Low Soo Fang, Portfolio Manager

The tide is turning in Singapore

This decade has seen global small and mid-cap stocks lag behind large caps, despite the traditional wisdom that smaller caps tend to outperform over the long term. Singapore was no different. To date, the top 5 percent of Singapore’s 600 listed stocks accounts for about 80 percent of the market capitalisation and the lion’s share of institutional fund flows.

However, several key initiatives designed to revitalise the Singapore small/mid cap sector are starting to reverse this trend. The most important of these is the roll-out of the Equity Market Development Programme (EQDP). So far S$3.95 billion of the S$5.0 billion earmarked for the programme has been awarded to nine asset managers.

As a result of the increased visibility, small and mid-cap stocks are seeing significant gains. The iEdge Singapore Next 50 index, which tracks the 50 next biggest stocks beyond the STI’s 30, rose just 7.0 percent from 2020 to 2024, but has spiked up about 25 percent so far this year, beating the STI’s 21 percent rise.

The Singapore Exchange points out that typically-conservative institutional investors are starting to recognize the virtues of small/mid cap companies. On an absolute basis, mid-cap stock City Developments saw the largest net institutional inflow in the three months from July to September 2025. If measured as a percentage of their market capitalisation, small-cap stocks Advanced Holdings and LHT Holdings were also top recipients of institutional net flows during that period.

A virtuous cycle in the mid-cap space

Of course, the question is whether this turnaround is just a flash in the pan. Our view is that smaller cap stocks beyond those in the STI will continue to appeal to investors over the long term, given the following factors:

- Dividend-focused

Unlike the STI, where financial stocks make up more than half of its market cap, Singapore’s mid-cap sector is dominated by Real Estate investment Trusts (REITs). Currently, the REITs sector accounts for 43 per cent of the iEdge Singapore Next 50 index. This helps the index to achieve relative price stability and an attractive average dividend yield of close to 5 percent, features that are highly sought after by institutional and retail investors alike. - Value creation

In today’s tech-driven world, medium-sized companies are in a sweet spot – they offer more agility and therefore faster innovation than the big boys, yet have more established products, higher liquidity and higher valuations than the small players.

Notably, Singapore mainboard IPOs, mainly of mid-sized companies, are seeing a dramatic rise in investor participation. After nearly two years of zero mainboard listings, there has been five since July this year. The NTT DC Reit IPO raised close to S$1 billion, and was 4.6 times subscribed. Given this healthy interest, SGX says that there are about 15 more mainboard listings in the pipeline.

Over the near to medium term, we expect a more diverse crop of IPO listings especially in new economies such as biotech and AI-related sectors. This should also help expand the breadth and depth of the mid-cap sector. - Improved corporate engagements

Amongst the MAS Equities Market Review Group’s final report recommendations are measures that will be particularly beneficial to mid-sized firms, including enhanced research coverage of Singapore-listed firms and increased shareholder engagement. Unlike blue chip companies with already well-established reputations, these measures will likely foster greater investor confidence in mid-cap stocks, especially those within the iEdge Singapore Next 50 index.

About the United Singapore Growth Fund (the “Fund”)

- Objective

To achieve medium to long term capital appreciation and to receive regular income distributions during the investment period through investing in shares of companies listed or quoted on the Singapore Exchange (SGX).

Manager comments: In general, the Fund is style agnostic and invests across all market caps and sectors, based on fundamental bottom-up research. However, we note that small and especially mid-caps have outperformed Singapore large caps year-to-date for the reasons detailed above. Looking ahead, we expect the sector to see continued interest and increased visibility as EQDP gains further traction. - Performance

Cumulative Performance (%) Annualised Performance (%) 1 M 1 Y 3 Y 5 Y 10 Y United Singapore Growth Fund 3.54 28.29 17.23 16.54 7.71 Benchmark 3.04 30.59 18.56 17.85 8.64

Source: Morningstar, as of 31 October 2025. | Benchmark: FTSE Straits Times Index | Fund performance is calculated on a NAV to NAV basis, in SGD terms. Past performance is not necessarily indicative of future performance. | Does not include the effect of the current subscription fee that is charged, which an investor might or might not pay.

Manager Comments: Over the past three years, the Fund has returned a healthy 17.2 percent per annum. The Fund slightly lags the index because of its generally lower risk profile. The Fund’s three-year average volatility is 8.9 compared to the Straits Times Index’s 9.1 percent . In coming years, we expect an increased allocation to mid-caps to add to the Fund’s potential for capital growth and dividends without a corresponding increase in volatility. - Sector Allocation

