- Temporary US-China tariff truce has helped lift China markets

- More severe risk scenarios for the Chinese economy have receded

- Stimulus package potentially delayed but remains on the cards for 2025

Colin Ng, Head of Asia Equities

China’s market recovery

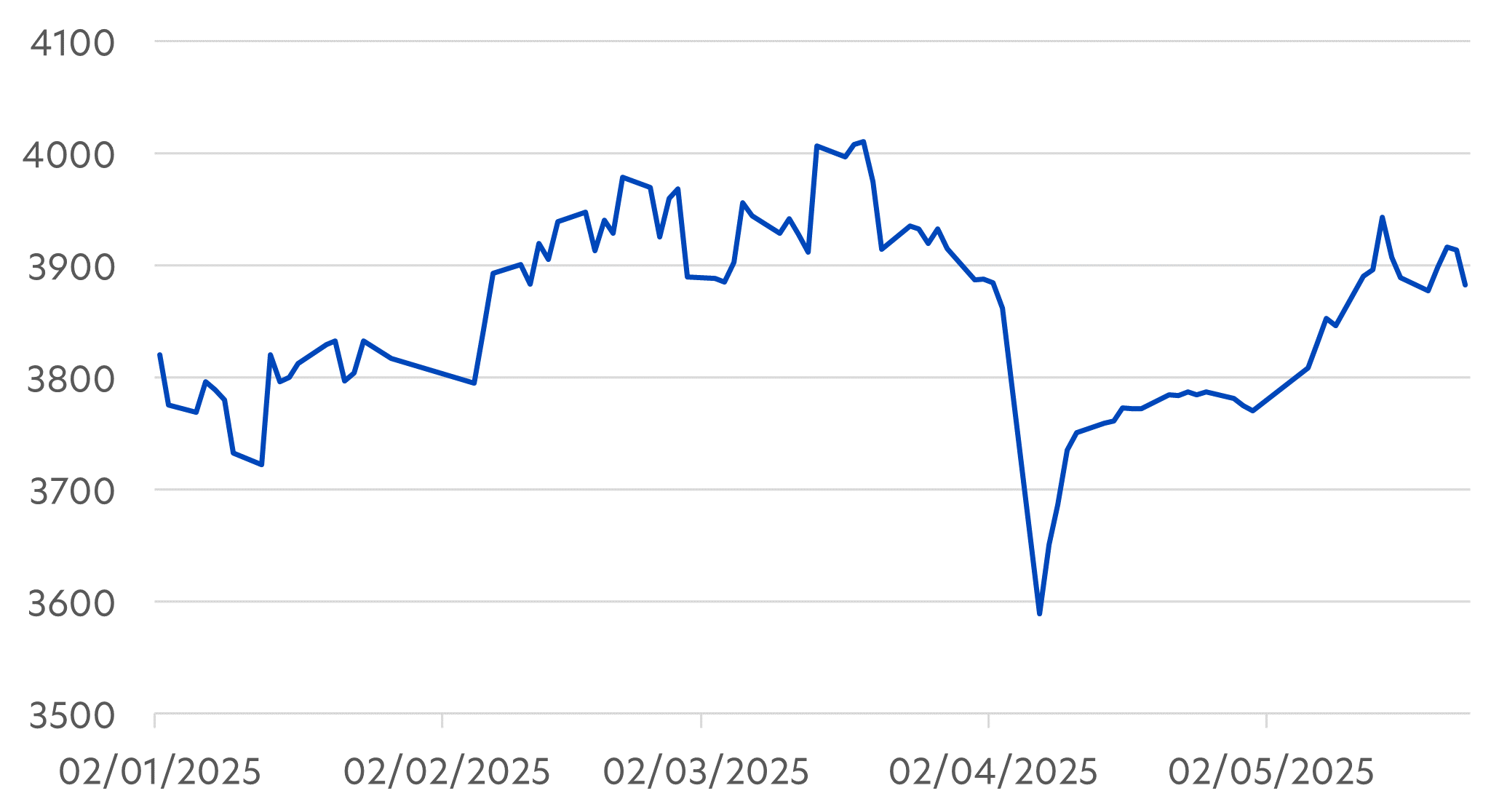

The China A-share market, as represented by the CSI 300 index, is 2.5 percent higher than it was at the start of the year, and about 5.0 percent higher than April’s low.

As seen below, the market started a concerted recovery in early May, even before President Trump announced his temporary tariff truce. However, the truce announcement on 12 May further boosted the market’s recovery, with some profit-taking along the way.

Fig 1: CSI 300 Index YTD

Source: Bloomberg, as of 23 May 2025

Positive 3Q outlook

As we enter the third quarter, we are shifting to a more positive view of the China market for the following reasons:

1. No trade decoupling

A complete decoupling between the US and China now appears highly unlikely, even after the 90-day reprieve. We acknowledge that trade negotiations between the two countries are extremely challenging with many outstanding issues. As such, the 90-day timeline could be extended. However, we do not see either country having the stomach for a re-escalation of tariffs.

2. Upgraded economic forecast

We expect considerable market relief that the threats to China’s economy posed by US tariffs have now been dialed down. Previously, economists had highlighted the potential for large scale lay-offs from China’s manufacturing sector, which would have impacted the population’s domestic consumption power. These same economists are now upgrading their China GDP projections to between 4.0 and 4.5 percent.

3. Lower US trade deficit

Assuming the current arrangement lasts i.e. 30 percent US tariffs on Chinese goods and 10 percent China tariffs on US goods, we would expect the US-China trade imbalance to reduce in 2025. Additionally, it appears that China may agree to buy more US agriculture and energy. A weaker dollar could also make US imports more attractive for Chinese businesses and consumers. A lower US trade deficit with China could help to partially mend US-China relations.

4. More trade diversification

China is focused on diversifying its range of trading partners, especially for the import of key goods. To date, China has struck deals to source more oil from Canada, agriculture from Brazil, and beef from Australia. China is also seeking to deepen its export relationships with Europe, Mexico, Japan, South Korea and ASEAN. The trade war sparked by President Trump has accelerated China’s shift away from the US as a key trading partner.

5. Potential for more stimulus

Investors had expected the Chinese authorities to announce a substantial stimulus package in response to the trade war. We think the current reprieve could delay this announcement by two or three months in order to reassess the full impact of the tariff reset on domestic consumption trends. Nevertheless, we don’t think that a stimulus can be delayed indefinitely if China is to reach its 4.5 to 5.0 percent growth target for 2025.

Room for more upside

Fig 2: 2025 equity valuation forecasts for select Asian markets

| PER (x) | PBR (x) | EPS growth YOY (%) | |

| China | 12.0 | 1.4 | 5.5 |

| Taiwan | 15.9 | 2.6 | 15.5 |

| India | 24.1 | 3.6 | 12.9 |

| Korea | 8.9 | 0.9 | 19.7 |

| Singapore | 14.9 | 1.8 | 2.9 |

| Asia ex Japan | 13.9 | 1.7 | 13.1 |

Source: UOBAM, Bloomberg, May 2025

China equity valuations remain reasonable and are among the lowest in Asia. While overall, Chinese companies’ earnings growth potential in 2025 is lower than the Asia average for 2025, we think this belies substantial areas of strength. The recent Contemporary Amperex Technology (CATL) listing on the Hong Kong exchange, alongside recent fund raising efforts by BYD and Xiaomi suggest that certain key sectors such as EVs have the potential for strong expansion in the months and years to come.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120