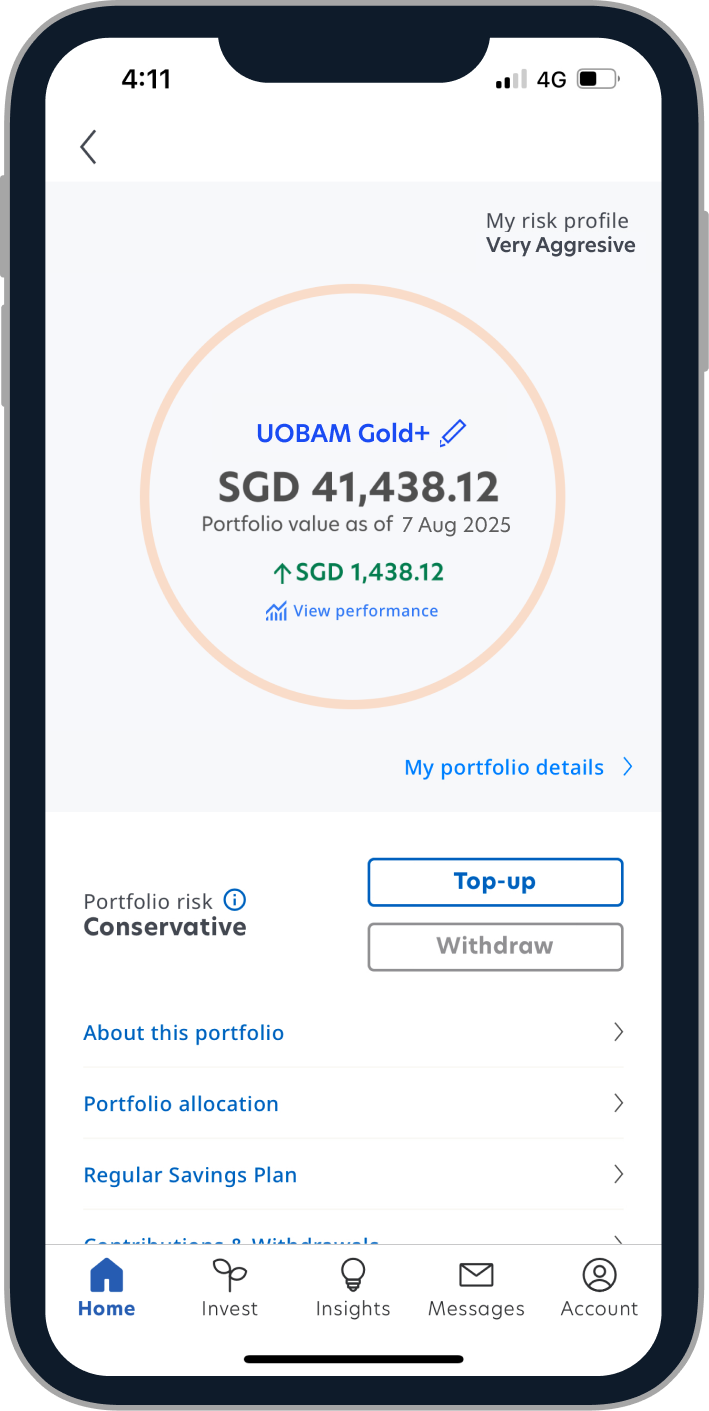

Gold+ portfolio: The best of both worlds

The portfolio holds physical gold and global-mining stocks in equal weights

SPDR Gold MiniShares Trust ETF

(NYSE Arca: GLDM)

Physical gold

Offers direct, low-cost exposure to the price of physical gold.

Gold ETFs offer a simpler and safer way to invest in physical gold without the hassle of dealing with storage and security.

GLDM stores its gold in secure vaults maintained by custodians ICBC Standard Bank and JPMorgan Chase Bank, ensuring institutional-grade protection and traceability.

United Gold & General Fund

(Class A SGD Acc)

Global-mining stocks

The Fund provides diversified exposure to gold and commodity mining companies, with a substantial allocation to leading gold miners such as:

- Gold Fields Ltd

- Northern Star Resources Ltd

- Newmont Corp

Cash

Gold+ portfolio underlying funds allocation. The portfolio maintains a 2% strategic cash allocation.

Source: UOBAM, as of 19 January 2026