- Tentative recovery for Deutsche Bank as markets swing between fear and hope

- The impact of higher interest rates on bank assets is causing uncertainty

- Concerns over the European banking sector appear to be overblown but future gains appear more limited

Market jitters continue

Even though Deutsche Bank stocks have regained almost all of their value, last week’s sell-down are a sign that banking sector worries continue to bubble away under the surface.

Coming in the wake of Credit Suisse’s buyout by UBS, Deutsche’s 5-year credit default swap (CDS) spreads had widened to levels not seen since 2019. CDS spreads are the cost of insuring against default risks, so this widening denotes increased investor nervousness.

The CDS spreads for other European banks also widened last week. In fact, since the start of the Silicon Valley Bank crisis, European equities have underperformed US equities, led by a larger decline in the financials sector.

European banks have high liquidity

This prompted German Chancellor Olaf Scholz and European Central Bank President, Christine Lagarde to issue reassurances that the EU banking system is stable and well capitalised.

We would agree that European banks are in much better shape since the 2007 - 2008 global financial crisis. Following the crisis, a host of requirements were put in place to avert a banking liquidity crisis, including annual stress testing and introduction of clearing houses to mitigate counterparty risks.

The enhanced regulatory framework has since significantly strengthened European banks, especially the bigger ones. We note that these large banks currently have substantial high quality liquid assets that can be readily exchanged for cash.

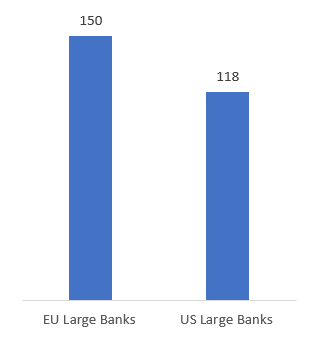

One measure of this is a bank’s liquidity coverage ratio (LCR), that is, its high quality assets as a percentage of estimated net cash outflows in stress situations. The median LCR for European big banks is at a healthy 150 percent, higher than the level for US banks. This makes a run on big European banks highly unlikely and indeed, this did not happen with either Credit Suisse or Deutsche Bank.

| Figure 1: Median Liquidity Coverage Ratio (%) |

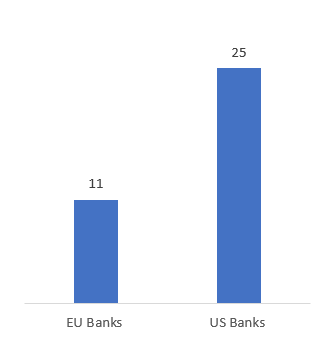

Figure 2: Securities as percentage of total assets (%) |

|

|

Source: Fitch/Bloomberg/UOBAM

Less exposure to securities and risky lending

Investors should also draw comfort from European banks’ limited exposure to invested securities. US banks have a quarter of their assets in securities such as bonds and stocks. In Europe, the figure is just 11 percent given stricter regulations on interest rate stress tests.

Meanwhile, some concerns have been raised regarding banks’ exposure to commercial real estate (CRE). Bank lending in this sector is under scrutiny as a CRE slump seems to be emerging. However, on average, CRE accounts for only about 10 percent of European bank lending, given the drive to diversify their lending risks in recent years. In comparison, 43 percent of US small banks’ lending book is in CRE1.

A rebound, but with constraints

These banking fundamentals suggest to us that current market corrections are temporary, and we would expect a near-term rebound amid continued volatility. It appears that investors are grappling with the larger uncertainties of inflation and interest rates, and banks are paying the price.

Nevertheless, once a clearer global economic picture emerges, there are reasons to think that European banks could start to underperform their US peers:

- The economic environment in Europe tends to be more dependent on global growth conditions than in the US. As such, European banks may see their earnings hit harder should we see a widespread slowdown.

- Europe is lagging the US in terms of its interest rate cycle. The ECB’s rate hikes have been slower and more gradual and core inflation appears not yet under control.

- While cheap relative to US banks, European banks have already received significant investment inflows and there may not be an incentive for investors to pick up more.

- Our research indicates that the US tends to outperform Europe once it becomes clear either that a US interest rate reversal or recession is underway.

The potential for a recovery of confidence in European banks suggest that investors may have the opportunity to take some profit, while seeking better opportunities elsewhere.

1ProActive, 24 Mar 2023 https://www.proactiveinvestors.co.uk/companies/news/1010194/banks-exposure-to-commercial-real-estate-is-red-flagged-by-analysts-1010194.html

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

Please note that the securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities.

UOB Asset Management Ltd. Company Reg. No. 198600120Z