Contact Us

Address:

UOB Plaza 2

80 Raffles Place, #03-00

Singapore 048624

(65) 6532 7988

1800 22 22 228 (local toll-free)

(65) 6222 2228 (calling from overseas)

(65) 6535 5882

UOBAMInvest@UOBGroup.com

The Digital Adviser employs risk profiling and goal setting algorithms to design investment solutions that are most appropriately aligned with your investment objectives, investment horizon and risk tolerance. To meet a broad range of needs, liquid Exchange Traded Funds (ETFs) and unit trusts are used to build portfolio solutions.

The Digital Adviser seeks to ensure that your investment allocation will be aligned with your respective risk tolerance levels across your investment horizon. With scenario analytical tools focused on goal achievements, these tools help present the probability of you achieving your specific saving goals associated with your investment plans.

UOB Asset Management Ltd (UOBAM) is responsible for all key investment inputs in UOBAM Invest, which are reviewed every quarter by UOBAM’s investment and product committees. Our Multi-Asset Investment Management Unit (IM-MA) undertakes the following:

Select appropriate investible universe - a curated list of ETFs and unit trusts to deliver the targeted risk levels.

Define suitable asset classes.

Input UOBAM’s proprietary Capital Market Assumptions (CMAs) derived from our in-house research processes into the algorithm.

Implement investment constraints so that the optimised and recommended portfolio solutions from the algorithm are aligned with clients’ investment goals and risk characteristics.

UOBAM’s optimisation model is designed to maximise portfolio returns for a defined level of risk that gives the highest probability of achieving an investment goal (or a combination of investment goals). The risk and return expectations for portfolio solutions can fluctuate over time due to changes to model inputs (e.g. shifts in risk expectations, return expectations, correlations, and constraints).

The Digital Adviser thus requires you to complete an online risk assessment and assigns a risk classification based on your responses. It will then recommend solutions that are aligned to your risk profile and investment goals.

Use the Digital Adviser’s Portfolio Planner tool to input one or more goals you seek to achieve and obtain an optimised portfolio based on your inputs. The success probability1 will be calculated for each individual goal. You can also explore and customise your investment plan to suit your needs by adding or removing goals, adjusting your contribution amount, time horizon and your risk tolerance levels. The success probabilities are re-calculated each time changes are made, and can help you review the viability of your long-term goals.

The Digital Adviser’s investment model is designed with the following key unique features:

Forecasting

Unusual market event shocks are taken into consideration that typical mean-variance optimisation models may not. This enables a more realistic analysis of downside risk in the forecasting model and a more accurate estimate of the success probability.

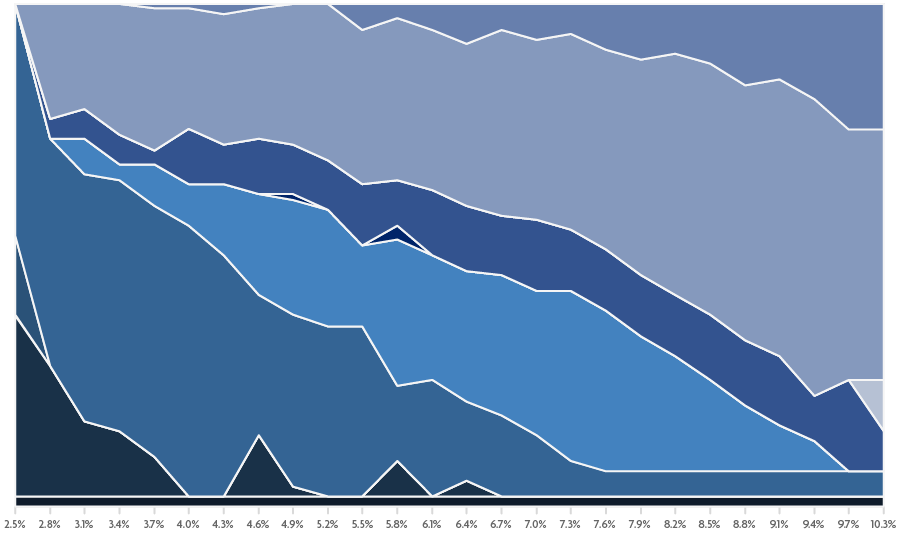

Customising solutions based on an investor’s investment horizon

The model utilises an algorithm to scale risk levels according to the time horizon of an investor, as the capacity to take risk and the probability to achieve a goal is inversely related to the duration of the investment horizon. Embedded in the model is an overlay function that “glides down” the risky assets allocations, known as the “glide-path”, which automatically adjusts the portfolio rebalancing (See ‘Rebalancing’) based on an investor’s remaining investment horizon.

These features enable the Digital Adviser to cater dynamically for complex or future contribution strategies, multiple savings and spending goals to closely reflect real life financial planning.

The Digital Adviser targets to maximise returns for your specified risk level based on your risk profile and investment horizon.

We adopt a risk-based approach where your volatility tolerance level is a key factor in determining the recommended portfolio.

In addition, your investment horizon is taken into consideration, where we gradually adjust the portfolio-solution risk by systematically switching from assets with higher risk to more conservative ones as we draw closer to the end of your target investment horizon.

Asset allocation by volatility target

Figure 1

Figure 1 presents a chart of the asset class weight as a function of the portfolio (solution) volatility. The non-linear shape of these allocations or weights is caused by the weighting constraints and non-linear nature of the glide-path.

Figure 1 is for illustration purposes only as configuration parameters and inputs can change.

In the Digital Adviser, asset class selection is based on two main objectives – to align with the goals of our investors and to ensure diversification of risk. Only liquid assets are included to enable investors with the flexibility to invest based on their investment goals and horizons.

