- Many ASEAN economies are region and domestic-centric

- As a result, ASEAN markets can offer investors resilience to US tariff scares

- A weak USD could provide additional tailwinds

Francis Eng, Head of ASEAN Equities

The 46th ASEAN summit held last week in Kuala Lumpur could not have come at a better time. It included a first ever formal three-way meeting between the 10 nations of ASEAN, China and the six-member Gulf states. And not surprisingly, US trade tariffs were high on the agenda.

China - ASEAN ties set to deepen

The meeting concluded with a commitment to promote “closer economic cooperation among the three parties”, a direction of travel that bodes well not just for ASEAN economies, but also for China.

Even before President Trump’s Liberation Day announcements, ASEAN and China were each other’s top trading partners. ASEAN accounts for over 16 percent of China’s exports while about 18 percent of ASEAN’s total exports are to China1.

And ASEAN-China trade continues to grow at a healthy pace. Bilateral trading volumes increased by 7.8 percent year-on-year in 2024, and 7.1 percent in 1Q 2025, according to China’s General Administration of Customs (GAC). US tariffs suggest that this trend could further accelerate.

ASEAN is regionally and domestically focused

However, it is not only their strong trading ties with China that enable ASEAN economies to stand out. Importantly, the establishment of the ASEAN Free Trade Area (AFTA), based on zero or near-zero tariffs, has helped deepen intra-regional trade over the past three decades. Other forms of ASEAN economic integration have also emerged, including transport links, human resource mobility and joint investments. Today, between a fifth and a quarter of ASEAN’s trade takes place within the region.

On top of this, at a time when global GDP forecasts are being downgraded due to US trade restrictions, domestic consumption has become a crucial measure of economic resilience. In its April 2025 report, the IMF stated that, “…heightened trade policy uncertainty may further hinder both short-term and long-term growth prospects.” As a result, it is expecting the GDP of Advanced Economies to fall from 1.8 percent in 2024 to 1.4 percent in 2025.

The decline is less steep for domestic-centric economies. Within the ASEAN-5 countries (Indonesia, Malaysia, the Philippines, Singapore, Thailand), the average GDP is forecast to ease to 4.0 percent in 2025, compared to 4.6 percent in 2024.

