Key Highlights

- Projected 95 million more EVs in China & Europe by 2030

- Asia is home to world’s biggest EV battery makers

- Commodities like nickel and copper to see rising demand

By Paul Ho, Senior Director, Asia Equities

The dizzy rise of Tesla shares on Wall Street has put the spotlight on electric vehicles (EVs) which is an idea whose time has finally come after so many years of false starts in the past. That’s especially after the pandemic and increasing concerns over the impact of climate change which have made consumers more conscious of the environment and their own personal consumption choices.

With the amount of carbon and other pollution associated with the burning of fossil fuel, it is no wonder that consumers are looking for cleaner mode of transportation. That has been made more feasible due to breakthroughs in battery technology which have made it possible for EVs to be more commercially viable at more acceptable prices.

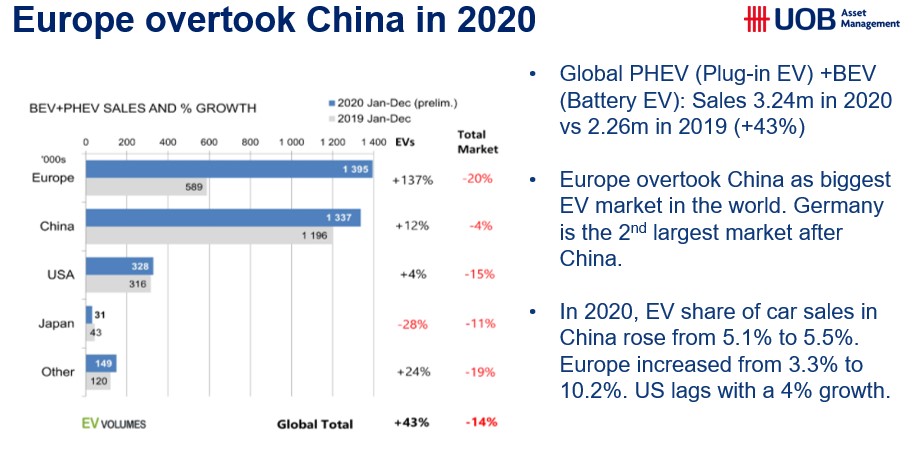

Global EV demand has seen exponential growth in the past few years. Despite the global slowdown due to the pandemic, global sales grew 43% to 3.24 million units in 2020. China and Europe are now the world’s largest EV markets with Europe overtaking China for the first time in 2020. The EV share of car sales in China had increased from 5.1% to 5.5%, and from 3.3% to 10.2% in Europe.

