Key Points

- US stocks experience worst broad declines since January on Fed pivot

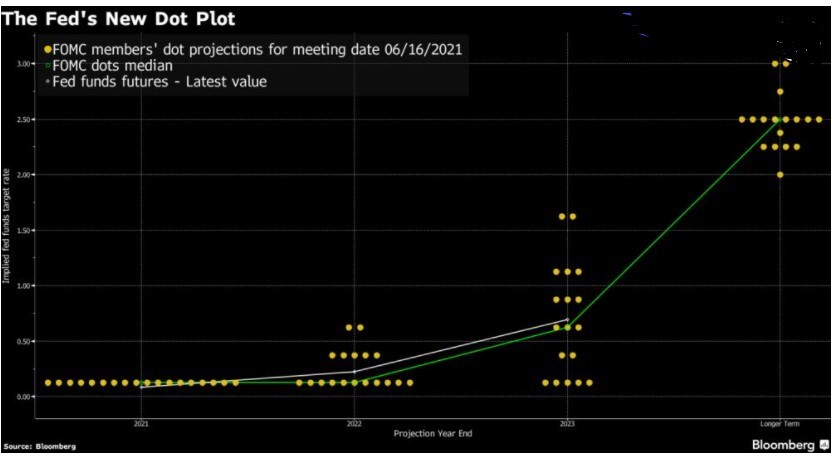

- Investors see end of peak dovishness from Fed policymakers

- US rates hike window moved forward to 2023, may be even late 2022

Major US indices ended the week (14-18 June) lower across the board in what was the worst week of decline this year with the blue chip Dow giving up 3.5%, the S&P 500 closing 1.9% lower with 11 of the S&P sectors declining, led by financials, energy and materials while the tech-heavy Nasdaq dipped 0.2%.

It was a U-turn from a week earlier (7-11 June) when investors shrugged off inflation concerns and this after comments from the US Fed took centre stage when the central bank signalled it may raise interest rates in 2023 with two projected rate hikes while raising projected inflation for the year.

Both the Dow and S&P 500 stumbled to their week’s low late Friday with the Dow shedding 533.37 points after the St. Louis Fed President Jim Bullard said the first rate hike might even come in late 2022. But whether it is the Fed being ‘hawkish’ or ‘less dovish,’ it was seen as the ‘end of peak Fed dovishness.’

Source: Bloomberg

That meant that the free-flowing liquidity flow from loose monetary policies which has kept interest rates low to propel US recovery from the pandemic and hence buoyed equities will be tightened – albeit gradually though the immediate market reaction appeared to be one of the Fed already tapering when some commentators have put it as “talk about talk of tapering.”

There is also fear among some investors that it will take the steam out of economic growth once policy tightening takes place earlier than expected in efforts to cool inflationary pressures.

Which explains why the wind was taken out of the sails for reflation trades – value and cyclical stocks – and in particular those deemed more sensitive to interest rates and why the small-cap Russell 2000 index saw its heaviest weekly loss since late January by more than 4%, while declines in growth including techs were more muted in response.

US long-term bond prices had meanwhile rallied with yield for the 10-year ending the week at 1.44% from trading as high as 1.59% during the week as investors viewed the earlier-than-expected projections of a US rate rise as a sign of the Fed’s willingness to manage inflation.

That also lifted the US dollar which saw its best week since April 2020 while gold seen as an inflation hedge and moves inversely to the greenback dipped more than 6% to $1,764 on Friday for its largest weekly decline since March 2020.

While the Fed’s ‘pivot’ was not entirely unexpected – it does have to come at some point once economic growth rates push nearer to peak – part of the market weaknesses could be attributed to an unwinding of positions (including those that are more speculative than fundamentals such as in commodities), it does lead to a reset in global financial markets by signalling that a loose policy is not a given with the door open to future rate hikes.

Which also means that going forward, markets will be looking even more closely at the Fed’s bond monthly purchases at $120 billion or in excess of $1 trillion a year, which has fueled the liquidity and hence market buoyancy even though the Fed chair Jerome Powell did also say that the Fed’s inflation forecast is by no means for certain.

For some investors, it does also clear the wall of worries that the Fed was behind the curve by being complacent on how it views inflation.

The inflation watch will continue this week with the release of US home sales, jobless claims, consumer sentiments, manufacturing and services PMIs and personal consumption expenditures (PCE) figures while more Fed officials will be making their comments with Mr Powell addressing the US Congress on the US economy and the progress from pandemic programmes.

The small sidestep by the Fed will likely see the tug-of-war in rotational plays between growth and value shift slightly in favour of growth at least in the US. Elsewhere in Europe, there is still room for pick-ups in cyclicals like autos and services due to further reopening of economies as vaccination rollouts expand.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.