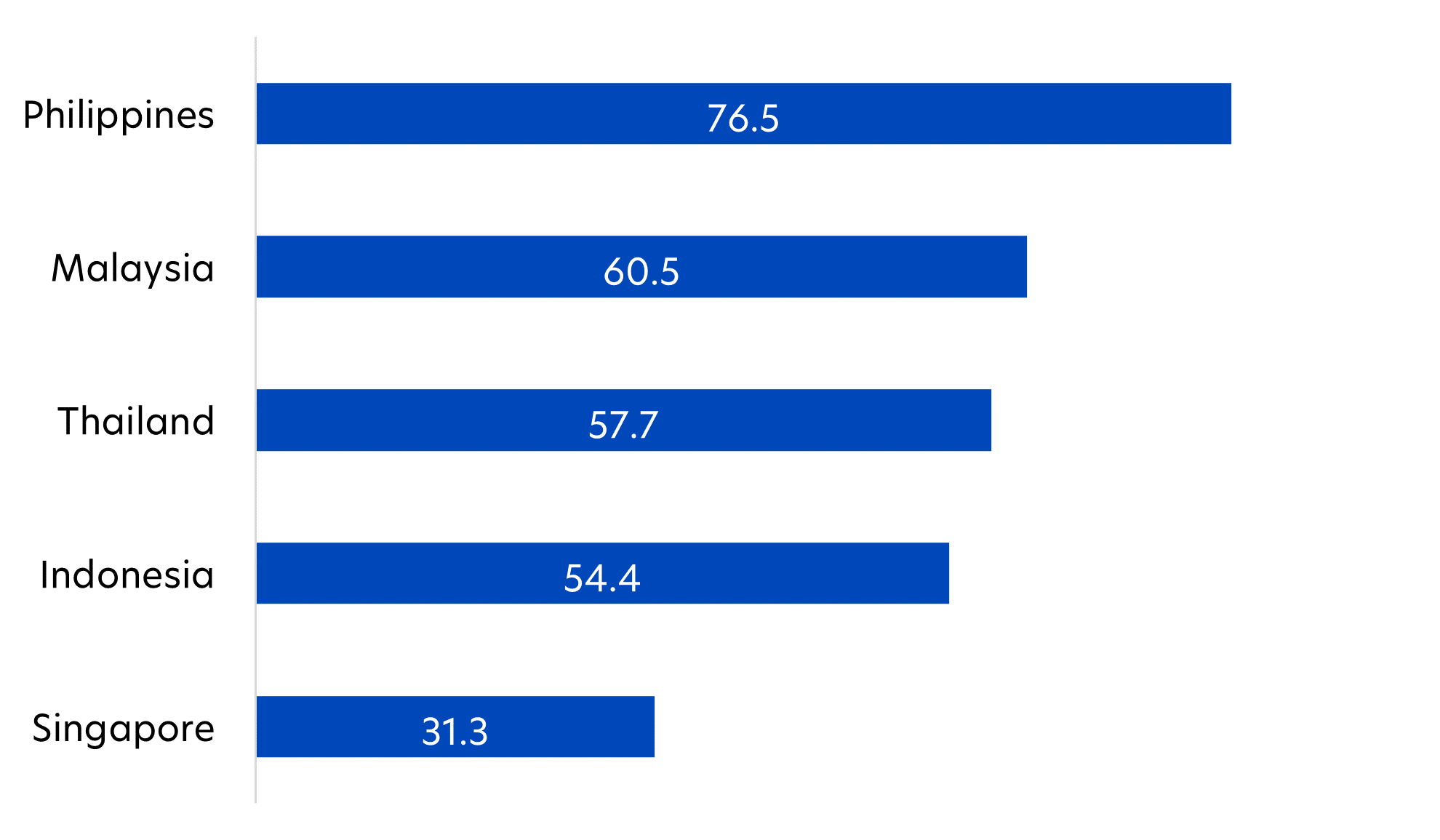

This can be partially attributed to the importance of domestic consumption as a driver of growth for the ASEAN-5 countries. In particular, the Philippines, Malaysia and Thailand economies are propelled by domestic consumption, with exports accounting for less than 43 percent of GDP.

Fig 1: Domestic consumption as a percentage of GDP (%)

Source: World Bank

More stable markets

Since hitting a Liberation Day low on 9 April, the FTSE ASEAN All-Share Index has risen by around 17 percent and is back to its start-of-2025 level, having gained 3 percent in 2024.

Much of this recovery can be attributed to the domestic makeup of ASEAN markets. Banks and financial sector companies predominate, comprising almost half of the region’s market cap. In fact, the big three Singapore banks - DBS, OCBC and UOB – account for a fifth, with Malaysian and Indonesian banks also well-represented.

Meanwhile, other domestic sectors such as telecommunications, real estate and food and beverage constitute another 20 percent.

In total, we estimate that over 90 percent of companies within the ASEAN region have a domestic or regional focus.

USD weakness a boost for ASEAN

Looking ahead, ASEAN markets stand to benefit from attractive valuations and the unusually weak US dollar (USD). Unlike previous periods of global macro uncertainty, investors are not flocking to the USD as a safe haven.

To the contrary, investors worry about the US’s indebtedness and the potential volatility of US Treasuries. As a result, the USD continues to be soft relative to many ASEAN currencies. This can help to make ASEAN assets look more attractive, especially as many markets, except for Singapore, are currently trading below their 10-year mean.

Over the longer term, the rise of multi-polar tendencies offer a more equal playing field for smaller markets. In the past, ASEAN caught a cold when the US or China sneezed. We think that this correlation could weaken, and the defensive qualities of ASEAN markets can help investors to diversify the risks resulting from US policies.

1Source: OEC

Francis has more than 27 years of investment experience, encompassing fund management and equities research. He joined UOB Asset Management (Malaysia) in 2007 as a portfolio manager and has assumed the role of Chief Investment Officer since 2010. Under his leadership, the investment team has achieved numerous accolades, including awards from Lipper, Morningstar, AsianInvestor, International Finance, and Asia Asset Management. Francis has been instrumental in developing the institutional business franchise for UOB Asset Management (Malaysia). In 2023, he expanded his responsibilities to serve as Head of ASEAN Equities.

Before UOBAM(M), Francis was a senior analyst at a foreign securities firm, where he contributed to equity research teams consistently ranked among the best by Greenwich Associates and Asiamoney.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United ASEAN Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120