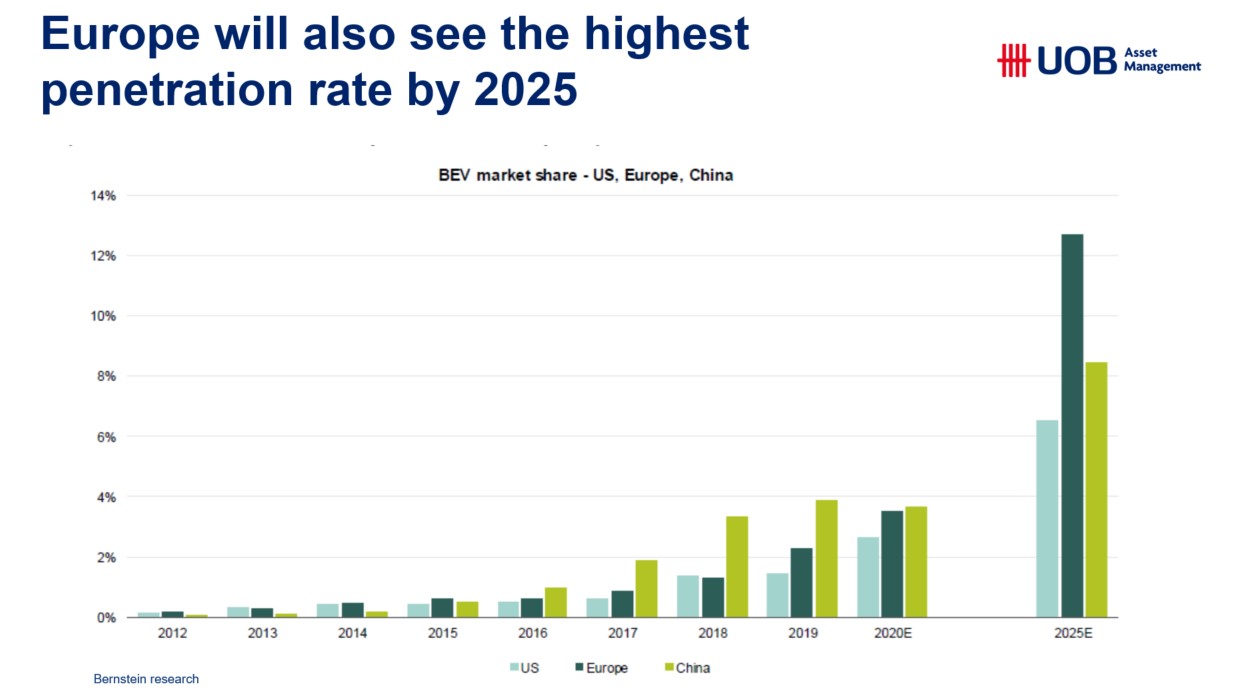

We expect Europe to outpace China due mainly to aggressive emission targets. To meet these targets, the European Union (EU) is expecting some 30 million EVs on their roads by 2030, representing a 20-fold growth over the decade. China has set itself a target of around 65 million EVs over the same period. With such big growth rates come great investment opportunities!

What to invest in?

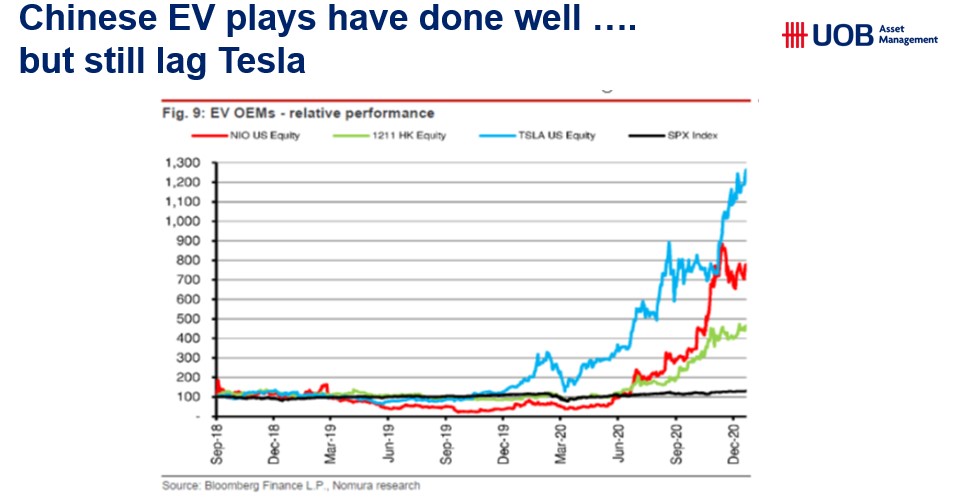

The most obvious choice would be EV manufacturers. Tesla which has been the forerunner had seen its share price rise by 18-fold in the past 5 years alone.

The question is who will be the Asian ‘Telsas’ who will share the highway lanes? Just like the Hondas and Toyotas who muscled their way onto American and European autobahns alongside the Fords, Chevaliers, Audis, BMWs, Fiats and Renaults in previous decades.

In China, three of the largest pure EV auto companies are already listed in the US: Nio, XPeng and Li Auto. Like Tesla, their past-year returns have also been spectacular. That is because investors view them as companies that ae likely to become dominant players in the auto market – not just in China, but globally.

With a combined market share at less than 2%, it is not hard to imagine the potential headroom for growth with sales gearing up to rise by 20 to 30 times over the next 10-15 years. Competition though will come not just from new EV players but also traditional automakers who will not be given up their positions in the auto arena so easily.

What powers EVs?

The next area where investors can participate is the EV supply chain – in other words, the suppliers of EV auto parts and components, much like chipmakers and other component parts for the manufacture of Apple or Huawei mobile phones.

The single largest component in the EV has to be the battery. Battery technology is currently still evolving with no fixed standards across the world, much like video players and mobile phone networks during their infancy.

