- The bill will cause US debt to escalate over the next decade

- The cost of servicing this debt could materially impact the US's growth outlook

- Investors should consider broadening their fixed income exposure beyond US Treasuries

Anthony Raza, Head of Multi-Asset Strategy

It’s been a tense month. Republican lawmakers debating President Trump’s megabill have not all been in favour. Elon Musk called it “utterly insane and destructive”.

Despite such strong words, President Trump’s last-minute concessions were enough to get the bill passed, albeit by the thinnest of margins. It was signed into law last Friday, marking a new era of indebtedness for the US government.

Now that there is no going back, here are some highlights on what this could mean for the US economy and US assets:

- Unprecedented borrowings

The current US federal debt is US$36.21 trillion. This bill’s package of tax and spending cuts will add around US$3 trillion by 2034 and another US$9 trillion by 2055. If temporary provisions become permanent, this piles on a further debt of US$4 trillion, bringing the grand total to US$16 trillion over 30 years.

The Big Beautiful Bill outweighs any previous stimulus packages, including those introduced to deal with Covid, the 2022 inflation crisis and the 2008 financial crisis. - New economic stresses

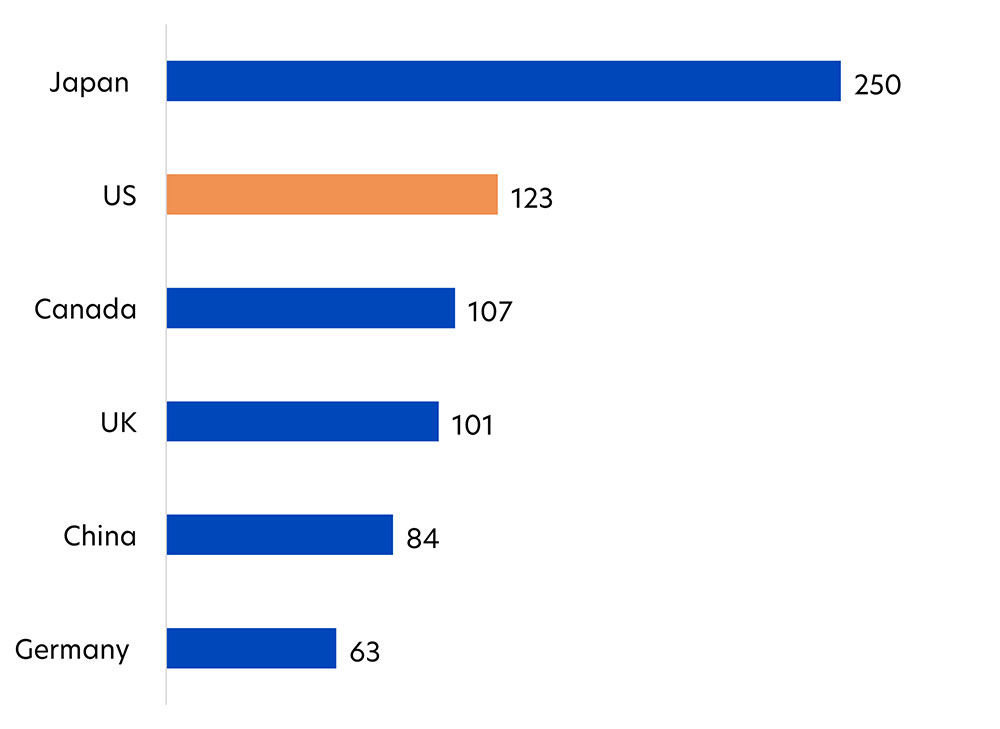

One way economists put debt numbers into context is to look at the debt-to-GDP ratio. This measures a country’s ability to meet its debt, and a ratio of 100 percent suggests that the country’s economic output is equal to its debt burden. The last time this was the case in the US was 2013.

Since then, the ratio has crept up steadily and reached 123 percent last year, higher than many other large nations. Should the bill’s tax provisions become permanent, it is estimated that the US’s debt-to-GDP ratio will rise further to 186 percent by 2055, putting it among the highest in the world.

Fig 1: Government debt as percent of GDP, 2024

Source: IMF

Maintaining such high debt levels has the potential to hurt the US economy. In 2024, it cost the US government US$1.1 trillion to service this debt, diverting money away from more useful economic programmes. For example, this amount is about four times more than the government spent on education that year.

The bill worsens this situation considerably. The Committee for a Responsible Federal Budget, a non-partisan thinktank, estimates that the bill will cause debt repayment costs to rise by two thirds to US$1.8 trillion over the next decade. - Creditworthiness matters

The above scenario does not take into account a prolonged spike in interest rates. Although the US national debt has increased every year over the past 10 years, interest rates have remained fairly low. This is because global investors still view US Treasuries as a safe haven with very little (if not zero) risk of default even in a crisis.

However, there is a limit to how much US debt can continue to rise before investors get nervous. Moody’s became the last of the three big agencies to downgrade the US’s top Aaa rating in May 2025. The company explained that “The US general government interest burden, which takes into account federal, state and local debt, absorbed 12 percent of revenue in 2024, compared to 1.6 percent for Aaa-rated sovereigns. While we recognize the US's significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics.”

While the bill will not have an immediate impact on the US’s creditworthiness, sustained rises in Treasury yields could spark a vicious cycle over the longer term. Higher yields make the debt servicing even more expensive, which will further diminish investor confidence, which in turn pushes yields higher. Investors will be closely tracking the bond markets for any signs of weakening. - US diversification, not divestment

President Trump’s surprise announcement yesterday, ahead of the expiry of the tariffs pause this week, raises the tariff rate on several countries, but extends the pause to 1 August. It is possible that these, plus the tariffs announced earlier, will help to address some of the debt resulting from the bill, but are also likely to increase inflationary pressures over the medium term.

All in all, a US recession is not our base case for this year. However, we think that its likelihood remains elevated, and the medium-term outlook for US markets continues to be marked by significant uncertainty. As such, we recommend a neutral allocation between equities and fixed income. This positions investors to participate in market upside if growth persists, while also offering some protection should conditions deteriorate.

That said, the longer-term picture seems to be one of a changing world order. The status of US assets as “exceptional” and therefore worthy of strong demand despite high valuations, seems to be on the wane. While we would not expect a large scale investment shift away from the US in the near term, there is good reason to prepare for a slow but steady trend of global diversification. This is especially true of Treasury holdings, given the US’s precarious debt situation, with gold, European and Asian bonds and short-term credits likely to benefit instead.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z