Key highlights

- Rising bond yields may cause wobbles in stocks though historically equities outperform when real yields are low

- Central banks led by the US Fed inclined to keep yields from rising too fast

- Value stocks tend to outperform their inflated growth counterparts in a recovery phase

- Tech enabling companies offer long-term investment opportunities

Q&A with Paul Ho, Senior Director, Asia Equities (PH) and Choo Chian, Director, Multi-Asset Strategy (CC)

Q: Tech stocks have been under pressure giving up a lot of their gains since the beginning of the year amid rising bond yields. There had been such precedents in past cycles in the late 1990s and 2000 which led to market corrections. Do you see similar patterns or any differences this time round that will not lead to similar corrections? Why so?

PH: Tech stocks have done tremendously well and outperformed the market by a wide margin. Given that it has gone up so much in such a short period of time, it is not unusual to see a pullback in their stock prices. The catalyst for the near-term correction was likely from rising bond yields over the same period.

However, when we look at the fundamentals in the tech sector, especially in the semiconductor industry, we see very strong underlying demand underpinned by big structural growth trends such as demand from artificial intelligence (AI), electric vehicles (EVs) and 5G. These growth sectors have not shown any signs of slowing and were in fact accelerated by the onset of the Covid-19 pandemic. Unlike previous tech cycles, we see severe supply side constraint stemming primarily from discipline in capital expenditure that was born out of the lessons learnt in the previous cycles. At this point in time, we still don’t see any definitive signs of a cyclical downturn. Having said that, we are aware that this upcycle has already gone on for an extended period and it pays for investors like ourselves to be prudent when we manage our positions and to monitor the data closely.

Q: How do the price earnings (PEs) and other yardsticks for performance compare now to those in previous up and correction cycles?

PH: There is no doubt by conventional valuation yardsticks such as PE, many stocks are trading at historical high multiples. However, it is worth pointing out that one of the biggest debate this cycle has been whether traditional valuation yardsticks like PE is the appropriate way to measure the value of a company like US EV maker Tesla or the Singapore Internet and mobile platform company, SEA Ltd. Unlike traditional businesses, these new hyper-growth companies are currently loss-making and is expected to make losses in the foreseeable future. The investment case for these growth companies often rest on the case that they are sacrificing short-term profits to scale up their businesses quickly (like Amazon for instance in the past) and in so doing keep potential new entrants out. Traditional fund managers and analysts have therefore been challenged in many ways by the significant outperformance of these growth stocks. There are no easy answers to the questions and as they say in the industry, performance speaks for itself. As fund managers, we have the rather difficult task of balancing valuations and managing risks while managing client portfolio on a daily basis.

Q: With the rollouts of vaccine and improvement on the pandemic and jobs front, do you see some of the more accommodative policies from central banks unwinding that will lead to a cool-off in sentiments for equities? (A few countries such as Brazil, Russia and Turkey for instance have already raised their interest rates).

PH: The fact of the matter is that despite the vaccine rollout plans announced in various countries, progress has mostly been slow in most countries due to supply shortages and logistic issues. It is too early to talk about the unwinding of accommodative policies at this point. In fact, the deflationary impact of Covid-19 is still felt by many countries, for example Japan and even Singapore. Many businesses in some countries are still struggling to survive and unemployment remains an issue.

CC: While the accommodative monetary policy in terms of central bank asset purchases would eventually taper off as economic recovery gains traction, fiscal policies have remained expansionary which will continue to be a tailwind for equities as they will be supportive of growth. US packages to date amount to more than $5 trillion with another $3 trillion being tabled by the Democrat-controlled Congress while over in Europe, the disbursement of roughly EUR 900 billion in EU funds to member states is expected to start in Q2 2021. Meanwhile, inflation in the Eurozone and Japan continues to stuck at low levels. In fact, their structural disinflationary problems appear to have become more entrenched in 2020.

Q: What do you think is the current stance of central banks towards rising yields with US Treasuries pretty much back to pre-pandemic levels – what is the outlook for high-yield and sovereign bonds?

CC: While the rise in yields has been spurred by concerns over inflation as economies reopen and pent-up demand surges, it should be noted that inflation by and large has been noticeably absent since the onset of the pandemic. That is despite initial worries that loose monetary policies and zero-interest rates would lead to runaway prices. Central bankers have also signalled that higher-than-average inflation is not necessarily a prelude to any rate hikes as governments are unlikely to risk any stalling in economic recovery amid concerns over renewed virus outbreaks.

The US Fed for instance has switched to the new average inflation targeting (AIT) framework would mean a slower pace of tightening. As the Fed chair, Jerome Powell has said on numerous occasions that US full employment is a priority in the path towards recovery and the Fed will resist any impulse for rate hikes and will tolerate inflation above 2% for a longer period than previously until economic growth shows sustained improvement and the employment goals are met. In its March FOMC meeting, the Fed had stressed that the risk of doing ‘too little’ supersedes the risk of ‘overdoing.’ In short, inflationary pressures could build but that will not deter central banks from their low-rate commitments especially when they have tools at their disposal and are inclined to keep bond yields from rising excessively.

In view of the Fed’s dovish stance, we are overweight in high-yield credit and underweight in sovereign bonds. High yield credits tend to have a higher correlation with equities than with interest rates. Looking ahead, the combination of the continued ‘search-for-yield’ phenomenon and improving macro-fundamentals through 2021 should fuel spread compression (as debt defaults continue to decline) for both global and Asian high yield assets. As for sovereign bonds, with prices close to record highs and economic activities expected to pick up sharply in 2021, the focus will be on inflationary risks in the next phase of recovery due to pent-up demand in consumer spending, creation of small businesses and relaxation of loan requirements.

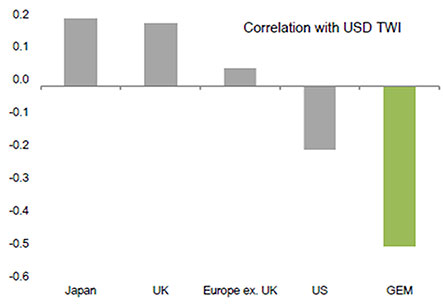

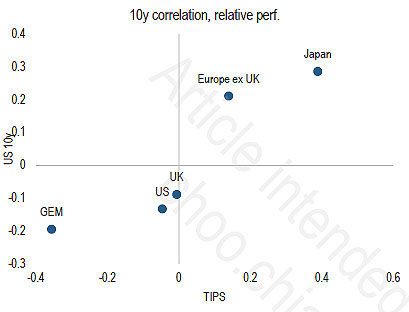

Q: How will the strength or weakness in the US dollar affect market performances, especially emerging economies which includes China?

CC: The continued strength in the US dollar would be a headwind for emerging market (EM) economies. EM equities tend to be hit when the dollar rallies and when US Treasury yields rise. Indeed, we have noted that the US dollar has surprised on the upside off the back of improving US macroeconomic fundamentals. For example, the Bloomberg consensus of economists had projected US GDP growth to be 3.8% in December but that figure has risen to 4.8% by end February while the US Fed has said in its March guidance report that it expects growth to be between 5.8% and 6.6% for 2021. Even while the macroeconomic fundamentals for most EM economies such as China remain healthy, EM market performances will likely lag that of the US, especially if the American economy grows as fast (if not faster) as some of the large EM economies.

| Chart: A strengthening USD dollar tends to be negative for global emerging market (GEM) equities TWI: Trade weighted US dollar index) |

Chart: Rising US bond yields/ TIPs tend to be negative for GEM equities (TIPS: Treasury Inflation-Protected Securities which provide protection against inflation) |

|

|

| Source: Credit Suisse | Source: Credit Suisse |

Q: Given some of the generous fiscal packages during the pandemic, do you see governments raising taxes and how would that be a factor in how markets will react?

CC: The prospects of the government raising taxes will be largely seen as macro headwind for equities. The proposed tax increases in the US by the Biden administration – statutory corporate tax rate on domestic income from 21% to 28%, partially reversing the cut from a rate of 35% passed in the 2017 Tax Cuts and Jobs Act – for instance will negatively impact earnings growth in 2022. The plan will also raise the tax rate on foreign income (also called the “GILTI” tax) by imposing a minimum corporate tax rate. Current consensus earnings growth for 2022 is slightly above 15% – but if the full scale of the proposed tax increases is implemented, the earnings growth rate for 2022 will dip to around 8.5%. Sector-wise, information technology, healthcare and communication services industries will bear the brunt of the negative earnings impact.