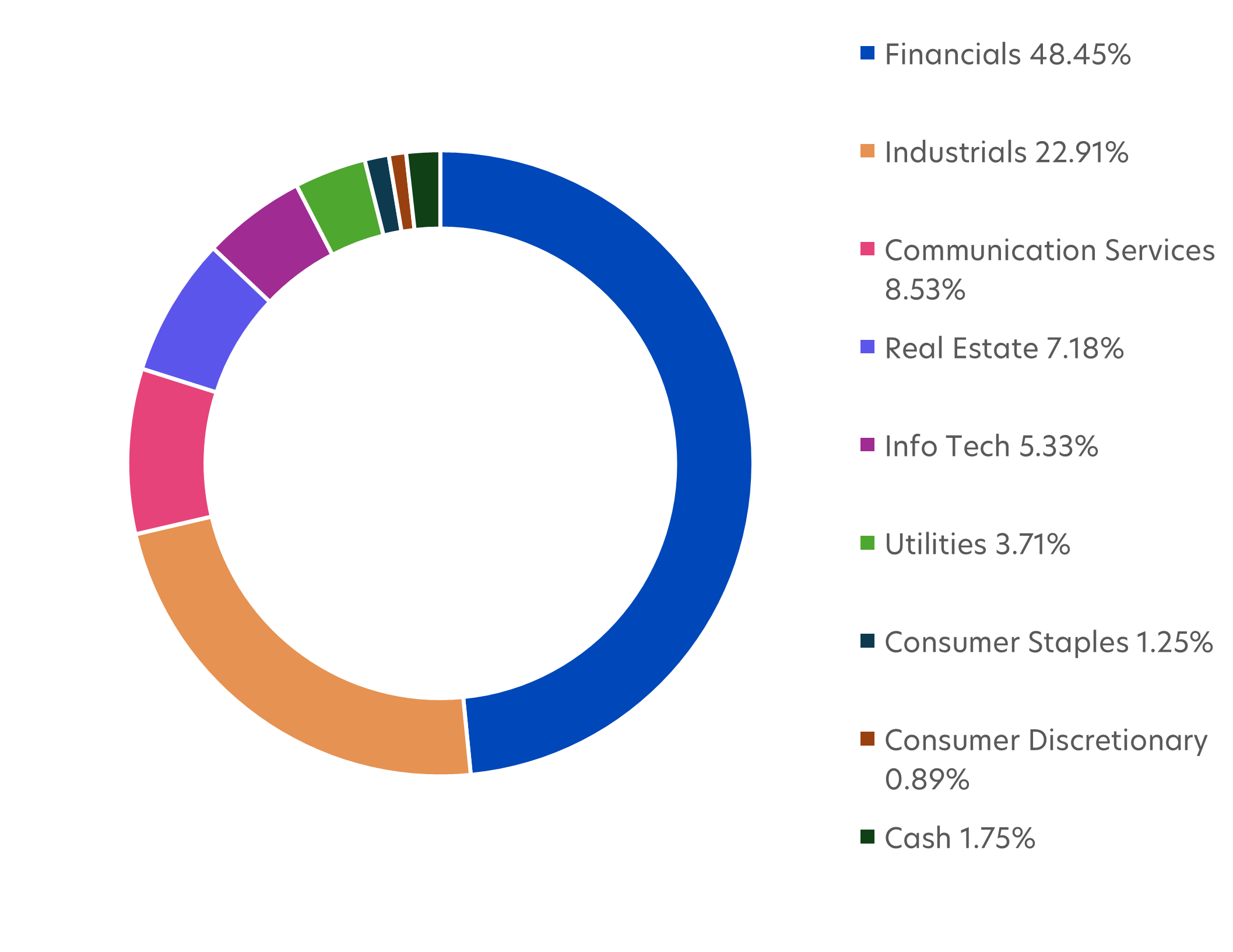

Source: UOBAM, as of 31 Oct 2025

Manager comments: We have been increasing the Fund’s exposure to selective mid and small caps stocks. Our allocation to this sector currently ranges between 15 – 20 percent, compared to around 10 -15 percent last year.

- Top 10 Holdings

Name Weight (%) DBS Group Holdings 21.91 Oversea-Chinese Banking Corp 12.17 Singapore Telecommunications 8.53 United Overseas Bank 7.41 Keppel 6.93 Singapore Exchange 4.82 Singapore Technologies Engineering 4.55 Sembcorp Industries 3.71 Yangzijiang Shipbuilding Holdings 3.22 Capitaland Integrated Commercial Trust 2.47

Source: UOBAM, as of 31 Oct 2025

Manager comments: We are particularly optimistic about the following sectors:

- Consumer Staples – We find potential in stocks with stable cash flow generation such as Food Empire with its market share leadership in the 3-in-1 instant coffee mix space. Our pick on upstream crude palm oil producer First Resources is premised on our bullish view on CPO (crude palm oil) prices and its improving profitability, which has contributed to strong performance.

- Technology – We see opportunities in the technology services segment e.g. CSE Global which is an integrated systems solutions provider riding on US data centre growth narrative. We also like selective tech players which are well positioned to benefit from the global semiconductor upcycle on the back of rising AI adoption.

- Real estate/REITs – We are constructive on the REITs sector, particularly selective mid-cap REITs trading at attractive valuations such as Lendlease REIT, which has performed well on the back of a more active capital recycling plan.

Fund Details

| United Singapore Growth Fund, as of 31 October 2025 | |

| Investment objective | The investment objective of the Fund is to achieve medium to long term capital appreciation and to receive regular income distributions during the investment period through investing in shares of companies listed or quoted on Singapore Exchange Securities Trading Limited ("SGX-ST"). |

| Top 5 sector allocation (%) | Financials: 48.45 Industrials: 22.91 Communication Services: 8.53 Real Estate: 7.18 Information Technology: 5.33 |

| Management fee | 1.00% p.a. |

| Subscription fee | Up to 5% p.a. |

| Minimum subscription / trading size | S$1000 (initial); S$500 (subsequent) |

1Source: UOBAM, as of 31 Oct 2025

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z