“UOB Asset Management believes that successful exploitation of mispricing in securities is uncovered through intensive and independent fundamental research. Hence, we adopt a bottom-up, fundamentally-driven structured team-based approach, ensuring consistent performance.”

Mr Thio Boon Kiat

Group Chief Executive Officer

UOB Asset Management

Our Investment Capabilities

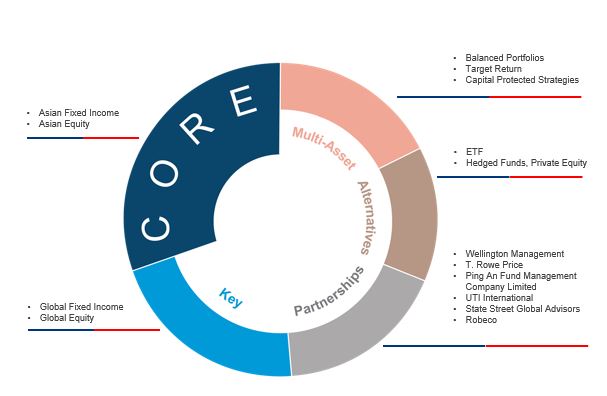

We have a team of more than 90 investment professionals located in Singapore and the region, conducting independent and rigorous fundamental research within a proven investment framework and process. Our investment capabilities can be summarised as:

Our strong Equities and Fixed Income capabilities form the building blocks for our Multi-Asset investment team. In addition, we have formed partnerships to complement our core capabilities and also to provide investors with access to Alternative Investment assets.

We have two main groups of investment products catering to different customer segments. Retail clients can invest in our Unit Trusts, which range from equities, fixed income, multi-asset to exchange-traded funds. We also customise investment management solutions and provide institutional investors with segregated accounts to meet their varying investment objectives.