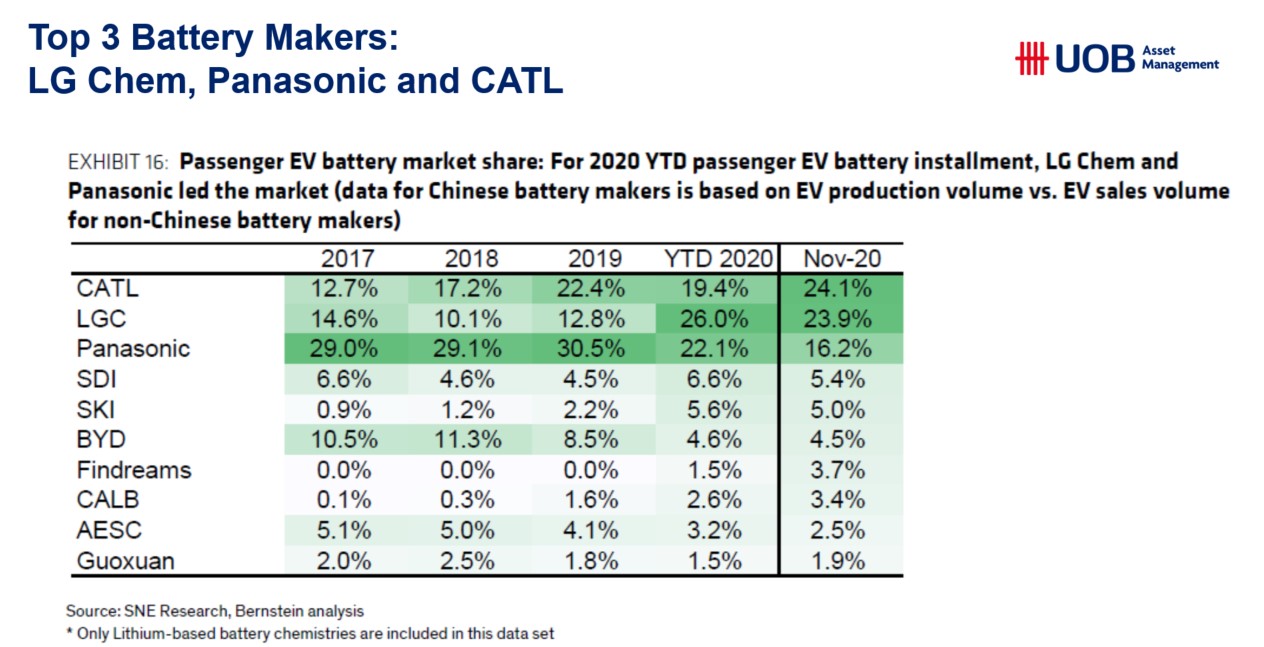

North American companies (mainly Tesla) use cylindrical batteries, whereas European auto companies prefer pouch type batteries. Chinese auto players, on the other hand, use prismatic batteries which have the advantage of being cheaper and a longer life but sacrifices on distances. Asian companies such as Panasonic (Japan), LG Chemical (Korea) and CATL (China) are the three largest EV battery makers globally which are all listed in Asia.

Boost to commodities

Last but not least, the tremendous growth of EVs will see rising demand for the raw materials, namely the commodities use to manufacture both EVs and batteries such as nickel, cobalt and copper which are likely to see drastic pick-ups in demand in the coming decade.

Class 1 Nickel, which is essential in EV batteries production is estimated to see a 24-fold increase in demand from current levels by 2030. The need for more charging stations and electricity grid upgrades for electrification of EV cars will also see copper demand climb from current levels.

Indonesia will likely be one of the biggest beneficiaries of this sharp increase in commodity demand over the next 10 years, with some of the world’s leading resource companies listed on its exchange.

Summing up

The rise of the EV sector is expected to cause much disruption in global auto markets over the next 10-20 years. New technology and business models are currently being tested which will likely see new names racing ahead of their competitors.

The ride over the next ahead may be fast-paced with curves and some speed bumps, but the long-term trends have been sign-posted. For the patient investor, it may be a case of several buses arriving en masse if you get the right combination to fuel your portfolio growth.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.