Q: Do you see 2021 as a year for value stocks to shine with growth stocks on the back foot as economies recover? Will the advances this year be more broad based?

PH: Given that value stocks have underperformed during the pandemic and that we are seeing signs of a gradual opening up of the economy, it is not hard to imagine these stocks doing well this year, at least in the near term with the resumption of normal economic activities. Other than that, there are also companies that will face fundamental issues over their lack of long-term growth prospects which was why they had underperformed in recent years, as well as those who will face stiff challenges if they fail to meet post-pandemic challenges, such as some of those in traditional fossil fuels.

CC: We expect the laggards from 2020 to rebound in 2021 and Asia to outperform in 2021 on the back of economic growth and pick-up in corporate earnings. Cyclical sectors should outperform as the economic recovery begins to spread progressively across the board. In the near term, growth stocks – being high duration assets – are underperforming the broad market as they have been adversely impacted by higher interest rates and a steeper government bond yield curve, especially out of the US. Conversely, high dividend equities, being short duration assets, have outperformed the broad market.

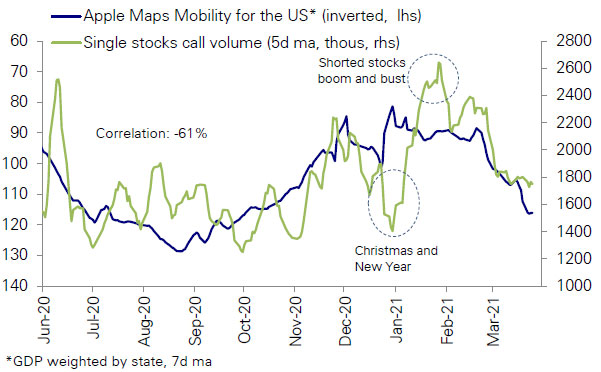

How much of a factor will the likes of retail investors in the Robinhood or GameStop Reddit ilk affect the trading environment?

PH: The retail phenomenon in markets is not new. They can and do historically impact stock prices in dramatic ways in small pockets of stocks. However, we have not seen any strong evidence so far that they will make a long lasting impact on the markets as a whole. However, when analysing individual stocks for potential inclusion in our portfolios, we certainly need to take into account this new factor – that of social media influencers – when assessing the risks of investing in any particular stocks going forward. It should be noted that retail trade volumes since mid-February have dipped since the pace of vaccine rollouts and the reopening of the US economy picked up with more workers heading back to their workplaces.

Chart: Decline in retail activity since mid-February has coincided with the rising pace of reopening

Source: Deutsche Bank

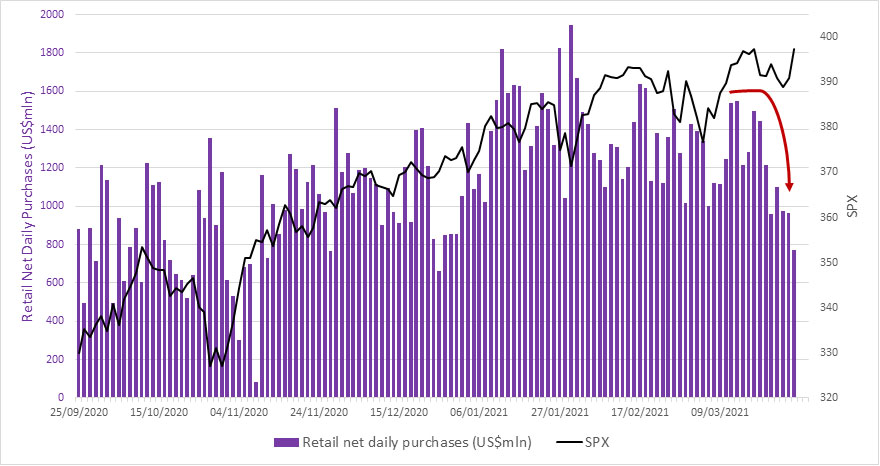

Chart: Noticeable dip in retail net buying in recent weeks

Source: VandaTrack

While tech stocks may have been on the retreat due to most of them having rich valuations, are there some segments which there are still room to grow due to structural shifts in how technology will become more ubiquitous (due to remote work practices, evolving fintech, e-payments)?

