ASEAN’s re-opening opportunities

Most ASEAN markets have started to ease Covid restrictions. Jerdphan Nithyayon, Albert Budiman and Francis Eng, UOBAM’s Investment Heads for Thailand, Indonesia and Malaysia respectively, give their assessment of the opportunities that lie ahead.

How did Covid affect your local economy and what is the outlook?

Jerdphan: Like many other ASEAN countries, the Covid crisis took a heavy toll on Thailand’s economy. The inflation-adjusted growth rate was minus 6.2 percent in 2020, and just 1.6 percent in 2021. We were particularly affected by the collapse in tourist arrivals, which in 2019 was around 40 million. In 2021, we had less than one million arrivals.

Thankfully, the Thai authorities had a relatively efficient response to the pandemic both in terms of its fiscal and health policies. The country’s cash transfer programme was one of largest in the world, and prevented some 780,000 people from falling into poverty.

Vaccinations have also progressed well, with 74 percent of the population having received their second dose. Third doses are currently well below the government’s 60 percent target, but there is an attempt to speed this up. Meanwhile Covid cases, hospitalisations and deaths are steeply down. With the relaxation of travel restrictions, the Bank of Thailand expects the economy to recover at a steady pace, reaching 3.2 percent this year and 4.4 percent in 2023.

“The country’s cash transfer programme was one of largest in the world, and prevented some 780,000 people from falling into poverty”

Jerdphan Nithyayon, Chief Investment Officer, UOBAM Thailand

Albert: In 2020, Indonesia saw its first economic contraction in two decades. Hopes of a quick return to normality were dashed when in May 2021, a large spike in cases due to the Delta-variant resulted in a range of area and sector-specific restrictions, known locally as PPKM.

Despite this, the country has managed to resume its economic growth, registering 3.69 percent in 2021. Indonesia’s central bank expect the rebound to pick up steam this year, and are forecasting GDP to come in at between 4.5 to 5.3 percent. This comes as Covid infections continue to fall, and are now just one percent of the daily average peak reached earlier this year.

That said, Indonesia lags its neighbours when it comes to vaccination rates. Only 61 percent of its 270 million geographically-dispersed population have received two doses. Worryingly, this rate appears to have stagnated and a large number of unvaccinated individuals are at risk of severe symptoms in the event of a new wave of infections.

Francis: Due to the pandemic, the Malaysian economy shrank by 5.6 percent in 2020, the largest contraction since the Asian Financial Crisis in 1998. But measures such a loosening of monetary and fiscal policies helped the economy to rebound by 3.1 percent in 2021. This was especially encouraging given that, in late 2021, Malaysia was devastated by its worst floods in a century. The resulting losses were estimated at RM6.4 billion (US$1.46 billion).

Malaysia has also managed to deliver second dose vaccinations to 83 percent of its population, one of the highest rates in the region. With the normalization of economic activity and this month’s re-opening of its international borders, Malaysia’s central bank is forecasting momentum in the recovery, with GDP growth for 2022 forecast at 5.3 to 6.3 percent.

What are the near and mid-term drivers of growth?

Jerdphan: In 2022, we would expect the tourism sector to lead the charge. In fact, while the forecast earnings for companies listed on the Stock Exchange of Thailand (SET) fell by 1.1 percent in April compared to the previous month, there were upward revisions for the domestic tourism and hospitality industries.

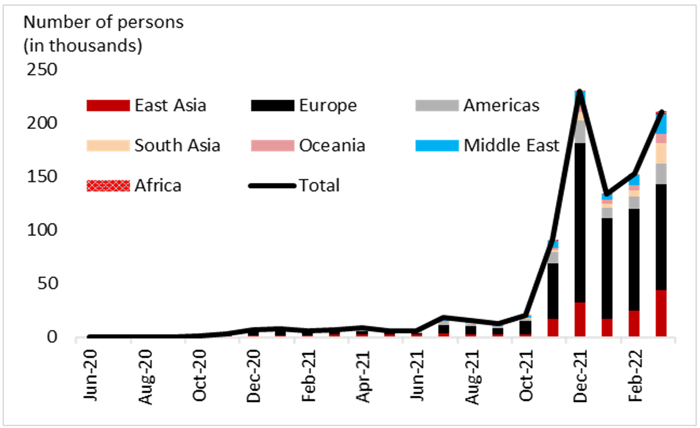

This trend will likely be substantially enhanced by the resumption of PCR and quarantine-free international travel for fully-vaccinated visitors. International flights from Thai airports have already climbed from under 4,000 in Jun 2020 to around 10,000 in March 2021.

Figure 1: Thailand’s foreign visitor arrivals by nationality

Source: CEIC, DBS

But it is the return of foreign visitors that will spearhead Thailand’s post-Covid economic recovery. The Bank of Thailand forecasts foreign visitor arrivals to reach 5.6 million in 2022, and 19 million by early- 2023. This is still less than half the 40 million yearly arrivals seen just prior to the onset of the pandemic. Pent-up demand suggests that such levels can be fully resumed by late 2023 or early 2024.

