Key Highlights

- Markets rattle by speed of rise in bond yields sparking rotational shift into financials and cyclicals

- Expect volatility as investors adjust to reset in equity valuations and rising yields

- Use opportunity to review and adjust investment portfolios for better diversification

- Long-term growth in megatrends are on track

What’s behind concerns over rising bond yields?

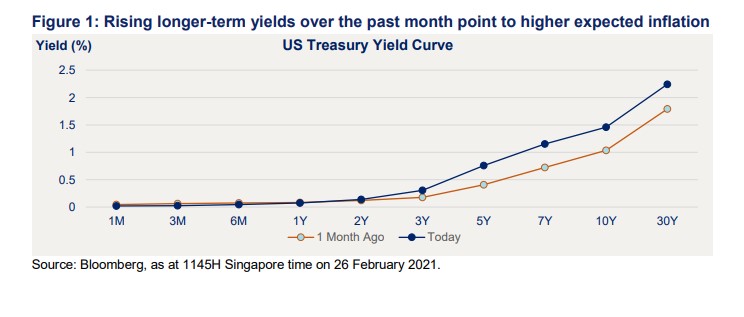

Investors have lately been looking nervously at 10-year US bond yields which had been rising – to as high as 1.6% last week vs 1.1% at the beginning of February – due to the improving outlook for US economic growth and expectations of the massive $1.9 trillion fiscal stimulus by the Democrat-controlled Congress.

Much of the rise can be attributed to accompanying fear of inflation once economies exit the pandemic as millions more over the world get vaccine jabs. Hence, the worries in some quarters that global central banks may reverse current loose market-supporting monetary policies or even hike interest rates if prices rise at a faster-than-expected pace.

High-growth technology companies, which have led the market’s rallies are seen to be more vulnerable to higher interest rates and inflation pressures which explain why stocks such as Apple and Tesla have borne the brunt of recent market retreats especially after US equities continued to advance by more than 10% since the start of the year.

As to fears of inflationary pressures, there are some signs of that in commodities – such as oil approaching the highest since 2018 while copper is at an almost 10-year high. The fact that US durable goods orders for January had risen by 3.4%, above an expected growth of 1.0% may had also led to the rise in yields alongside concerns over inflation from the next round of US stimulus.

Inflation likely to stay muted

Yields did however come off their last- week's highs after US Federal Reserve (Fed) Chair Jerome Powell pushed back against the idea that over-the-top inflation is coming despite overheating in some sectors.

He had reiterated in his views to the US Senate that inflation for now will likely stay muted given the fragile US economy. Any rises, he added, would likely be "transitory" noting that the US economy is a long way from the Fed’s employment and inflation goals.

US Fed officials have also said repeatedly they have adequate tools to address inflation concerns and have also noted that the continued weakness in the pandemic-scarred US economy mean that inflation risks are "weighted to the downside."

The Fed and the European Central Bank (ECB) have recently said that they do not see inflation as a near-term concern. Rather like the World Bank and International Monetary Fund (IMF), their views are that any premature withdrawal of coronavirus (COVID-19) support measures will be a bigger threat to the global economic recovery.

With the Fed shifting to average inflation targeting (AIT) or allowing for inflation to exceed 2.0% over sustained periods and Eurozone inflation still near-zero, central banks will likely continue to keep interest rates low to avoid derailing a global recovery.

More rotational shifts ahead

Looking ahead, expect investors to shift into so-called reopening trades which would be stocks of companies that would benefit most from vaccine rollouts. That explained why the US energy sector had gained more than 21% in February on expectations that consumers will be able to get back to regular activities like restaurant dining and air travel and in the post-pandemic return to normal.

In such a scenario, tech and growth stocks will likely be taking a backseat to cyclicals and value stocks like energy, industrials, materials and financials – after being the darlings of investors in the previous year under a low interest rates environment.

Expect more rotation into REITs, consumer staples, financials, and utilities. It should be noted that despite last week’s declines all the major US equity benchmarks ended February with modest gains. The S&P 500 was up 2.6%, the Dow by 3.2% while Nasdaq just short of 1%.

For bullish investors, the rise in bond yields is not viewed as negative for stocks as it has come on the back of good news in economic growth, stimulus and vaccine rollouts.

Do note that most investors still believe that a fresh stimulus deal and flattening Covid infections curves will lead markets higher – though some of it may already be priced in – especially tech high flyers while cyclicals and small caps still have room to advance.

For instance, more than half of global fund managers recently surveyed by the Bank of America are bullish on equities with 27% with just 13% who believed stocks were in a bubble. A UBS Global Wealth Management report noted that while Asian stocks had gained faster than their US counterparts this year, it expects a further 10% rise for the year as the macro momentum in Asia is in the early stage of recovery with conditions supportive of robust profits across sectors and regions.

However, do expect volatility ahead as markets adjust to the current rethinking in equities valuations while bond yields rebound from historic lows over the past year. That will likely set the tone for this week especially if stronger than expected economic data nudge yields higher.

UOBAM views on investment outlook

- We remain positive on equities this year and neutral to fixed income as we expect the global economy to rebound strongly after last year’s contraction due to vaccine rollouts paving the way to reopening of economies though global vaccination programmes will likely be uneven due to supply bottlenecks.

- In the near term within equities, we are positive towards Asia ex-Japan equities, particularly China, for its strong recovery and efforts to build on its domestic growth.

- We also like specific sectors that will benefit from economic reopening, such as US financial and consumer discretionary sectors in contrast to growth stocks particularly Big Techs which will face headwinds due to their rich valuations after strong rallies in 2020 on the back of abundant liquidity in a historically low interest rates environment and investors’ fear of missing out (FOMO).

- In fixed income, we continue to prefer Asian investment grade and high-yield bonds for their better risk-returns over government bonds.

- For longer-term growth, the outlook is on track for megatrend ideas such as Sustainability, Global Healthcare, Innovation, Artificial Intelligence (AI) and Electric Vehicles (EV).

What should investors do?

- Do not rush for the exit as the outlook for global equities remains positive

- Instead set aside ample cash to buy on opportunistic dips during market pullbacks

- Also make use of the current situation to review and adjust your portfolio to better diversify across asset classes through UOBAM’s global multi-asset strategies

- Investors looking for longer-term sustainable returns can look to ride on secular and megatrend growth.

- Consider investing in financial which are likely to benefit from the rising net interest margins (NIMs) as a result of higher long-term yields as well as consumer discretionary stocks which will benefit from higher consumption as the global economy recovers.

- Contact your UOB Advisor on possible courses of action in light of the latest market developments as well as longer investment trends.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.