With the efficient frontier, we aim to balance and limit the number of asset classes2 to a reasonable level and also deploy a forward-looking optimisation model. There is a suitable allocation to risky assets, versus the conservative ones, and such allocation is controlled through constraints and the glide-path.

For each asset class, UOBAM IM-MA will identify and recommend the most appropriate assets to gain exposure to the specific asset classes. Currently, our universe of instruments is confined to ETFs and unit trusts listed on BATS, NYSE and NASDAQ. Our methodology considers qualitative and quantitative driven indicators applied to a larger universe of ETFs and unit trusts, in addition to selecting non-synthetic instruments which avoids derivatives and leveraging which increase the underlying risks an investor might be exposed to.

Asset classes3 included are:

Core Asset Class:

Money Market Instruments

Government Bonds

Investment Grade Corporate Bonds

Tactical (or non-Core) Asset Class:

High Yield Bonds

Equities

The following selection and screening criteria are being applied:

Quantitative indicators to select ETFs and unit trusts include tracking error, expense ratio, fund size to select instruments which will deliver more stability and better performance.

Qualitative factors like reputation of the fund manager and track record of managing ETFs and unit trusts.

Use of non-synthetic instruments only, where screening on use of derivatives, leveraging and stock lending is performed.

Recommendations to include a certain asset (ETF) on the platform are based on overall performance analysis with preference given to the instrument with higher scores using the above selection and screening process.

Capital Market Assumptions (CMAs) are provided by UOBAM IM-MA.

Key inputs for each asset class include:

In addition to the market equilibrium implied returns, we also use data on historical returns, interest rates, credit spreads, forward-looking return expectations, earnings growth, and other macroeconomic variables to form long-term expected return views for each asset class.

We use a two-tier CMAs implementation approach: mid-term and long-term forecasting processes. We design and provide a blended solution for input onto the Digital Adviser’s optimiser. These CMAs are expressed through expected returns, volatility of returns for each asset class, and their correlations.

Return estimation

Equities asset classes

Return forecasts are derived by combining two forward-looking estimation models, one based on forward-earnings and the other based on earnings smoothened for extreme outcomes.

Fixed Income asset classes

Money market asset class:

Returns are derived based on UOBAM’s medium-term forecasts for inflation and Inter-Bank rates.

Government Securities Index:

Returns are estimated based on medium-term forecasts when it comes to assumptions of inflation, interest rates and yield curve movements. Return estimates incorporate resulting

capital gain-loss factors and are annualised.

Investment Grade Credit and High Yield Credit Index:

Returns are estimated by adding a risk-adjusted credit spread to the relevant Government Security curve to derive return estimations.

Risk estimation

Risk (volatility) estimation is based on the average 5-year and 10-year rolling volatility of returns. We define both the 5-year and 10-year volatility as the geometric average to smooth the result.

Correlation estimation

Matrix of correlation assumptions are based on 5-year rolling returns with adjustments based on UOBAM’s investment views so that we can forecast with longer persistency and higher stability of estimation.

Our optimisation model is a forward-looking financial model, providing probabilistic outcomes about the future portfolio performance or a list of projections to suit your investment plan or risk profile.

We focus on managing the risk level, evaluate, and monitor potential loss metrics, similar to Value at Risk or even Conditional Value at Risk.

Separately at each asset class level, we replicate different market behaviour principles especially when it comes to idiosyncratic characteristics and/or historical periods for these respective asset classes. The model incorporates market shocks or “jumps” on top of a financial modelling process that auto-regresses around average values given by market assumptions. This enables portfolios to have better sensitivity as compared to models focused on historical observations, which are based on normally distributed events.

Our optimisation model is closer to a “real-world” financial model, and is designed to consider and implement the multiple-goal planning process, with visibility on the probability of achieving your goals.

We aim to limit the degree of shift in allocations, to achieve greater stability and better alignment with investors’ risk tolerance and investment objectives.

The applied optimisation model aims to avoid scenarios like:

Significant change in allocation when there are modest changes in the model inputs.

Irrational allocations as a result of aiming for an optimal Sharpe ratio4 where risky assets get allocated into very conservative or conservative portfolios.

In addition, there are constraints being implemented on the model to limit allocations and exposures especially when asset classes are relatively highly correlated.

On a quarterly basis, UOBAM IM-MA reviews our CMAs and asset allocations. UOBAM Invest will notify you via email when there is a rebalancing action to re-align the asset allocation of your Digital Adviser portfolio.

After rebalancing is completed, you can continue to track the performance of your investment portfolio against your savings or financial goals and objectives. You can review your contribution or withdrawal plans to improve the probability of success in achieving your financial goals.

We analyse and control key inputs for the Digital Adviser. These inputs go through our internal committees for approvals prior to release.

These include:

Recommending asset classes that are suitable for the various releases

Updating CMAs on a regular basis

Reviewing and monitoring the model outputs

Reviewing the performance of the underlying investment instruments (ETFs) and unit trusts

For each update of UOBAM Invest, UOBAM IM-MA documents the following:

Justification for asset class inclusion

The methodology behind setting CMAs

The framework and logic behind setting constraints and limits

Justification for ETF and unit trust inclusion

UOBAM IM-MA works intensively to validate the current model by conducting tests on the model output and sense checking against our in-house optimisation models.

In the event of a server disconnection, which could result in a faulty algorithm, the computation of the weightage of the asset allocations for clients’ portfolios may not be mapped to what is intended. A kill switch function is available for activation once we discover discrepancies or anomalies in our robo-advisory algorithm. Investors will be notified through email and allowed to conduct full withdrawal transactions only.

Otherwise, there is no intention to make changes to the models in any way (optimiser and forecasting). If there are any future changes to the model, thorough testing will be conducted to be reviewed and approved by UOBAM and modifications will be documented and audited.

Notes: