating domestic consumption. China’s Ministry of Commerce (Mofcom) is also urging the development of e-commerce capabilities and delivery logistics to help boost consumption in rural areas. There are also moves to more actively support tech innovation and overseas listings.

Support for infrastructure initiatives also lead us to favour upstream materials, industrial and renewable energy companies.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z