Higher visitor arrivals will flow through into better earnings for a range of tourist-related sectors, including retail, aviation and hospitality. However, I do not expect the re-opening theme to be priced equally across all sectors. Investors will be keeping a close eye on the potential extent and speed of each company’s profit recovery. This includes companies that directly benefit from re-opening activities, such as higher hotel occupancy. Others stand to gain indirectly, for example, charging higher commercial rentals due to improved footfall.

Albert: Post-Covid economic growth in Indonesia is premised on the return of private consumption, which accounts for half of the country’s GDP. This can have a positive impact for many sectors beside tourism. For example, banking, as a backbone of the country’s economy, is set to benefit from loan growth as re-opening activities pick up.

Similarly, I foresee the greater optimism associated with re-opening also having an impact on property prices. Property is the go-to for wealthy and middle class consumers and will likely be a focus for those with access savings and pent-up spending power.

I would also expect a strong uptick in the demand for commodities and component parts as manufacturers rush to fulfil outstanding orders and meet elevated consumption. This in turn could push up commodity prices further.

“Post-Covid economic growth in Indonesia is premised on the return of private consumption, which accounts for half of the country’s GDP”

Albert Budiman, Chief Investment Officer, UOBAM Indonesia

Francis: While re-opening measures will help boost Malaysia’s economic recovery, the government has also recently announced a fourth round of special withdrawals for individuals to tap their retirement savings, capped at RM10,000 (US$2276). These withdrawals are aimed at helping contributors overcome their pandemic-induced income losses. From May 1, a new minimum wage level of RM1,500 (US$341) will also be implemented.

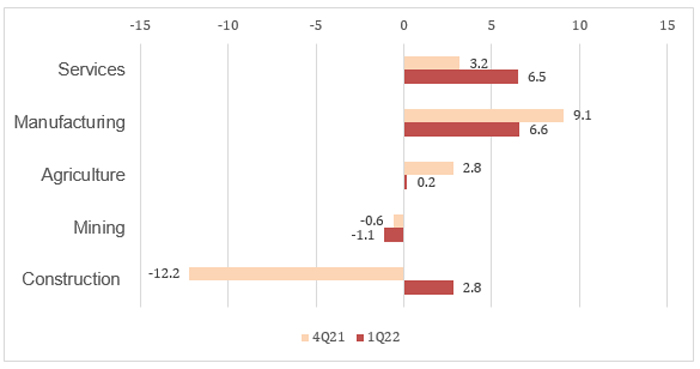

In the first quarter of 2022, economic growth was led by the services and manufacturing subsectors. Conversely, the agricultural sector stagnated as heavy rainfall disrupted oil palm output, while the mining sector was weighed down by the temporary closure of several oil and gas facilities.

Figure 2: Malaysia’s sector GDP, annual change (%)

Source: DOSM/UOBAM

What are the challenges going forward?

Jerdphan: Like the rest of the world, Thailand faces the spectre of inflation. The Bank of Thailand has already warned that inflation could rise sharply in the second half of the year. Although food prices could stabilise, I see any potential hikes in diesel and fertilizer prices to be key risks for the country’s economic recovery.

The weakening baht will also lead to higher import costs. For Thailand, a net importer of both oil and gas, every US$10 per barrel rise in the oil price is estimated to result in a 48 bps rise in inflation. This suggests that growth may moderate in the longer term, and energy, materials and petrochemical companies are likely to continue to outperform.

“The outlook for Malaysia’s economy and investment markets cannot be divorced from global macro developments”

Francis Eng, Chief Investment Officer, UOBAM Malaysia

Albert: Inflation fears are no less prevalent in Indonesia. That is why we are closely monitoring the potential inflationary impact of Lebaran, Indonesia’s recent fast-breaking festival. Lebaran is a very important date on the country’s religious calendar and marked not only by a long holiday (the first to be celebrated since the start of the pandemic) but also a legally mandated salary bonus.

There is therefore the likelihood of higher demand during this period, but also the potential for a spike in Covid infections, especially given the country:s lower vaccination rates. Indonesia’s central bank recently trimmed its GDP forecast in recognition of the heightened inflation risks, despite its relatively unique status in Asia as a net commodity exporter.

Francis: The outlook for Malaysia’s financial markets cannot be divorced from global macro developments including elevated inflation and tightening monetary policy. As such, continued global market volatility can be expected to be a headwind to financial markets in Malaysia.

One of the factors driving inflationary pressure has been high commodity prices. Malaysia is in a better position relative to its neighbours as it benefits from high commodity prices including palm oil, and oil and gas. Also, while the cost of petrol and cooking oil has increased in line with the higher commodity prices, government subsidies have allowed the consumer price of these basic items to remain unchanged.

Over the medium term however, the government has said that it will be reviewing its subsidy mechanism. Any removal or reduction of these subsidies could crimp consumption and result in higher inflation. This also has implications for Malaysia’s monetary policy. However, with General Elections expected by mid-2023, I do not foresee the government making any significant changes to existing subsidies, at least in the near term.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.