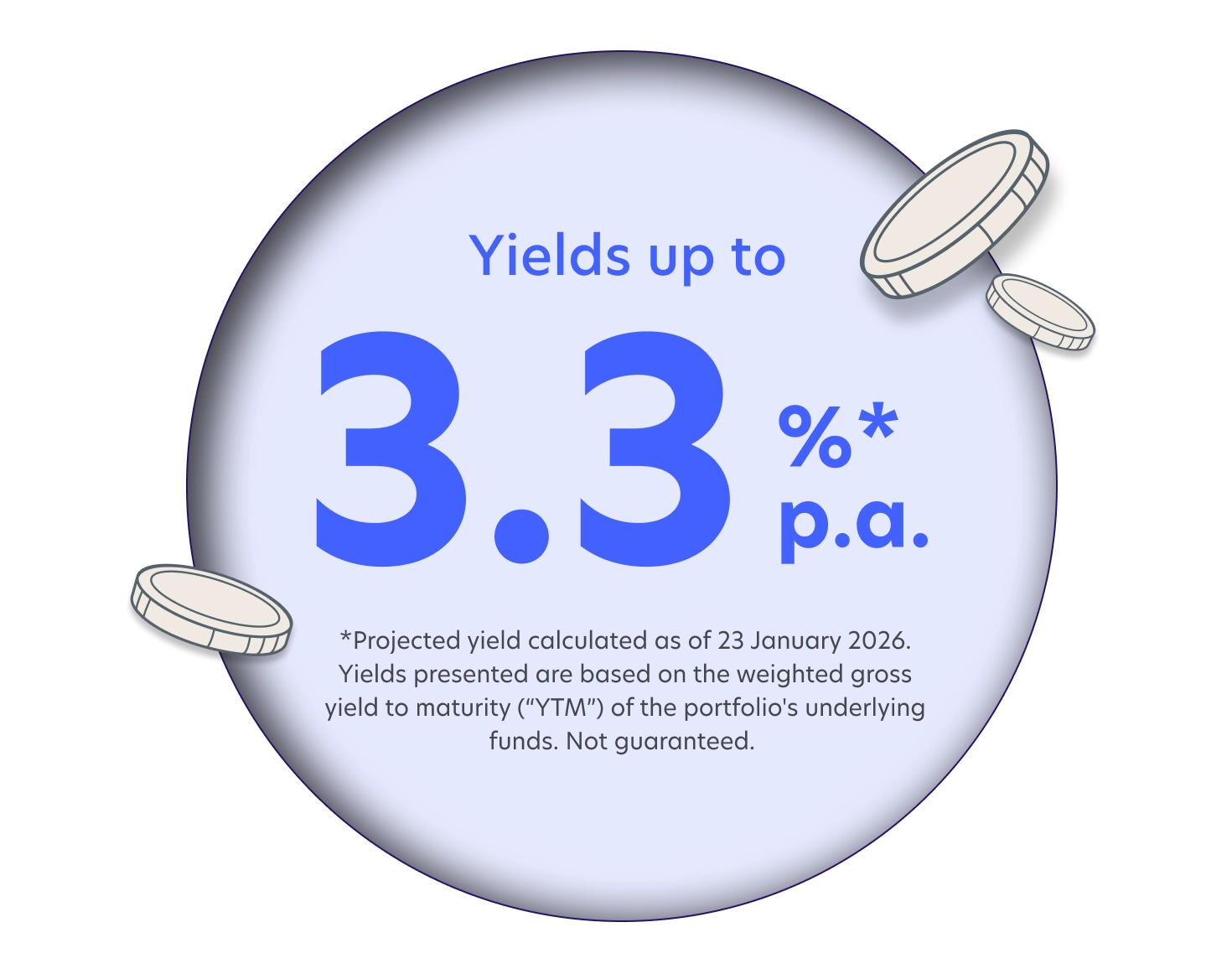

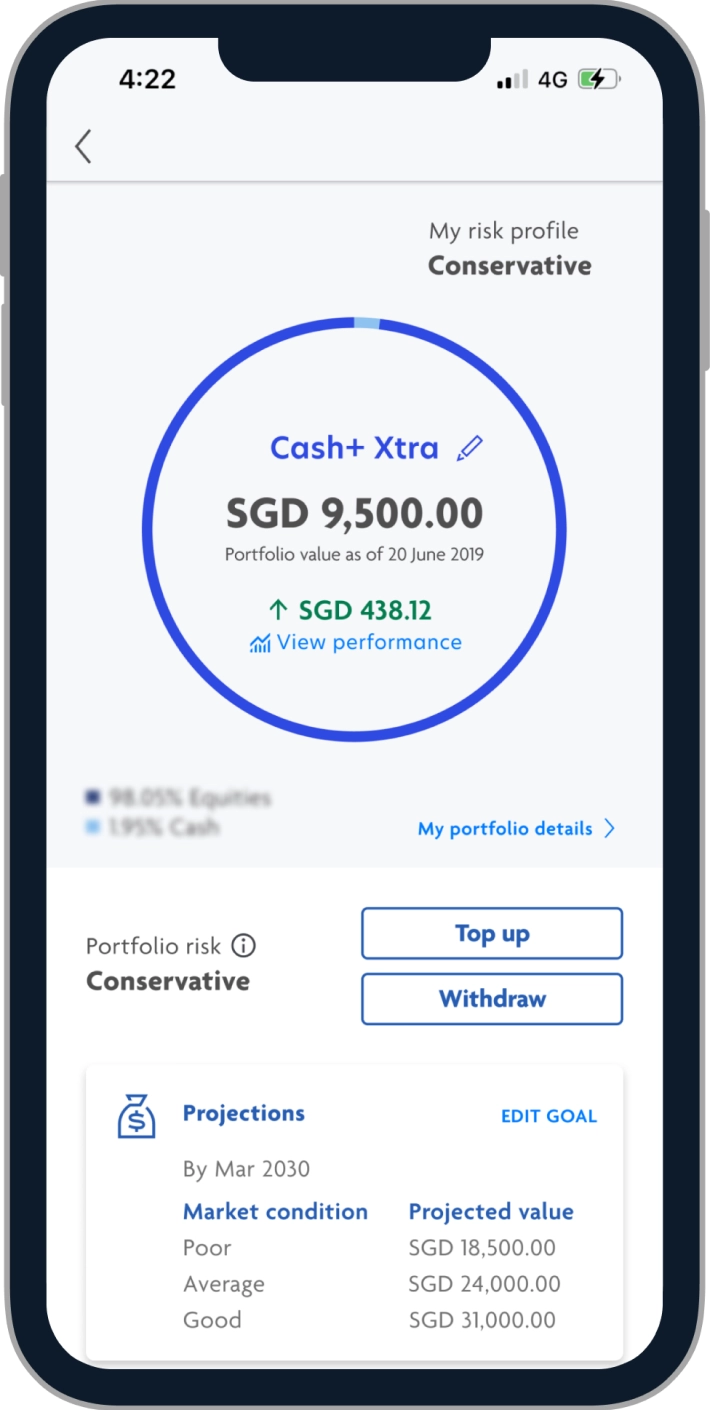

Money market funds and very short-term bonds are currently providing some of the best interest rates we have experienced in quite some time. This is a significant turn from the near-zero rates seen since the great Financial Crisis. Investors now have a prime opportunity to move cash from low-yielding savings accounts into these options, which present the chance to earn potentially higher returns with very low risk.

Dharmo Soejanto — Chief Investment Strategist, UOB Asset Management Digital Solutions