Key Highlights

- Chinese government intervention in developers’ debt restructuring is forthcoming

- This should help prevent any further deep dives in the Asia High Yield market

- However, we do not expect a significant near term reversal of market sentiment

Government involvement

Over the past few months, investors have been asking the question: will the Chinese government step in to save Evergrande and stabilise the market? Or will they take a hands-off approach and let the chips fall where they may?

The answer seems to be that the government is no longer prepared to risk economic instability. This week the Communist Party’s Politburo stated that the country’s economic decision-making for 2022 will “put the word of stability as the top priority”. At almost the same time, the government signalled their involvement in an Evergrande debt restructuring process, likely one of the biggest ever seen in the country’s history.

A risk committee has been announced, comprising the Evergrande management plus officials from Guangdong and several state-backed institutions. On the face of it, this committee is Evergrande focused, and will be seeking ways for the company to restructure its business and to deal with its US$ 300 billion in debt obligations, plus resolve the socially disruptive issue of millions of uncompleted apartments across hundreds of cities.

Liquidity challenges

But Evergrande is just one of many developers now facing a debt crunch, with at least 10 having already defaulted. According to Bloomberg, China’s developers face around US$ 1.3 billion of bond payments in December alone, with elevated bond maturities in the first half of 2022 compared to the second half of 2021.

These developer woes are exacerbated by the inability to raise fresh funds. Despite recent reports that the government is easing up on credit measures to boost liquidity, uncertainty reigns. As a result, debt issuances have now fallen two months in a row. To address its liquidity pressures, embattled property group Kaisa offered to exchange at least 95 percent of its USD 400 million 6.5 percent note, maturing December 7, for new notes with the same coupon maturing June 2023. But this offer has failed to garner sufficient support and the company now looks likely to join Evergrande in requiring debt restructuring.

Figure 1: China RRR Cuts vs JACI China Spreads

Source: UOBAM/Bloomberg

On the plus side, China’s central bank, the People Bank of China (PBOC) announced this week that it is cutting its reserve requirement ratio (RRR) for the second time this year. Starting December 15, the reduction of 0.5 percentage points for financial institutions releases interbank liquidity worth 1.2 trillion yuan (US$188 billion). The market expects some of this to flow into the property sector, thereby helping to stabilise Chinese high yield spreads. However, in our view, more RRR cuts such as those seen in 2018-2019 may be needed for spread tightening to be significant.

Asia impact

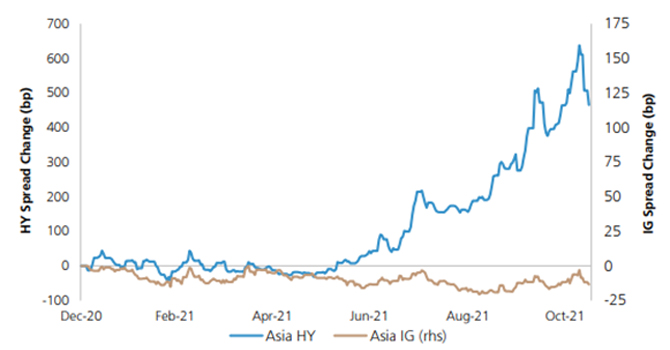

China’s property woes have had spillover effects on other Chinese high yield sectors, especially given rising inflation and the ongoing pandemic challenges. But as with other Chinese downward spirals, this one has dragged Asian high yields into its vortex. As a result, Asian high yield credits have underperformed their global counterparts. Month-to-date, the JP Morgan Non-Investment Grade Asia Credit Index (JACI) returned -0.16 percent and has fallen 10.35 percent since the start of the year.

Despite recent developments, we expect high-yield corporate spreads in Asia to remain at elevated levels until a significant resolution is reached for these developers. While we think that the downturn is near the bottom, the reduced liquidity in the short term suggests that a significant turnaround in credit sentiment is unlikely in the opening weeks of 2022.

Asia High Yield vs High Grade Spread Change: Dec 2020 – Oct 2021

Source: UOBAM/Bloomberg

That said, the Asian high grade space, except for Chinese high grades, appear to be relatively rich and therefore less attractive. Once Omicron fears abate, valuation factors kick in and the search for yield resumes amid rising inflation, Asian high yields look likely to come back into favour. This leaves room for credit selection opportunities.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.