Key Highlights

- Previously sanguine US and European equity markets have turned more volatile

- Mounting tensions may prompt investors to seek more “flight to quality” options

- Prolonged sanctions could have growth implications for Europe and the rest of the world

Markets are not unduly worried...yet

Political leaders from the UK, France, Germany, Turkey, Poland and the Netherlands have all made their way to Kyiv this week to deliver promises of support. Meanwhile, over in the US, the Biden administration is busy preparing its response to a Russian attack amid the massing of Russian troops on Ukraine’s borders – now estimated at 150,000.

Despite the heightened diplomacy, the world is still left guessing as to when, or even whether, hostilities will ensue. The week started with warnings of an imminent Russian invasion, followed by unconfirmed reports of a partial troop withdrawal. Markets have responded with a mix of fear and hope, and it is clear that the Russian-Ukraine crisis is now top of the agenda for equity investors.

But while we are experiencing considerably higher volatility, even within European markets, levels are not much lower than at the start of the year. The market inclination seems to be to follow the playbook set down by Russian incursions into Georgia and Crimea. In these two cases, sell-offs while severe, were confined to the Russian and directly-affected equity markets. Negative price action elsewhere was limited and many investors are no doubt keeping their fingers crossed that the same holds true this time around.

Sanctions would bite

However, as we have highlighted previously, even in the absence of a full scale military conflict, long term sanctions can be expected to take a toll on European and global growth. The latest spike in oil, gas and metal prices give a taste of this. Russia is a major producer of metals including aluminium, nickel, copper and palladium and of course, oil and gas.

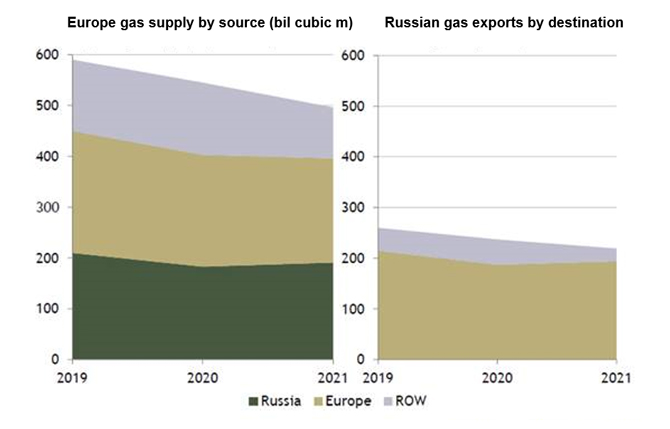

Given this, it is perhaps not surprising that Brent crude prices crossed the US$96 per barrel mark this week, the highest level in almost a decade. European natural gas prices are around 90 Eur/MWh, and have actually fallen over the past month due to warmer weather and an influx of imports. However, EU storage inventories are at record lows, and any disruption in gas supplies can be expected to cause higher risk premiums and price volatility, especially given European dependence on Russian imports. This impact would be greatly exacerbated by sanctions on Russia’s Nord Stream 2 pipeline, if this happens, and could mean a drying up of supplies over an indefinite period.

Figure 1: Europe is highly dependent on Russian gas imports

Source: ASR Ltd. / Peterson Institute

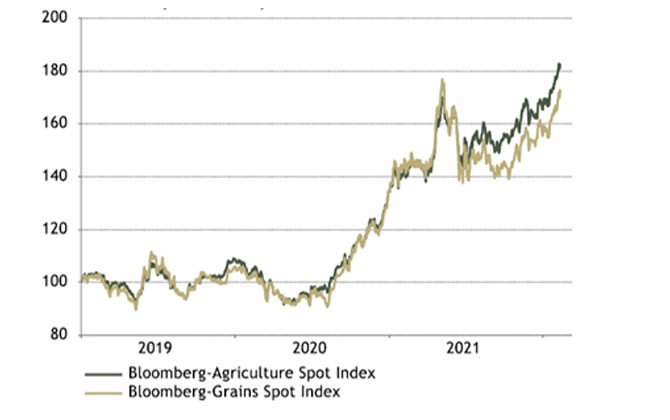

In addition, Russia is the largest exporter of wheat globally, while Ukraine is also an important agricultural producer. War or economic sanctions would deepen global food shortages and likely intensify the inflationary impact of existing supply disruptions. Emerging market countries are most vulnerable to this shock. Most are already forced to pay higher food prices, and a strong response can be expected from EM central banks at a time when post-Covid recoveries are still in the works.

Figure 2: Markets are expecting agricultural prices to spike

Agriculture and Grains Spot Price Index (Jan 2019 = 100)

Source: ASR Ltd. / Refinitiv Datastream

Flight to quality

However, depending on the length and nature of the Russian attack, and the sanctions and military actions taken in response, it is Europe that is most likely to be at the forefront of a global growth slowdown.

European markets had previously begun to price in an extended cycle of rate normalization. Should tensions escalate, and in the event that European assets come under significant selling pressure, the European Central Bank (ECB) will likely find it difficult to hike rates. Under such circumstances, Europe could well face a stagflation scenario where both the growth and inflation outlooks are adversely impacted, paving the way for the EUR to return at least to January levels.

Conversely, given that the US is less affected from both a geographical and economic sense, the USD can be expected to benefit. This is especially so when we consider that the EUR makes up 60 percent of the dollar index and the USD is traditionally a safe-haven currency, as is the JPY. Other assets such as US Treasuries and gold also stand to benefit from this flight-to-quality. Meanwhile, oil prices spiking above $100 - barring any response from OPEC – would not be a surprise.

Risks have increased but war not our base case

UOBAM analysts’ base case is that a full-scale Russian invasion is unlikely, and we would maintain that the severe consequences associated with economic sanctions and fatalities are sufficient to deter any major action. Russian hopes of a repeat of the Crimea takeover in 2014 are also unlikely to materialize, given that the Ukrainian population is far less pro-Russia.

That said, the risks have increased at the margins and we cannot rule out the possibility that current Russian posturing could spill over into a new global war. We are continuing to closely monitor the situation and are on the lookout for negative impacts on investor sentiment and global financial conditions, regardless whether a Russia attack becomes a reality.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.