PH: We believe that many of the megatrends that we have highlighted in our various presentations and previous webinars are likely to persist for many years, if not decades to come. Some of the new technology have fundamentally changed the way we lead our lives. Just as mobile phones and the Internet had evolved and changed our lifestyles and consumption habits, it is very unlikely that consumers will revert to the old, less efficient payment systems or how we shop for instance. As lifestyles and habits change, the companies with these enabling technologies will gain market share from their traditional competitors stuck with offering legacy solutions. This is where we can find the long-term opportunities for investments in both developed and emerging economies. In the latter, we see further room to grow due to infrastructure upgrades and younger populations – especially in Asia – who are likely to be mobile and more tech-savvy.

Despite news of the widespread shortage of semiconductor chips as well as the increasingly adoption of electric vehicles (EVs) which employ chips, we have also seen stocks and ETFs in these and other innovation related sectors on the retreat. What gives? Is this the case of their potential and fundamentals (including stocks like TSMC, Samsung, Intel for example) already being priced in? Short-term profit taking? Or other concerns such as rising prices of commodities used for EVs and other reflation products?

PH: There’s a saying in the industry: “Nothing goes up in a straight line.”. So it is the case for the likes of the EV industry. Will these companies’ share prices see euphoria along the way? That’s for sure! Will these companies face issues as they grow? Most certainly! Should we stop investing in these sectors or companies because of that? We think the answer is “No”. However, it does mean that we have to navigate the short-term volatility in their share prices. Let’s take the case of Amazon; its share price had plummeted by more than 70% a couple of times in the past two decades. If investors had kept the faith and exercise risk management strategies, they would have been rewarded handsomely for their patience. In the same vein, the same approach may also apply to many of these new and promising industries and companies as they overcome teething issues, navigate the challenges along the way to becoming the next leaders in their pack like the Apple, Amazon, Alibaba of today.

The last commodity super cycle dated back to the emergence of the BRIC economies – Brazil, Russia, India, and China – who were then embarking on rapid industrialisation programmes that necessitated huge amounts of raw materials, energy commodities and even agricultural produce. That cycle cooled off with China’s slower growth from the double-digit growth in GDP and other interim crises. Are we currently yields looking at an upswing due to normalisation of the global economy or a new super cycle? If it’s the later, what are the new drivers and supporting factors?

PH: We believe that in the short term, the demand and supply conditions for many commodities look more favourable than they have for many years. This is due to a combination of surging demand from some of the megatrends we have talked about earlier (AI, EV) and supply bottlenecks caused by years of a lack of investment in the sectors due to low prices. And as the whole world moves back to the path of normalisation in economic activities amid proposed mega infrastructure plans – including those related to climate change and clean energy in the US under the Biden administration; China’s latest Five-Year Plan while 30% of the European Union’s fiscal stimulus of 1.8 trillion Euros will be directed to green initiatives – the commodities sector certainly deserves closer attention. There is also the emergence of a new market segment for metals such as cobalt, lithium and nickel for batteries in the transition to electric vehicles (EVs) with more American and European car manufacturers pledging to stop building vehicles with internal combustion engines by 2030 or 2035. The move to electrification will also lead to higher demand for copper used in EVs and charging stations and grid in the years to come. While it may still be early to say if this will be another one of the super cycles we have seen in the past, we will have to take it one step at a time from here though it has to be noted that while the Chinese economy is not expected to grow at the pace in the late 1990 and early 2000s, it is much larger in size.

What would be your advice for investors?

CC: Stay invested, even as some investors question whether financial markets may have run ahead of fundamentals or whether the rise in bond yields would derail the positive performance of risky assets. We think that we are in the first year of a period of strong recovery, and that the macro outlook continues to look positive. Historically, this is the part of the cycle when risky assets tend to perform best while low-risk assets are most likely to underperform. Thus we are overweight in equities and high-yield credits while underweighting government bonds and cash. Alternatives will benefit from strong alpha-generation opportunities while growth commodities will likely also see strong gains. We do not recommend holding cash with short-term rates remaining near zero.

Check out our Quarterly Investment Strategy for 2Q2021

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.